InforceHub: Impact 25 member 2019

March 4, 2019

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25 2019.

Life, health and pensions insurance companies have long-standing relationships with their customers, often through intermediaries, but few direct customer interactions. This means they often lose touch over time with the changing needs and circumstances of their customers. This can impact profitability as risks change and lapses increase. There is value to be found and released in the existing customer base. InforceHub builds tools to help insurers understand these opportunities and to design and implement campaigns to build more profitable relationships within their existing customer base.

The company’s ‘CAFE’ platform enables an insurers’ customer-facing staff to have smarter and more relevant conversations with customers. This is not only useful to customers but also engages staff leading to better all-round relationships. Matt Gosden, CoFounder says: “we have proven that responsible use of machine learning and artificial intelligence really does help insurers identify the right conversation to have with the right customer at the right time.”

InforceHub says that its campaign work to date has achieved results on average 5x to 15x more successful than insurers’ existing approaches. In time it sees opportunities in P&C.

“As more and more insurance companies are using technology as an enabler, machine learning has the ability to quickly and

effectively analyse customer data for complex patterns.”Zubair Siddiqi, Head of In-force Management, Zurich

Company in action

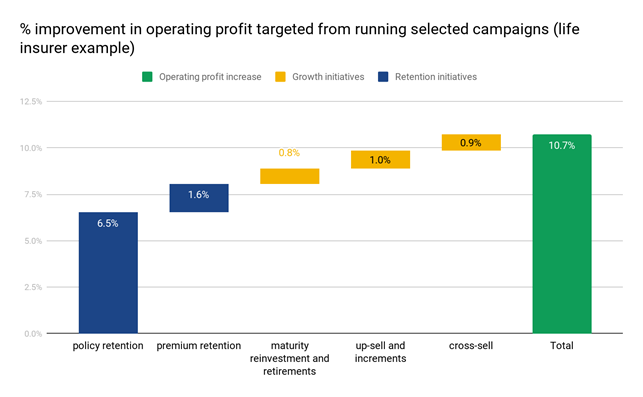

The chart shows incremental operating profit increases (in % of current operating profit) targeted using InforceHub’s methods and campaigns, scaling up the benefits the company has already achieved in pilots. This is the output of InforceHub’s ‘Estimator’ tool which helps insurers focus on the commercial levers with the most potential. The shape of these incremental profits varies by insurer.

Case Study

Case Study

Client situation: An insurer noticed that a large number of customers were stopping paying their protection insurance premiums. There were many reasons: some customers’ needs had changed, others had found a better or cheaper offer – but service issues such as disengaged advisors and lack of communication from the insurer also contributed. The insurer wanted to reengage these customers but needed to identify which customers to contact and how best to approach the conversation with them.

What they did: InforceHub used its data mining and analytics software to work with the insurer to identify the best customers to target in two distribution channels. The company then used its technology to manage a campaign, including detailed feedback capture from each interaction.

What impact it had: The result was that almost 50% of customers contacted wished to recommence their insurance with the insurer – approximately 10 times better than the current rate.

The Oxbow Partners View

InforceHub is a good illustration of our view that incumbents need often to think of InsurTechs as hybrid product and service companies. A ‘classic’ InsurTech is product-led, promoting analytics or claims software (for example) to its clients. The reality is that considerable development and tweaking is often required to deliver the specifications that the client requires. That is good in some scenarios – clients receive a bespoke product – but implies some risk to the delivery process. Incumbents need to be as comfortable with the competence of the team, cultural alignment and business priorities and strategy before engaging.

InforceHub is taking an interesting approach to InsurTech because it is building technology to augment and ‘industrialise’ its service (consulting) proposition, which has been the starting point for its client relationships so far. A point we also make in this year’s report is the need to remember the broader change activity that often needs to sit around an InsurTech deployment; it will be interesting to see to what extent InforceHub become a technology provider or must remain service-led to deploy its digital tools effectively.