Digital Fineprint: Impact 25 2018 profile

March 9, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

Digital Fineprint provides a customisable social media analytics product. The product is primarily used to connect social media users with insurance policies.

Through analysis of social data (using predictive analytics and machine learning), the company creates actionable marketing and pricing / underwriting insights.

Products include:

- Social Autofill: Completing insurance quote form using LinkedIn or Facebook details (used for SME insurance and personal lines)

- LinkedIn Analytics: Insurers can send insurance suggestions to customers based on LinkedIn data

“We’re excited about the role social media could play in providing a more personalised service.”

Head of Underwriting Insights, Hiscox

Impact

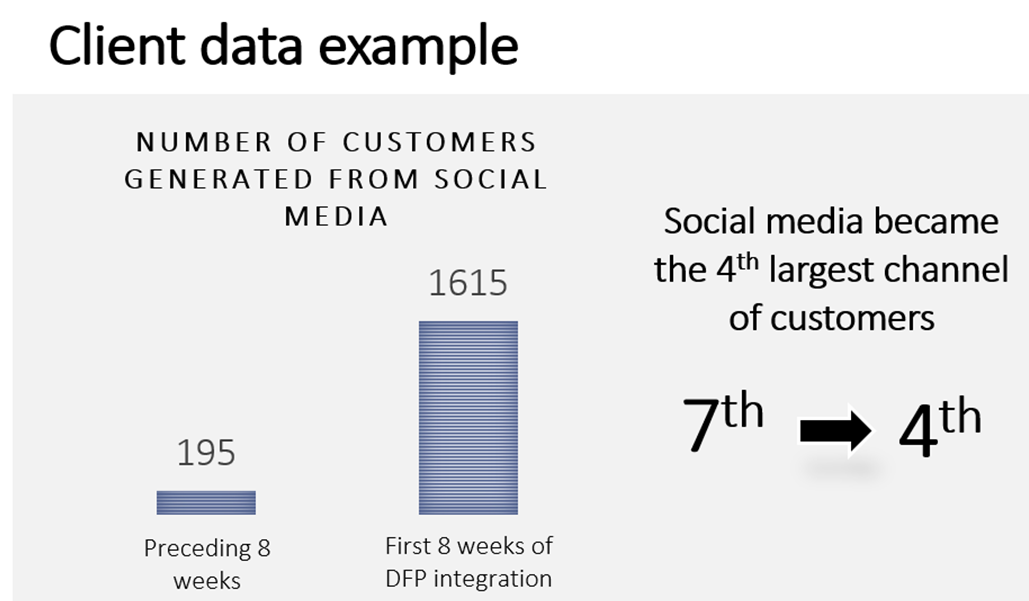

DFP’s client had attempted social media marketing in the past but had not seen a positive ROI. By applying proprietary analytics models, DFP increased the number of leads by over 7x and turned social media from the 7th to the 4th most common lead channel. Total integration time from launch to these results was 8 weeks.

Case Study One

Client situation: A major APAC insurer was launching a D2C sales channel in the UK.

What they did: DFP built a Social Autofill solution enabling their customers to click ‘Autofill’ in order to get an indicative quote and a recommendation for policy amount.

Impact: The client saw increased conversion rates and dramatically higher marketing ROI compared to existing distribution channels, adding £3.2m to the global P&L in the first 12 months.

Case Study Two

Client situation: A top 5 UK insurer was looking for new ways to reach the right SME insurance customers.

What they did: DFP built a LinkedIn Analytics Solution which allowed customers to get tailored recommendations by connecting with their LinkedIn account.

Impact: The estimate for GWP uplift was £5m, with customer acquisition costs falling by 40% driven by targeted advertising.

The Oxbow Partners View

Traction: DFP’s patent-pending technology has resonated with insurance businesses and has been introduced into live processes by insurers such as Hiscox and QBE; for a small (14 FTE) and new (founded 2016) business, this is impressive.

Data released from trials includes:

- Using Social Autofill increased conversion rate from lead to sale for a major UK insurance broker by 4x

- 30% increase in lead generation for a major UK insurance broker

- 40% reduction in customer acquisition costs driven by targeted advertising

Potential: Social media data has the potential to be used at every step of the insurance value chain. DFP is one of only a few companies exploiting this opportunity.

The 2018 challenge: The 2018 challenge is to grow profitably, navigating the challenge of whether to evolve into an advisory business with technology, or a pure technology company.