Akur8: Impact 25 2020 profile

March 10, 2020

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2020.

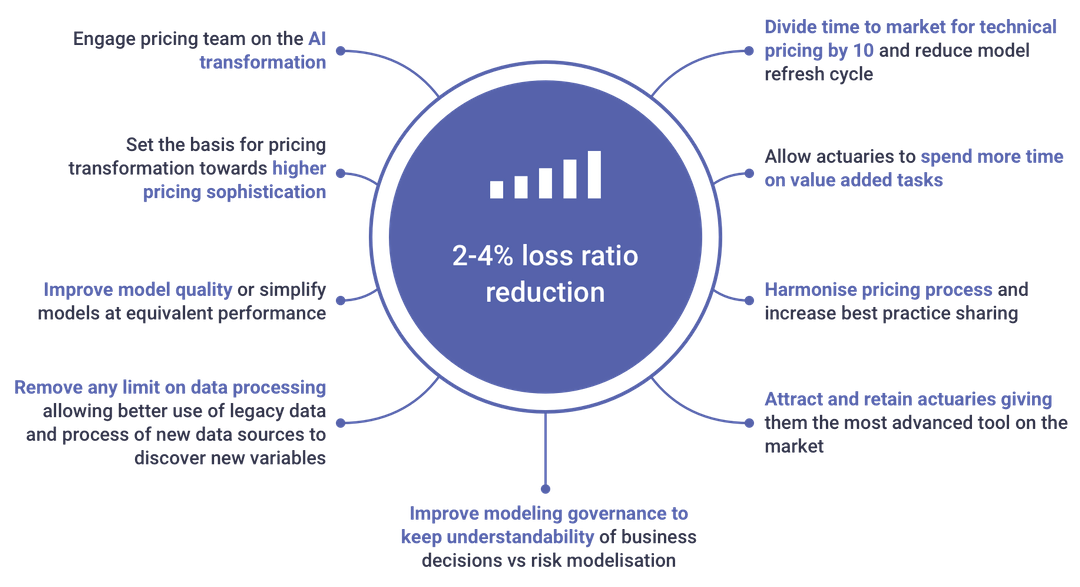

Akur8 has developed an AI and machine learning SaaS platform that enables actuaries to build and update pricing models much quicker than traditional tools.

It was established by a former member of AXA’s R&D team in 2018 and has collaborated with ENSInternational Centre for Fundamental Mathematics and Algorithms with funding from the French Ministry of Research and Innovation.

To date, the Akur8 solution is live with several AXA entities, and successful pilots were completed with other Tier-1 entities in 2019. These will convert into recurring SaaS contracts this year. The implementations within AXA have generally decreased the time taken to create and deploy models by a factor of 10.

Additionally, some portfolios examined with the Akur8 algorithms have generated new insights leading to price optimisation decisions and corresponding profitability improvements. Akur8 describes its algorithms as transparent AI. Many AI solutions are ‘black box’, meaning that they generate outputs that are difficult to interpret and can lead to costly and reputationally damaging errors. Transparency and auditability have therefore been central design principles for the Akur8 solution. All decisions made during the modelling process are automatically tracked, enabling actuaries to explain their decisions. This functionality is particularly important for global (re)insurers who often operate multiple models independently to meet local market regulatory requirements.

“Akur8 allows me to quickly and easily design high-performance models almost automatically. I can focus on bringing my business insights to the model thanks to a comprehensive customisation and review.”

Amaury Rault, Senior Pricing Actuary, AXA

Company in action

Akur8 automates many pricing-related activities which are usually performed by valuable actuarial resources and are therefore expensive and time consuming. It enables actuaries and cross-functional groups to focus their efforts on price optimisation strategies rather than processing and manipulating data. The platform consolidates all pricing-related data and processes into one solution.

Case Study

Client situation: AXA France wanted to accelerate its pricing time-to-market to capitalise on opportunities, improve the accuracy of its pricing risk models, and strengthen the governance and auditability of its pricing process.

Solution: AXA decided to deploy Akur8’s P&C personal lines risk module to inject AI and machine learning into the pricing process, replacing the existing solution from a large vendor. This module allowed AXA to automate a significant portion of the

process and leverage external data sources. It also enabled AXA to discover new, highly predictive variables while retaining full transparency and control of the new model.

Results: The Akur8 solution accelerated the modelling speed by a factor 10, reducing time-to-market from months to weeks. It also increased the model’s accuracy by 10% following the selection of stronger variables and the addition of new variables into the model. AXA France subsequently expanded the use of this module to P&C commercial lines. The solution is currently used by over 50 AXA France staff.

The Oxbow Partners View

We have chosen Akur8 as it demonstrates impact in the pricing function, one of any insurer’s most critical capabilities. A strong signal of traction is the fact that it recently replaced an established industry vendor at AXA France.

We believe that Akur8’s focus on transparency is also important. As pricing sophistication increases through techniques like machine learning, there is a risk of unintended outcomes. Indeed, we believe that one of the biggest emerging reputational risks for the industry is that ‘black box’ pricing approaches accidentally discriminate against certain demographic groups. For example, a company may not be deliberately discriminating against a minority group but may be doing so accidentally because of correlated data used as pricing inputs.

Whilst the ethical principles of price discrimination in insurance are yet to be fully defined (gender, for example, was an early decision taken in Europe), we believe process transparency is an imperative for companies so that they can minimise exposure to reputational issues and be prepared for future rules.