Cognotekt: Impact 25 2018 profile

March 9, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

Cognotekt creates AI software for insurers to automate administrative and claims processes.

Cognotekt have a SaaS platform to allow insurers to:

- Automate administrative and claims processes

- Perform deeper analysis on processes and indemnity spend

Sophisticated language processing technology is at the core of Cognotekt’s proposition: their experience suggests that insurers do not have enough data to automate processes using machine learning. The business’s current focus is on automating motor and non-motor P&C claims.

“AI solutions from Cognotekt allow us to fundamentally change our business model.”

Jan Schellenberger, CTO Health AG

Impact

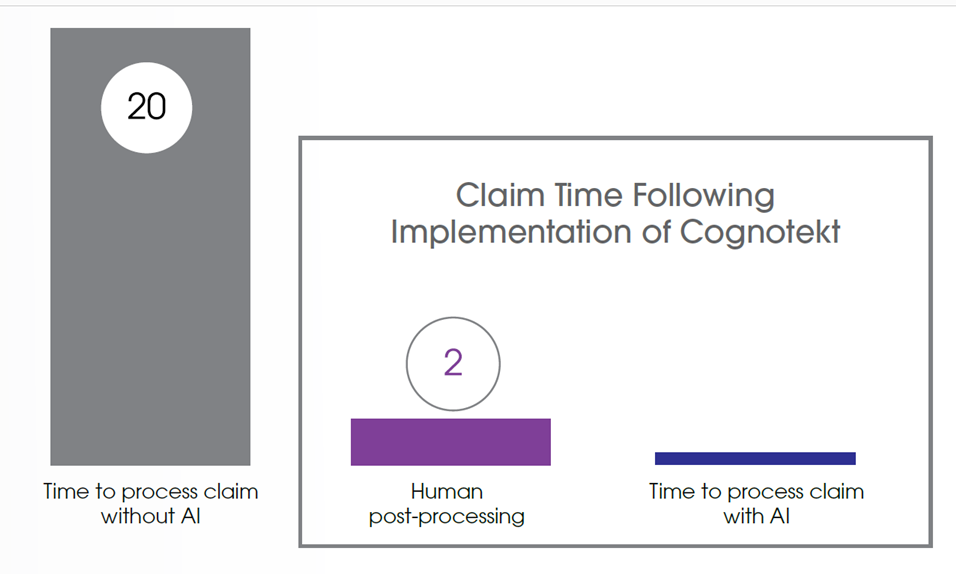

Cognotekt found that their client was spending c.20 minutes on any glass claim. After implementing Cognotekt’s technology, each claim was processed in 100 milliseconds. Claims still require post-processing by a human; this currently takes c. 2 minutes / claim but the company is working to reduce this to c.10 seconds / claim.

Case Study One

Client situation: An insurer wanted to automate claims validation in motor claims (glass damage).

What they did: Cognotekt used their language technology to create software to automatically compare claims against reference calculations for the specific type of damage. The software reads the bill’s line items and compares the data against the reference values.

Impact: The client was able to automate 90% of claims and reduce indemnity payments by 10%.

Case Study Two

Client situation: An insurer wanted to automate customer correspondence management.

What they did: Cognotekt used their language technology to create a correspondence engine that reads client correspondence and extracts the information to be able to answer.

Impact: The client was able to automate up to 90% of customer communications.

The Oxbow Partners View

Traction: Cognotekt turned over nearly €4m in 2017 – 5 years after it was founded and without any outside funding. Amongst the current cohort of InsurTechs, this is impressive. Cognotekt has four live implementations with German insurers including SV Sparkassenversicherung and R+V Versicherung.

Data from these pilots demonstrates that the business is creating real value, for example:

- Process cost reduction by up to 70%

- Indemnity spend reduction by up to 10%

Potential: We believe that Cognotekt is advanced in the development of differentiated software to automate processes. We believe that this IP has the potential to be adopted widely in insurance.

The 2018 challenge: Cognotekt has grown without outside investment since 2013. In 2018 it will need to ensure it keeps ahead of competitors as robotics and AI become more congested spaces.