Flock: Impact 25 2018 profile

March 9, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

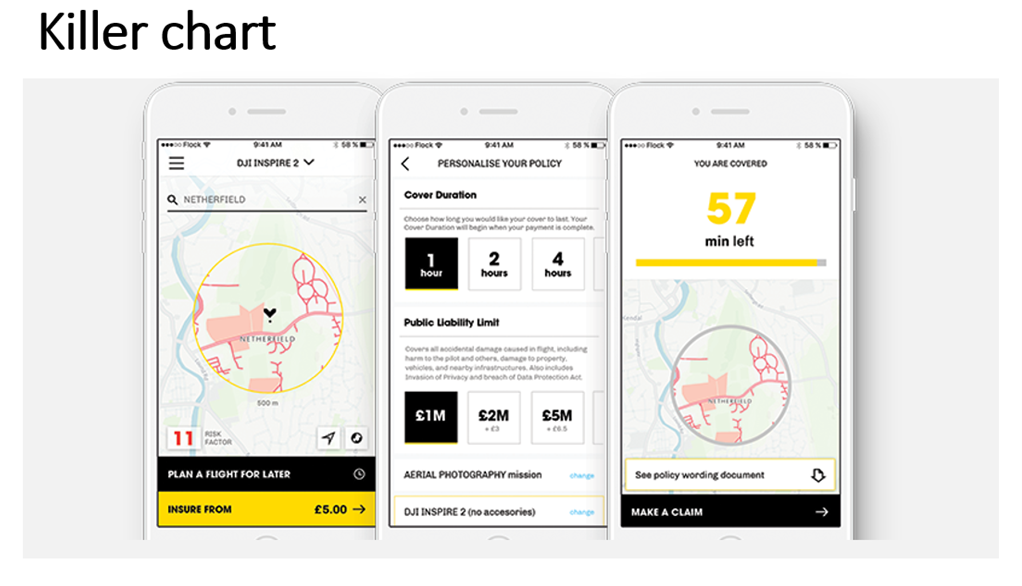

The ‘Flock Cover’ app provides on-demand insurance for drone pilots. Flock’s algorithms aggregate static and real-time data including drone information (e.g. model), operator profiles, environmental data and hyper-local weather conditions (accurate to within a few minutes and a few hundred meters) to support underwriting and provide risk management information to users.

Claims are processed by Flock’s digital claims platform which minimises fraud by reconciling customer claims reports with actual machine and environmental data collected at the time of the incident.

“Costing is good and the idea is brilliant to insure you only when you need it. Customer service is very helpful and friendly too. Highly recommended.”

Ryan Davidson, Flock Customer

Impact

Flock’s platform is made available to customers via a mobile app.

Case Study One

Client situation: Allianz wanted to access premiums in an emerging market, requiring a deep understanding of real-time risk, enhanced data about their customers, and protection from potentially high-risk scenarios.

What they did: Flock built and launched a drone insurance platform to facilitate the distribution of intelligent, real-time and risk-assessed insurance premiums through a smartphone application.

Impact: Over the first 2 months, 500 customers have registered with Flock, which represents 14% of the total commercial drone pilots in the UK.

Case study Two

Client situation: A pilot flying occasional drone missions wanted insurance that reflected his requirements, rather than an inflexible annual policy.

What they did: Flock created their pay-as-you-fly drone insurance application, which allows the purchase of fully customisable, hourly insurance policies from £5.

Impact: The pilot now has more control over their insurance spending and is able to pass the insurance costs directly on to their customers.

The Oxbow Partners View

Traction: Flock has had an impressive start: there are an estimated 3700 commercial drone pilots in the UK and Flock has managed to sign up 500 of them just over two months. We are also impressed that the business has built sufficiently robust risk pricing methodology to persuade Allianz to rely on it as their pricing input.

Potential: The drone market is embryonic but growing fast. Flock has the potential to establish itself as the leading platform in the space. In our view, the bigger opportunity might however be the business’s ability to convert complex data, including real-time situational data, into predictive pricing inputs. That could be hugely valuable to insurers for emerging, data-rich areas such as commercial IoT.

The 2018 challenge: Insurance is increasingly being ‘embedded’ in digital platforms – for example sharing economy users activate GUARDHOG or Zego insurance not directly but through the sharing economy platforms. Flock feels like the kind of proposition whose distribution will be driven by its ability to secure manufacturer or platform partnerships quickly.