Getsafe: Impact 25 2020 profile

March 11, 2020

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2020.

Getsafe is a German D2C personal lines MGA targeting the millennial market (20 to 35 years of age).

The company offers six product lines (bike, home contents, dental, legal, personal liability and travel) and has partnered with Munich Re and a panel of five tier-1 insurers as capacity providers. It launched a home contents product in the UK in January with support from Hiscox. More products are planned.

The company has generated significant traction, selling over 100,000 policies to 80,000 customers with 50,000 new policies added in 2019. The median age of these customers is 26 and more than 75% are purchasing insurance for the first time.

Getsafe plans to develop its proposition to become an insurance “companion” as its customers experience life events related to buying insurance (e.g. buying a house or having a child). Life insurance and pension savings products are planned for 2020 and 2021.

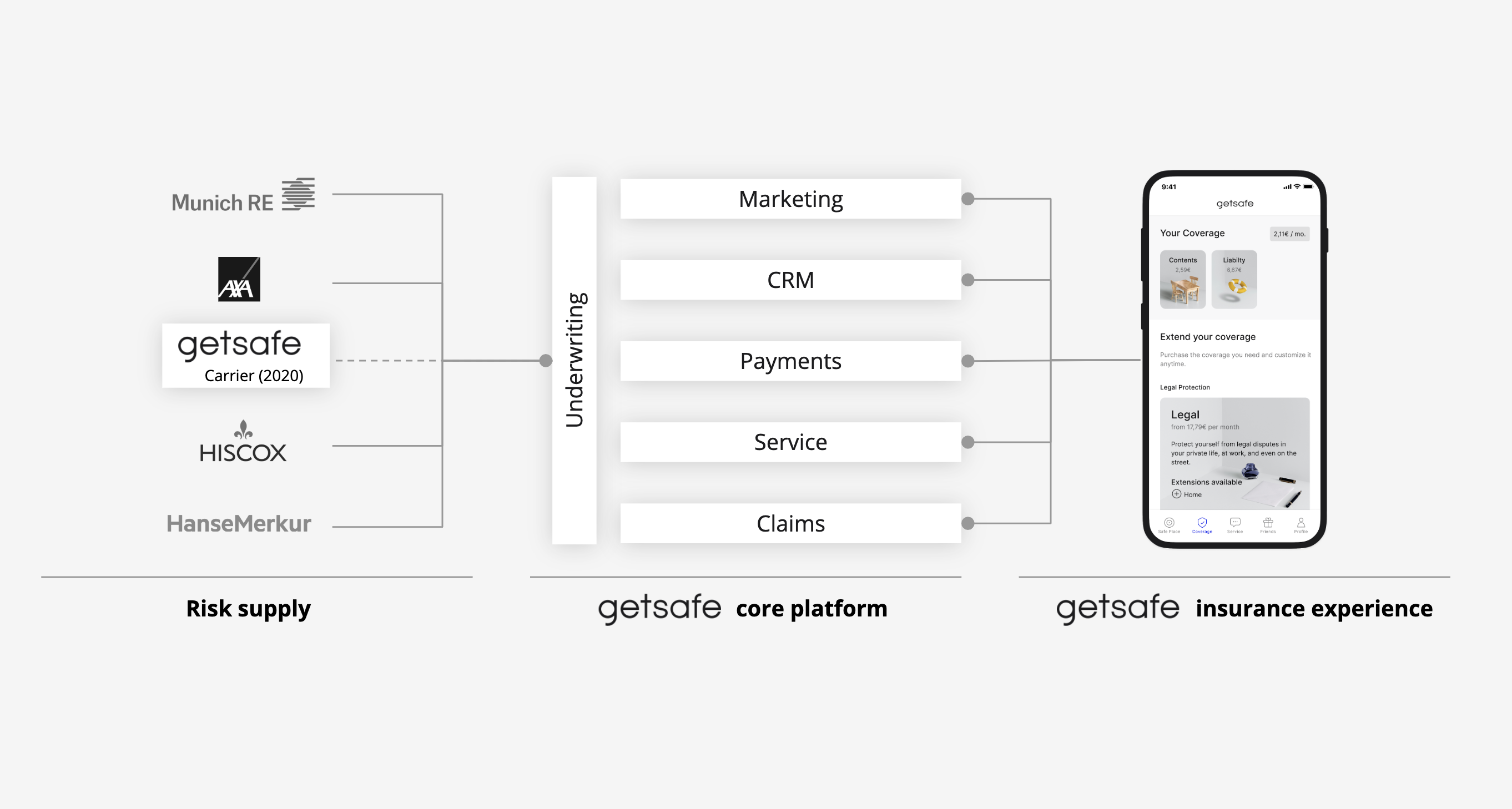

Getsafe began life as a digital insurance broker offering a digital wallet for customers to manage their policies in one place. However, the team quickly discovered that it would be impossible to digitise the entire customer experience (CX) with a dependency on insurers’ legacy technologies and processes.

Today, Getsafe operates a proprietary smartphone app backed by a core policy administration and claims platform. AI is applied throughout the CX from quote to claim. The platform collects a large amount of data which allows Getsafe to deepen its understanding of customers, their needs and behaviours, and fine tune its product design and CX.

“Getsafe’s app provides the simplest and most flexible access to affordable insurance products, especially for young people – a clientele that has remained hard to reach for the insurance industry.”

Christian Nagel, Managing Partner, Earlybird

Company in action

Getsafe is building a technology stack and operating model that will enable it to become a “full stack” carrier. For example, Getsafe’s customers can submit claims 24/7 via its chatbot. Proprietary algorithms are applied to customer data to automatically settle claims and detect possible fraud. Behavioural science is also applied to this process by requiring customers to sign a “Fairness Agreement”.

Case Study

Client situation: Digital-native millennial and younger generations expect digital customer journeys that are intuitive to use and products that can be customised frequently to adapt to their changing needs. They want insurance that is simple to understand, transparent and fair.

Solution: Customers can obtain coverage via the Getsafe app in under three minutes. The monthly membership subscription can be customised in real time, for example new products can be added or the home contents coverage widened to include a customer’s partner when they start living together. The subscription can be cancelled at any time.

Results: According to its internal research, Getsafe has a greater millennial market share for its product range than established carriers, and its app usage rates are four times higher than direct digital competitors. The Getsafe app is rated 4.8 out of 5 on the Apple App and Google Play Stores from over 1,200 reviews, a very high score for any sector.

The Oxbow Partners View

We have selected Getsafe as an example of the small number of Distribution InsurTechs with strong momentum.

It is also interesting to note its ambitions to become a “full stack” carrier. It shares this ambition with a number of other Impact 25 Members such as ELEMENT and Ottonova, and we believe this is an emerging trend for the next decade.

Getsafe’s traction with millennials positions it well for the future.

First, Getsafe is able to access a historically underinsured segment – arguably demonstrating that these customers value insurance but don’t ‘connect’ with traditional propositions. This will be interesting for established carriers looking for future growth.

Second, this market will grow massively in the next decade; Getsafe calculates that around 1bn policies will be purchased by European millennials in the next ten years. Again, Getsafe is well positioned for growth.