hx: Impact 25 2020 profile

March 11, 2020

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2020.

hyperexponential – hx – is a technology company that has developed a cloud-based actuarial pricing platform.

reNew, the name of the platform, allows actuaries to build models using ‘modern’ languages such as Python, React and JSON and to access and incorporate a huge array of internal and external services and data sets.

The business’s objective is to replace the legacy systems and spreadsheets currently used by pricing teams, and to become a company’s primary method of collecting and interpreting pricing data.

The concept is based on the founders’ collective 26 years of actuarial pricing experience and a deep understanding of the unique requirements of P&C speciality lines.

hx has won three contracts since its first product release in October 2018. hx attributes its success to its ‘API-first’ approach which has allowed it to integrate relatively easily with legacy systems. The standard set-up time for reNew is six hours, after which actuaries can start building models.

hx is carrying significant momentum from its participation in the 2019 Lloyd’s Lab accelerator programme with Proofs of Concept (‘POCs’) with five potential clients, mostly large Managing Agents at Lloyd’s and London Market carriers. The Lloyd’s programme enabled the company to collaborate on development of best practice pricing approaches for speciality lines and strengthen its integration capabilities for third party data sets.

“hx are a dynamic and agile company whose leadership have strong domain knowledge of both specialty insurance and technology. Working with them is enabling us to quickly facilitate better underwriting decisions.”

Sarah Brooks, Portfolio Optimisation, Convex

Company in action

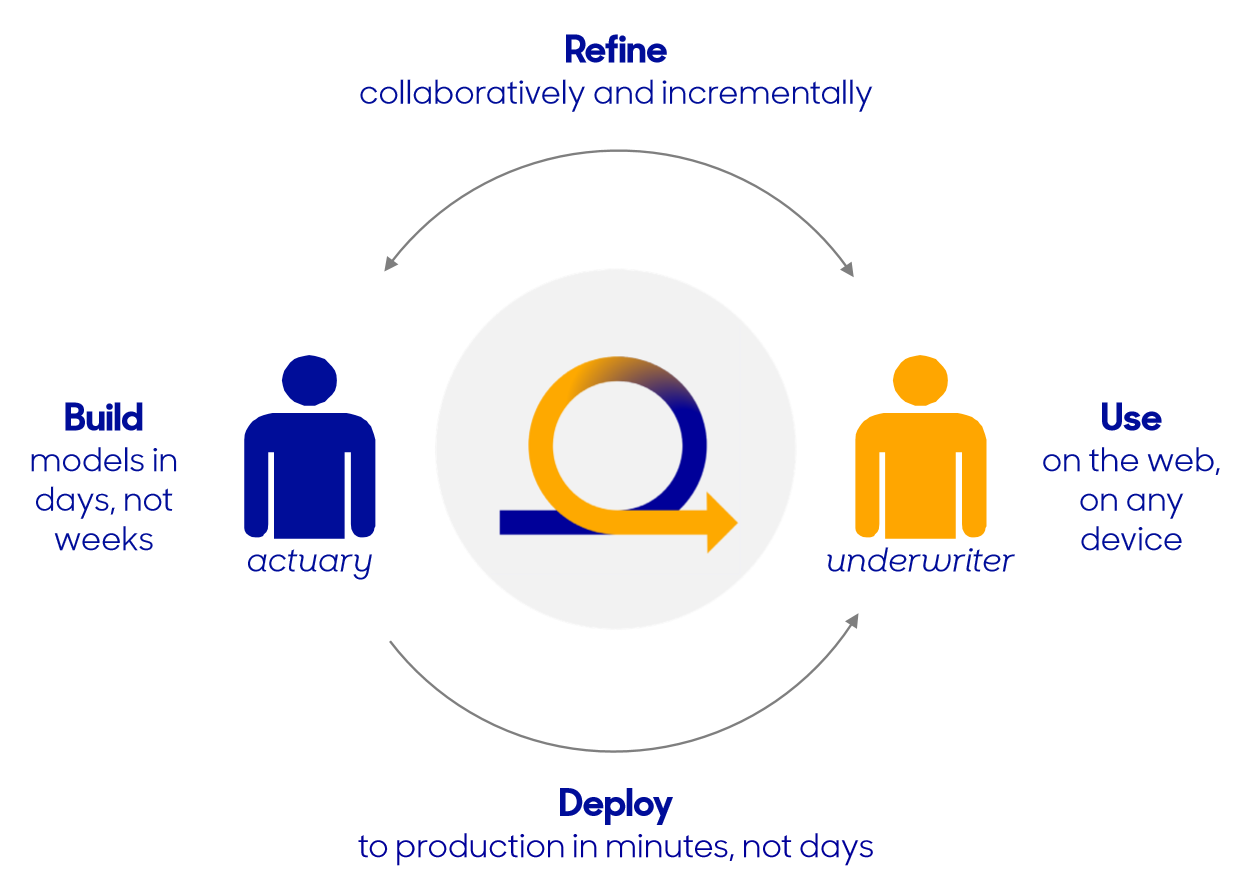

Build: Actuaries require less than six hours of training before they begin building models unaided.

Deploy: reNew fully automates the model deployment to the cloud-hosted solution

Use: Underwriters can access and use the model anywhere on any type of device

Refine: reNew supports an iterative process between actuaries and underwriters to promote effective pricing.

Case Study

Case Study

Client situation: Convex is a new international specialty (re)insurer that launched in 2019. It needed to rapidly develop a scalable pricing model ecosystem from a standing start.

Solution: Convex chose hx to build a sophisticated modelling framework. hx’s Python-based rating algorithm engine and a customised set of user-friendly UI components enabled Convex to design, build and deploy actuarial pricing models in weeks rather than months across multiple speciality lines.

Results: This short development time has saved Convex considerable cost and allowed it to start delivering models to its underwriters several months ahead of market standards.

The Oxbow Partners View

hx is one of two actuarial pricing solutions selected for the Impact 25.

It is interesting that actuarial tools have arguably received limited attention since the first waves of InsurTech hit the industry in c.2015; whilst there are many data and analytics businesses, they are generally helping supply or process data rather than build models. It is impressive – and perhaps a signal of unfulfilled demand for innovative solutions here – that hx has had such rapid traction, and the company certainly dispels the myth of the 18-month sales-cycle for enterprise insurance solutions.

Unsurprising is that hx’s main ‘competitor’ is existing spreadsheets. Spreadsheets create many operational risk challenges for insurers but have survived for decades, particularly in the specialty market, due to their flexibility, relative low cost and users’ familiarity. We expect to see a more rapid shift to cloud solutions in the next few years as more and more companies integrate new data sources into their pricing – and thus exceed the capabilities of a spreadsheet.

The $87m valuation of Rulebook, another SaaS pricing tool, when it exited from Moore Stephens Consulting to Verisk in 2018 perhaps confirms this hypothesis.