bsurance: Impact 25 2020 profile

March 11, 2020

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2020

bsurance is an Austria-based MGA and technology company that designs and delivers tailored embedded insurance solutions for its distribution partners. To date it has sold 20,000 policies across 10 products and has a strong pipeline of clients with large customer bases. It closed its Series A in late 2018, which brought on board Austria’s market leader, UNIQA.

Products are typically niche; current partners include cashpresso, a payments service, and Playbrush, a smart toothbrush. On average, it takes bsurance six weeks to launch an insurance product from ideation to the first active policy. Its 10 live products can be repurposed for new partners and the product set will grow over time.

The bsurance cloud-based technology stack and business model is end-to-end, meaning that it can service its policyholders without any heavy technology integration or operational effort from its distribution and insurance partners. The proprietary stack contains the functionalities of a core policy administration system: quotation, real-time policy issuance, billing, pre- and post-sales policyholder documentation and claims management. This solution also presents opportunities for insurers to quickly launch embedded and standard insurance products. Carriers currently working with bsurance include Munich Re, AXA Partners and UNIQA.

“Ultimately, we were surprised by how quickly and easily they were able to embed an insurance product into our sales process. We now have two different insurance products thanks to bsurance.”

Paul Varga, CEO, Playbrush

Company in action

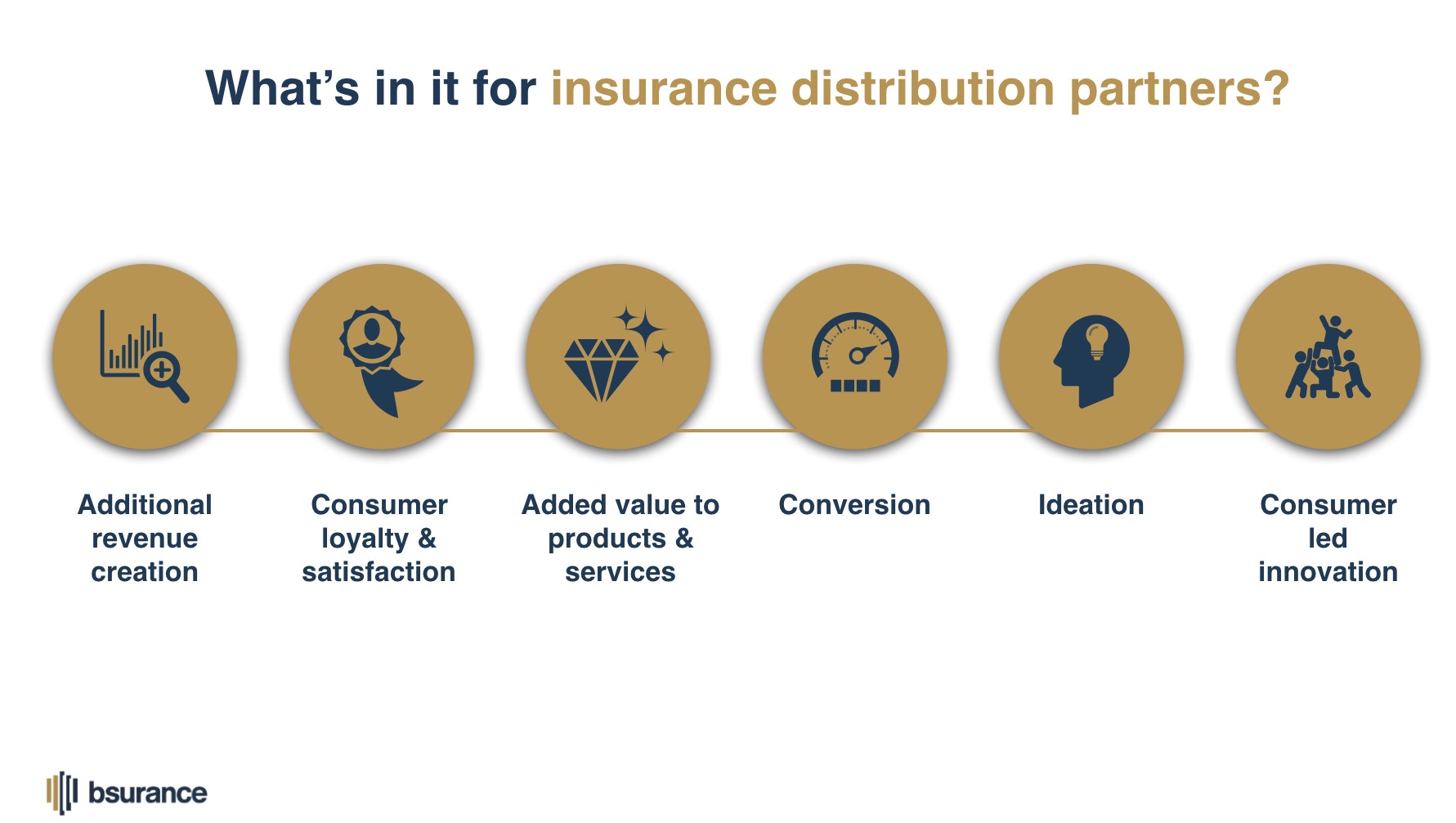

The bsurance solution is relevant not only for distribution partners to grow their revenue but also for insurance carriers. For these carriers, bsurance is producing new premium pools, which cannot otherwise be accessed easily. These pools are expected to grow as consumers continue to transact more aspects of their lives online.

Case Study

Client situation: Playbrush offers gamified technology that encourages children to brush their teeth regularly to prevent expensive dental interventions. It wanted to strengthen its value proposition by embedding dental insurance at point of sale and as part of its subscription model.

Solution: Playbrush partnered with bsurance to develop an innovative embedded insurance product and seamlessly integrated this into its digital customer journey. Policies are generated, offered automatically and issued at point of sale without Playbrush customers incurring an additional cost for the product. Claims are also fully digitalised.

Results: To date, 10,000 policies have been issued with only 5% of Playbrush customers deciding to opt-out of the insurance. A/B testing (with/without the embedded insurance) has demonstrated that the insurance product increases the customer retention rate by almost 10%. Playbrush and bsurance has subsequently developed a second product targeting adults.

The Oxbow Partners View

bsurance has been selected because we see B2B2C insurance platforms that can embed products into a retailer’s core value proposition as an important future trend. Some people refer to this as insurance becoming ‘invisible’; we have previously written about the attraction of presenting an insurance product as a simple product or service ‘guarantee’ to customers.

bsurance is an interesting proposition because it can offer not only the technology integration but is also regulated as an intermediary to deliver the product. We have described in this report the resource constraint that most insurance carriers operate under; a proposition that offers access to new premium pools with low operational effort is therefore an attractive partner for many.

However, for many insurers in the central European zone, where digital distribution is still immature and many back-office processes like pricing are relatively unsophisticated given the market structure, might benefit from working with a partner like bsurance simply to enhance their digital trading capabilities.

At least one carrier has partnered effectively with bsurance to win an affinity distribution deal in this way. That said, the current wave of embedded insurance products has largely been niche, high volume and low value products, for example mobile phone or gadget insurance.

The challenge for bsurance and its peers will therefore be either to find partners with enough volume to make this economic long-term, or to persuade carriers that it can help them with the digital distribution of higher value products.