Descartes: Impact 25 2020 profile

March 11, 2020

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2020

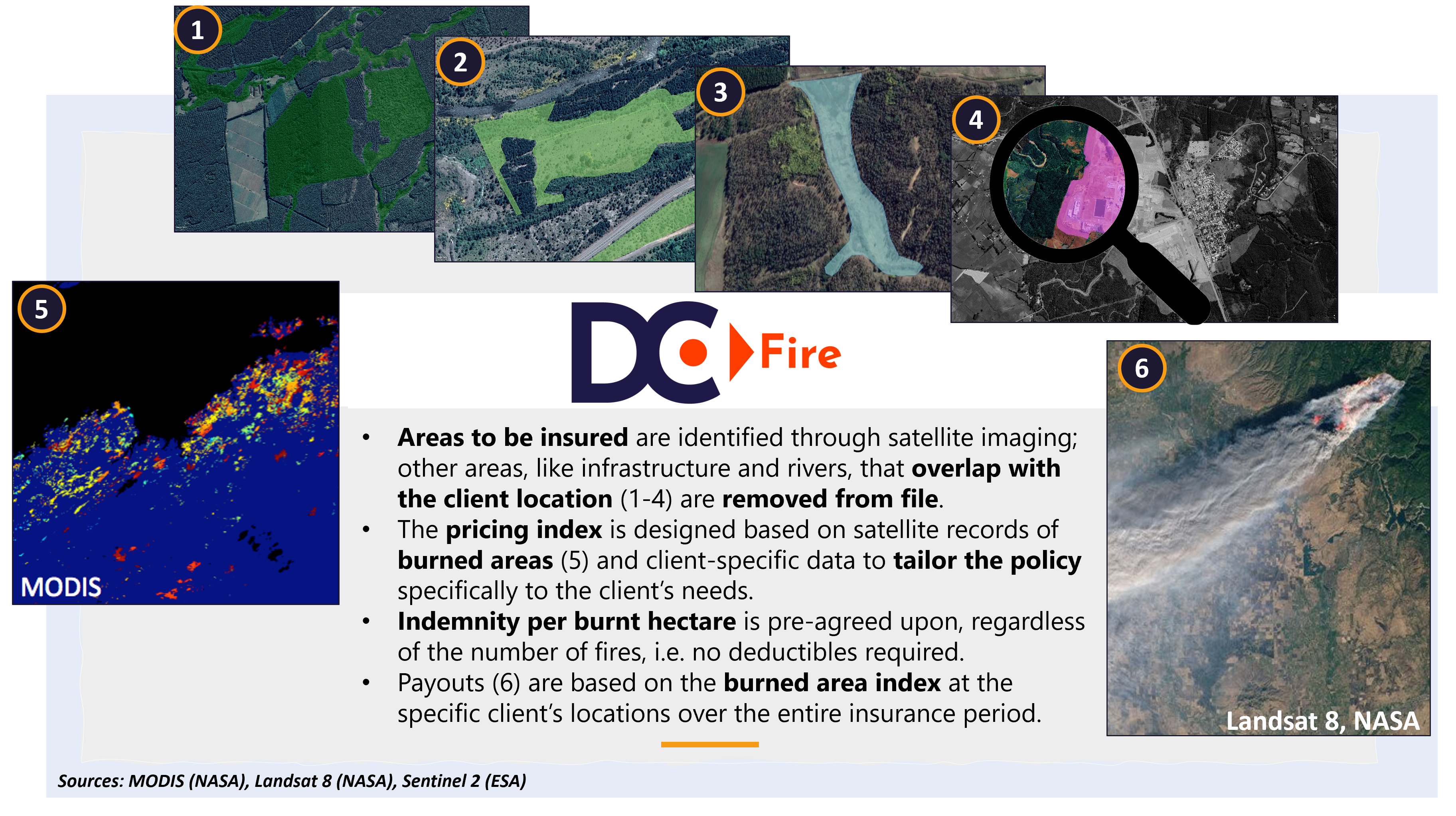

Descartes Underwriting is a France-based MGA offering parametric insurance products. It has underwritten more than 30 customised weather-related products for corporate clients and governments during its first year of trading. It has capacity to underwrite limits of €75m per deal.

An example solution is a drought product for a French agriculture cooperative. Daily satellite surveys inform Descartes about soil moisture and vegetation development, enabling the client to receive compensation within a few days of the trigger being reached.

Descartes distributes its products exclusively via brokers, who it believes have the deepest understanding of their clients and in particular where they have coverage gaps. They then work with brokers and clients to design bespoke coverage using parametric triggers which strengthen transparency, reduce costs (most products do not incur claims handling costs), and rapidly speed up claim pay-outs.

Descartes is continuing to build its in-house data and analytics capabilities, supplemented with an ecosystem of global data partners. It ingests and processes large data sets from a wide variety of sources such as satellites and IoT devices. It then applies AI and machine learning to develop its risk models.

“Working with the talented and pioneering team at Descartes allows Generali to provide flexible, bespoke solutions to challenge the conventional thinking around the risk transfer landscape.”

Peter Leslie, Chief Underwriting Officer, Generali Global Corporate & Commercial UK

Company in action

Case Study

Client situation: Many insurers are reluctant to cover hail risk as they struggle to estimate it. This is due to a lack of systemic, unbiased hail reports and high spatial variation of risk. This means that hail-exposed clients find it difficult to cover their hail risk and remain uninsured or underinsured.

Solution: Descartes models hail risk by analysing historic climate model data and satellite imagery to map hailstorm frequencies. An algorithm using trusted historical hail reports is subsequently applied to calibrate the hail maps produced. Local weather stations measure the hail event characteristics. Payouts are instantly triggered using on-site reports obtained from trusted third parties.

Results: Hail policies are designed for each client. They are customised to ensure that the policies meet client needs and that they are both affordable and competitive. Transparency is ensured by avoiding any ambiguities regarding the policy wording and by agreeing well in advance on the payment index between all parties.

The Oxbow Partners View

Insurers view parametric solutions as new business opportunities; however, many cannot deliver at the speed needed to underwrite these opportunities and the specialist market knowledge possessed by many MGAs.

We selected Descartes Underwriting as its team, all previously senior executives with AXA Global Parametrics, are making real headway. Oxbow Partners is bullish on parametrics. It provides greater transparency and certainty to all parties to an insurance contract and can address protection gaps in traditional indemnity products, e.g. deductibles and excluded perils.

It will also play a critical part in addressing underinsurance in emerging nations, disaster risk financing and providing resilience in the face of nat cat losses that are likely to increase due to climate change, economic growth and demographic density.

The team’s distinctive experience, its external investors, panel of underwriting partners and first year traction all suggest that Descartes will deliver its impressive plans for 2020 onwards.

Its primary challenge will be building a team of experienced modelers and data scientists to strengthen its in-house data scientist team and technology to create a sustainable USP.