Cytora: Impact 25 2018 profile

March 9, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

Cytora uses artificial intelligence and external data to improve the way commercial insurers quantify, select and price risk.

Cytora’s product, Risk Engine, works by:

- Continuously ingesting data from thousands of online sources, e.g. online journals, news reports

- Cleaning, structuring and normalising this data

- Calibrating the data against insurers’ internal data to align use with business objectives Risk Engine operates at the portfolio level to reveal profitable segments and at the underwriting level to enable better risk selection and pricing decisions. Risk Engine also facilitates question-less underwriting.

“With ever-increasing levels of available data we can really see the benefits that artificial intelligence and other similar

technological advances bring to the industry. We believe that Cytora can use this information in a powerful way to provide a competitive edge to Starr and its other clients.”Maurice Greenberg, Chairman, Starr Companies

Impact

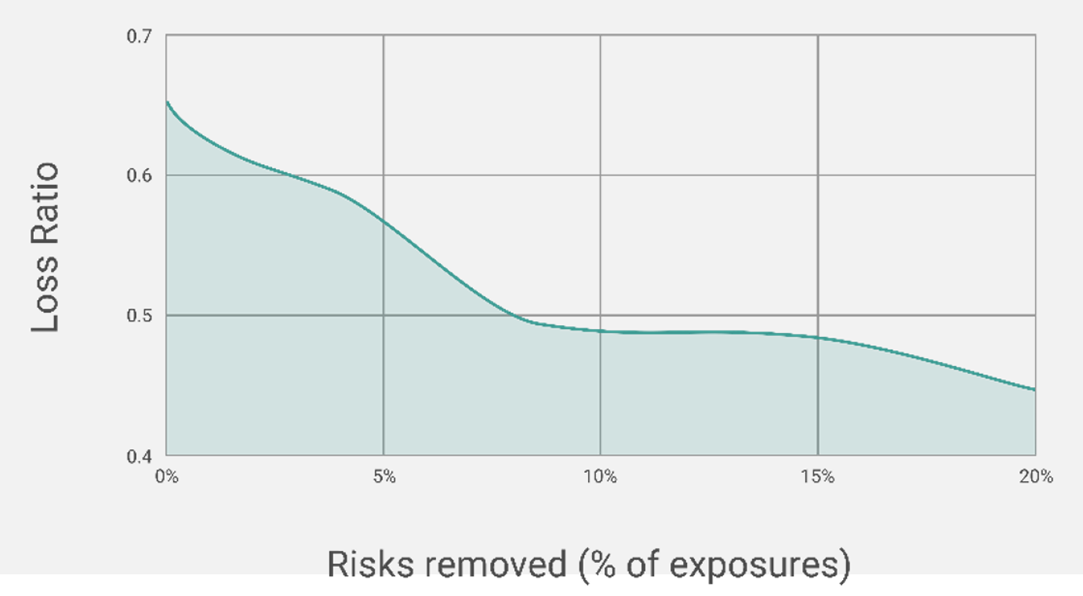

When back-testing a commercial property portfolio of a leading P&C insurer, Risk Engine successfully:

- Improved loss ratio by 18 percentage points from 65.7% to 47.7%

- Increased profit by 43%; from £13.9m to £19.9m

Case Study One

Client situation: A large commercial insurer wanted to increase profitability by reducing underwriting and distribution costs in SME segments. They also wanted to enable underwriters to refocus time on complex referrals in profitable areas.

What they did: Cytora’s Risk Engine augmented the insurer’s internal pricing with a technical risk price for every potential customer in the market, enabling automated risk selection and pricing across a pipeline of live submissions from panels and aggregators. Cytora ranked micro-segments according to loss ratio, enabling the insurer to continuously assess their portfolio mix against the total population to target the most profitable consumers.

Impact: The insurer’s underwriting expenses in SME segments were reduced by 60%. They were able to exclude unprofitable sub-segments and refine marketing campaigns to target the most profitable segments of the total population.

Case Study Two

Client situation: A commercial insurer was seeing attritional loss ratios rising quickly, reflecting rising rate pressure and unchanged portfolio mix. The insurer needed to validate whether losses resulted from short-term deviation or more fundamental change.

What they did: Cytora compared the insurer’s portfolio against peer frequency, severity and loss costs and recommended that the insurer shrink or exit eight underperforming segments and grow in six outperforming segments. Cytora identified 20 attractive micro-segments to target. Cytora helped the insurer integrate risk scoring and pricing into their existing underwriting workflow, enabling underwriters to access information outside of question sets and base risk selection and pricing on market-wide experience instantly at the point of quote and renewal.

Impact: The insurer reduced their commercial property loss ratio by 18 percentage points over the following underwriting year. They also improved submission conversation in target segments by 8%.

The Oxbow Partners View

Traction: Cytora’s case studies speak for themselves. The business is creating real value for insurer and it comes as no surprise that a high profile insurance executive (former AIG CEO Maurice Greenberg) was involved in a £4.4m funding round in Q4 2017.

Potential: We have been impressed with Cytora’s proposition and trajectory since we first met the business in 2016. Their market coverage operation is focused and dogged (if somewhat stretched) and we see them making serious progress with high profile customers in 2018.

The 2018 challenge: Cytora need to prove that their methodology and technology work outside their core segment of SME property.