Geospatial Insight: Impact 25 2018 profile

March 9, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

Geospatial Insights uses machine learning and big data analytics to provide insight from satellite, drone and aircraft imagery.

There are 3 insurance use cases:

- Precise risk analysis: Using satellites to help understand risk location and elevation to millimetre levels of precision

- Dynamic risk analysis: Using satellite imagery for dynamic monitoring of insurable assets

- Rapid response post-loss: Using aerial footage and analysis of catastrophe events before loss adjusters can make assessments

Impact

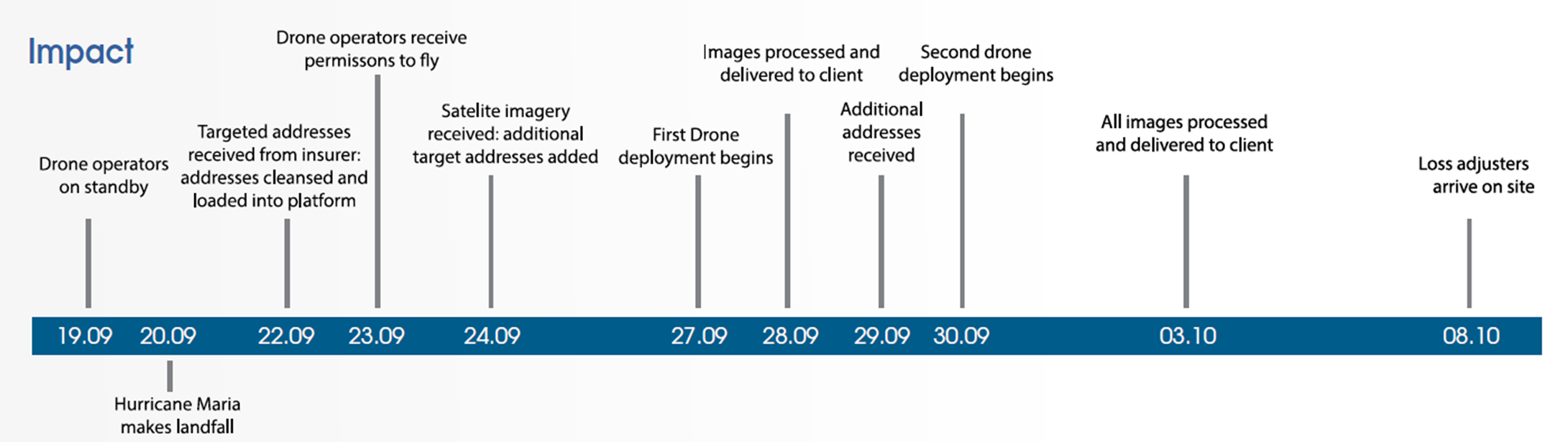

During Hurricane Irma, Geospatial Insight was able to provide its client with high resolution drone imagery of the event 5 days before loss adjusters could arrive at the scene, thereby expediting the claims process.

Case Study One

Client situation: A large insurer wanted to increase the speed of hurricane claims assessments using aerial imagery.

What they did: In the wake of Hurricane Harvey, Geospatial Insight geocoded all relevant policyholder data to develop baseline situation assessments, scheduled fight plans and organised the logistics of collecting and analysing image data of the hurricane aftermath.

The business built a flexible response strategy capable of handling changes in access to aircraft and other resources, cloud-cover visibility and the evolving storm path.

Impact: Within a week of Harvey making landfall, Geospatial Insight delivered: Predictive assessments of storm and food paths (and potential damage), detailed property-level assessments of damage and a bespoke, customer-facing user interface allowing a group of policyholders to access information and damage estimates.

Case Study Two

Client situation: An insurer wanted to map the impact of the Tianjin Port chemical explosion to assist their claims estimation process and to assess any physical barriers to viewing the site.

What they did: Geospatial Insights accessed and analysed satellite imagery from immediately before and after the explosion, highlighting damaged points of interest (e.g. damaged vehicle storage).

Impact: Within 48 hours, the blast and resulting chemical damage had been identified and mapped, enabling accurate loss estimation predictions well before loss adjusters could assess the site.

The Oxbow Partners View

Traction: Geospatial Insight is working with over 10 (re)insurers including Guy Carpenter, Marsh and Flood Re.

Potential: We believe that there is significant potential to improve the quality of geospatial data in the models insures use. Insurers using this insight will achieve benefits, ranging from selecting risks better to managing their aggregates better.

Hiscox has recently taken this further and launched its own US food product to compete against the National Flood Insurance Program, partly based on better data insight.

The 2018 challenge: The geospatial imagery and analytics space is quickly becoming crowded. It remains to be seen whether the market becomes an oligopoly (similar to catastrophe modelling) or if there will be a range of niche suppliers. Building a meaningful foothold quickly is key to be positioned for either scenario.