INSHUR: Impact 25 2019 profile

March 4, 2019

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25 2019.

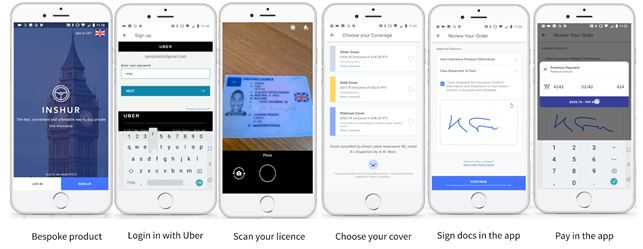

INSHUR is the latest InsurTech providing a product tailored to the needs of professional drivers working with services such as Uber, Lyft and Gett in the ‘rideshare’ or ‘gig’ economies. The company’s mobile app allows drivers to obtain a quote and purchase a policy in minutes. Traditionally they would have had to visit or call a broker, and receiving the policy documentation often took days.

Furthermore, mid-term adjustments and payment are managed in the app. The app uses a digital messaging assistant, Ami, to collect basic customer information. An important component is the collection of driver IDs and licences, which the system ingests and analyses in real time. The company claims that a policy can be issued within three minutes.

INSHUR provides digital claims processing and document uploads via the app. Users also receive timely alerts for items needing attention, such as renewals and claim payments. During renewal periods, the company’s platform automatically reviews prices and presents options to users in the app. INSHUR plans to use its technology platform to target future sectors such as transport and delivery, where the driver profile, employment status, and commercial insurance need is similar.

“With a solid UK launch well underway and the financial backing from ourselves and others, INSHUR is one to watch in 2019.”

Andrew Rear, CEO, Munich Re Digital Partners

Company in action

The INSHUR solution is a mobile-first digital insurance platform, driven by a chat-based agent called Ami. The goal is to present a simple set of questions to the user, but underneath the hood, Ami relies on a sophisticated proprietary framework that allows INSHUR to configure new underwriting flows quickly with analytics to track user behaviour.

Case Study

Client situation: Professional drivers are frustrated with the process of buying insurance. For example, after calling an insurer it was necessary to send copies of various documents by post or email and sign forms in person. It took several hours or days to confirm cover.

What they did: A driver can download INSHUR’s mobile app for free from either Apple or Google Play. The automated chat process makes data entry simple, which is essential considering the diversity of the driver customer base. A quote and policy can be bought in a matter of minutes with the record being 171 seconds. Over 38% of transactions are handled outside of traditional broker hours.

What impact it had: The driver was able to return to work, confident that they had reliable insurance that could be managed using their phone.

The Oxbow Partners View

We selected this business on account of its rapid initial growth – $24m of GWP within 10 months of launch. In comparison, Oxbow Partners analysis suggested that Lemonade wrote only around $2m at the same point. Clearly, there are big differences – Lemonade is writing $5/month renters policies whilst INSHUR is writing commercial motor – but still…

The question is, therefore, whether INSHUR can make money on motor. Traditional underwriters sometimes have a black-and-white view of portfolio profitability, often based on historic anecdotes – and taxis are ‘bad’. We think that InsurTechs might be more successful: a datadriven approach to finding pockets of profitability is likely to win against incumbents, not to mention lower acquisition costs and maybe (time will tell) better retention.

This has certainly been the experience of some of the other InsurTechs in this area that we have been tracking.