FRISS: Impact 25 2018 profile

March 10, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

FRISS’s platform uses AI and machine learning techniques to detect and prevent fraud. The SaaS platform generates the ‘FRISS Score’, a measure of risk for each quote, policy or claim, allowing insurers to increase straight through processing (STP) and support digitisation.

The business’s ready-to-use products include:

- Risk assessment: Fraud evaluation of customers at point of underwriting

- Claims fraud assessment: Automated fraud detection in the claims process, making an objective estimation of the risks related to a claim.

“With FRISS we increased the number of proven frauds by almost 30% in 6 months.”

Supervisor Claims Management Anadolu Sigorta

Impact

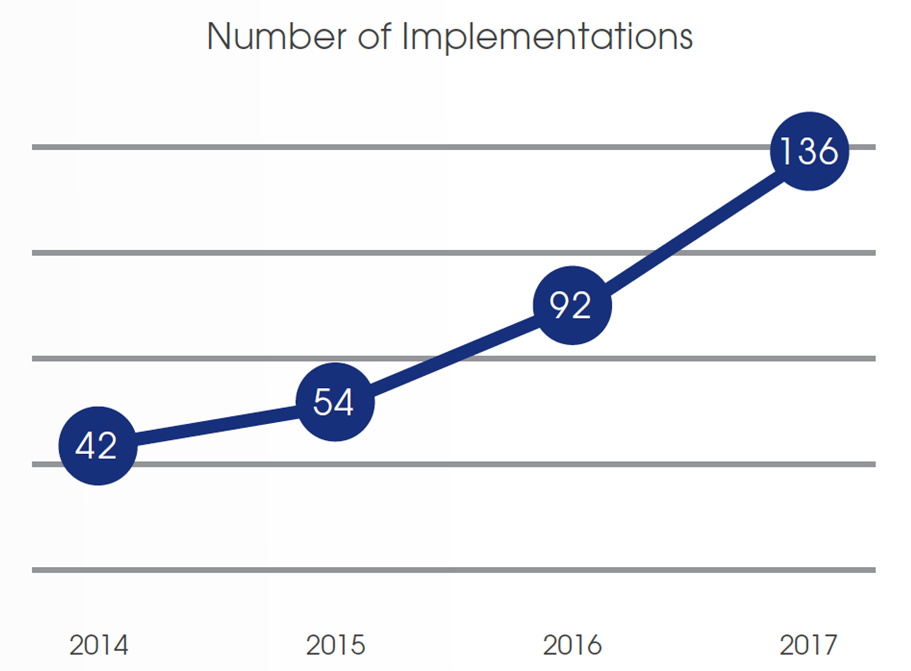

FRISS’s client list has grown steadily in the last 4 years with the total number of implementations now standing at 136

Case Study One

Client situation: Turkey’s largest P&C insurer (14% market share and c.$750m motor GWP) experienced difficulties detecting claims fraud.

What they did: FRISS’s platform was implemented to automate the fraud analytics process (i.e. automatically detect fraud in core processes and reveal similarities between claims).

Impact: Within 6 months of going live, the business achieved a 1,200% ROI.

Case Study Two

Client situation: A large reinsurer wanted to support its Latin American clients with an anti-fraud solution that reduced claims ratios.

What they did: FRISS was selected from a list of over 30 vendors and started working with their clients, delivering real-time claims fraud scores.

Impact: FRISS now delivers fraud solutions to all of their Latin American customers, a solution which benefits the insured, the insurer and the reinsurer.

The Oxbow Partners View

Traction: Founded in 2006, FRISS is not your stereotypical InsurTech (and required us to waive the eligibility criteria about the date of incorporation). FRISS has spent the last ten years growing steadily and internationally. Growth has accelerated in the last four years as data-driven propositions have captured the industry’s attention.

Potential: FRISS has built stable technology foundations and we believe it is ideally positioned to benefit from continued interest in data-driven propositions over the near term. The investment by Aquiline’s technology fund in 2017 will help it extend its client reach.

The 2018 challenge: With 100 employees, FRISS’s forecast growth will see it transition to beyond the ‘new business’ size band. The challenges of growing beyond 100 employees are well documented – by Roman military historians onwards.