Carpe Data: Impact 25 2018 profile

March 9, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

Carpe Data provides new data sources to insurers to help them quote and settle claims faster and more accurately.

What do they offer?

Commercial insurance solutions: Includes form data pre-fill, eligibility assessment and verification; automated underwriting is supported through scoring of risks based on available data.

One-time claims solution: Automated assessment of publicly available online activity to verify claims.

Recurring claims solution: Scalable solution which automatically assesses online activity to monitor risk and claims in portfolios.

“Carpe Data will help support Allstate’s ongoing efforts to seamlessly integrate data to help our people make the best, most accurate, and timely decisions.”

Glenn Shapiro, President, Allstate Personal Lines

Impact

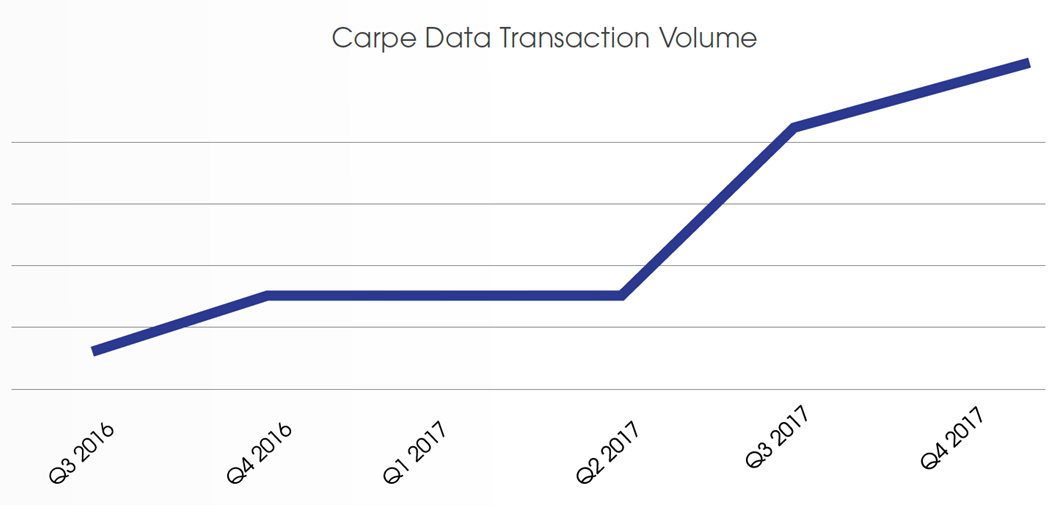

Carpe Data’s transaction volume increased over 200% in 2017. This has been driven by:

- The onboarding of new clients

- Increasing usage of existing customers

- Adoption of new data products brought to market

Case Study One

Client situation: A commercial insurer wanted to reduce the time and cost of underwriting small business insurance while improving pricing accuracy.

What they did: Carpe Data implemented their Data Pre-Fill, Validation & Qualification, and Predictive Scoring solutions into the insurer’s processes.

Impact: Application times fell from over 30 minutes to under 5 minutes. Unwanted business was identified more quickly, reducing cycle time and increasing agent satisfaction and new business velocity dramatically increased, resulting in high growth and lower combined ratio.

The Oxbow Partners View

Traction: With over 40 insurance customers, Carpe Data is becoming well-established in the US insurance ecosystem (with a view to expanding to Europe in 2018). The fact that Allstate was prepared to comment on the impact of using Carpe Data in a November 2017 press release is significant.

Impact: Carpe Data is one of only a few InsurTech data companies that is showing real traction. We believe that its platform will be attractive to European insurers in 2018.

The 2018 challenge: The 2018 challenge will be internationalising the business from its California base: the cultural hurdles will be significant.