About the author

Gayle Watts

Get market insights straight to your inbox

Keep me informedMarch 9, 2018 Gayle Watts

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

Atidot helps life insurers use more of their data in strategic decision making: Data is often siloed in multiple systems and traditional modelling tools are hard to implement and require manual effort. Atidot extracts raw/unstructured data from insurers’ legacy systems and cleans/normalises it, enriches the dataset with external open source data and applies AI, machine learning and actuarial modelling techniques to extract insight.

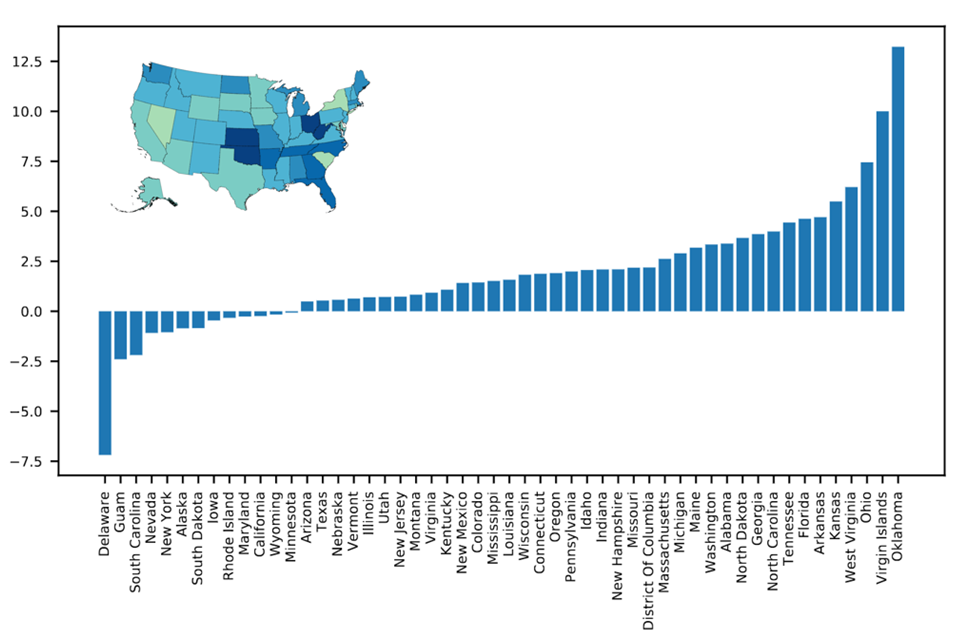

A tier 1 life insurance carrier wanted to identify under-insured policyholders. Atidot combined various models to complete this goal (see case study below). Atidot was able to provide specific state-by-state insights to help prioritize targeting strategies. As the chart shows, it is clear that Oklahoma, Kansas, Ohio, and West Virginia are the most under-insured states. From here, the carrier was able to prioritize efforts and conduct tests.

Case Study One

Case Study OneClient situation: A mid-size, D2C life insurance carrier in South Africa wanted to optimize retention efforts amongst policyholder cohorts with high lapse rates.

What they did: Atidot used its platform to predict the lapse propensity of each policyholder. Data from admin systems, CRM systems and cashflow, augmented with external sources, was uploaded to the system.

Models (e.g. actuarial analysis, machine learning and predictive models) were used to assess propensity to lapse and the impact of a discount on the policyholder decision.

Impact: The optimised retention strategy led to a 35% increase in incoming premium from high-risk customers.

Client situation: A Tier 1 life insurance carrier in the US wanted to identify under-insured policyholders in its independent advisors channel and create triggers for approach.

What they did: Atidot used its platform to predict the level of under-insurance in the portfolio. The analysis was based on data from the carrier, augmented with external sources. Atidot used its methodology to determine the expected level of insurance of each policyholder and defne targeting strategies.

Impact: The analysis identified a sub-set of 25% of the under-insured policies for a personalised targeting strategy. The conversion rate of up-sales approaches increased by 300%.

Traction: Atidot has generated material financial benefits with its technology on multiple continents. It has also raised $6m from high-profile investors and with a staf of just 15 at present this suggests significant financial runway.

Potential: Atidot is one of very few InsurTechs focusing on life insurance. The management team is well qualified to make an impact – founders combine technology expertise from the Israeli military Intelligence Corps with insurance expertise from Swiss Re.

The 2018 challenge: Many life insurers fall into one of two categories. Some are fully focused on re-platforming their legacy technology and data landscape and therefore have limited resource for new opportunities. Others are so constrained by their legacy that they are unable to act on data insights. Atidot appears to have found early niches of insurers that do not fall into these categories; the challenge will be moving up into some of the larger players.

Magellan™ is Oxbow Partners’ online searchable database of insurance technology

FIND OUT MOREAbout the author

Gayle Watts