Hokodo: Impact 25 2019 profile

March 4, 2019

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25 2019.

Hokodo makes niche financial products available to SMEs who would not otherwise have access to them.

Single invoice insurance – the company’s first product – has a low premium per transaction meaning it is unattractive and difficult for brokers or insurers to distribute through traditional channels. Instead, Hokodo integrates with platforms used by SMEs in the course of their ordinary business to distribute these products. For example, invoice insurance can be sold at the point of invoicing on a cloud accounting platform.

This integrated sales model means distribution costs are low and the ‘context’ will raise conversion rates. The company’s pricing and policy administration is fully automated making operational costs highly scalable. Integration with partner platforms is done via API with a relatively low effort for partners.

Hokodo was set up by two experienced insurance professionals. Richard Thornton is the former Head of Strategy and Group COO at Aspen, and Louis Carbonnier was the founder and Co-CEO of Euler Hermes Digital Agency. Hokodo’s data science team uses a range of external data sources to build the rating structure and accurately price risks. Its products are underwritten by the Channel Syndicate, a unit of SCOR P&C.

“We’re glad to partner with Hokodo as they make it incredibly simple to offer different insurance solutions through our platform.”

Maex Ament, Co-Founder & CEO, Centrifuge

Company in action

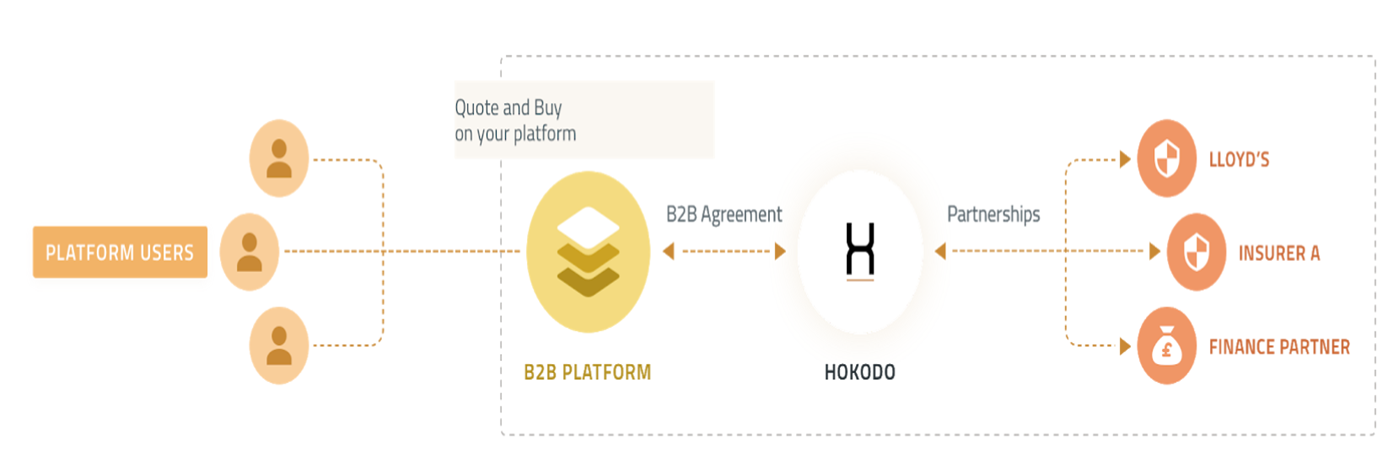

When making a transaction online, platform users can choose to easily add insurance or financing to their invoice. For B2B platforms, the advantage is an enhancement to the platform’s range of services at relatively low effort and without disruption to the core customer journey.

Case Study

Client situation: A growing SME will find itself issuing more and more invoices to clients it does not know. The SME will be faced with an increasing credit risk exposure. Traditional risk management options include whole account credit insurance which may not be tailored to the requirements of the SME (for example it covers known clients with good payment records).

What they did: The SME can purchase invoice insurance directly from the cloud-based tool that they use to issue those invoices. Hokodo is able to provide insurance for these accounts thanks to its data science capabilities, which use third party data to understand the exposure of these accounts.

What impact it had: The SME can trade in the knowledge that its invoices will be paid – ideally by the client but if not by the insurer.

The Oxbow Partners View

Hokodo did not meet our minimum revenue requirement in 2018, but we have chosen to include the company because we see it as high potential given its proposition and management team.

Online marketplaces and cloud accounting providers are becoming an increasingly important part of an SME’s operations. In fact, many SMEs find that insurance is one of the few services where they still need to deal offline – everything from banking and accounting to CRM and office supplies are done on digital platforms. Being able to offer relevant products at a tailored price as part of that system’s functionality feels useful to the platform and its users. Clearly there is scope to broaden the product range over time to higher premium products such as professional indemnity.

The interesting thing about the proposition is that no conscious channel shift is required. An SME doesn’t have to tell its broker that it’s switching to an online broker – an awkward conversation at the golf course. Instead, the SME just starts to buy more and more products embedded into its third party platforms, and at some point realises that it no longer needs the broker. We think this will drive faster adoption than other digital SME insurance platforms.