Insuradata: Impact 25 2018 profile

March 9, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

Insurdata technology is used by insurers and reinsurers to develop and augment building-level property insight.

Peril-specific exposure attribute data is available from point of underwriting to portfolio management. Additional services include generation of 3D property-specific models. This insight is generated through proprietary data augmentation methodologies.

The technology works globally and has to date been used to augment client exposure data in 84 countries.

The information created using Insurdata technology has a material impact on exposure management and modelled loss estimates, impacting pricing, underwriting, portfolio management and risk transfer. Insurdata’s mobile and desktop technology is blockchain-enabled and is available through API.

“Thanks to Insurdata’s technology, we will soon be better placed to assess the risks to which an individual property is exposed,

allowing us to calculate risk on a micro level, building by building.”Nicolai Heitz, Business Analyst, Non-Life, Baloise

Impact

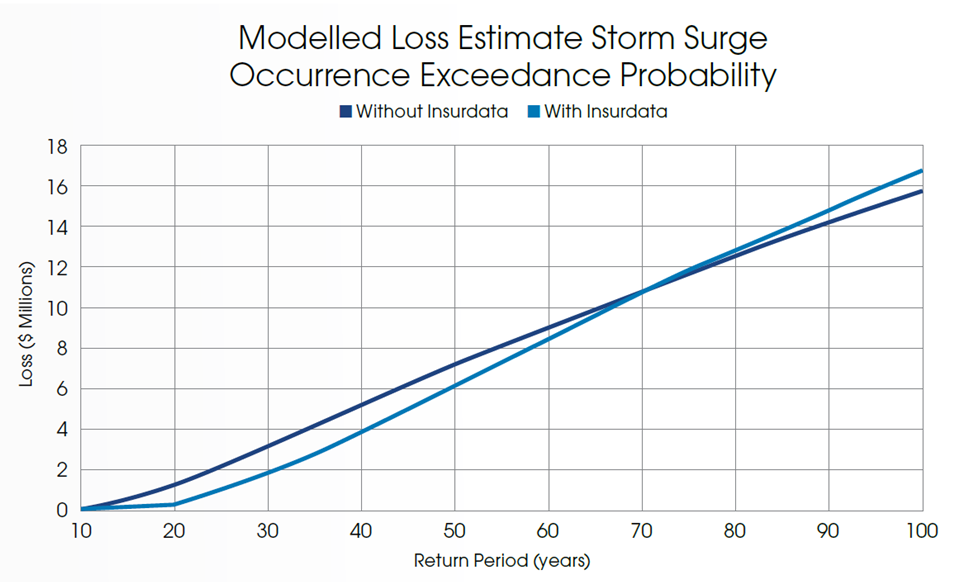

A recent project resulted in material changes to the client’s modelled loss estimates, including:

- Average Annual Loss: ~22% of exposures had a minimum ~5% change in average annual loss

- Occurrence Exceedance Probability: ~20% impact on return period modelled loss estimates

Case Study One

Client situation: The client’s focus was on high-quality, high-resolution underwriting and pricing of US food risks at point of underwriting.

What they did: Insurdata integrated its API into the client’s underwriting process through Microsoft Excel, including primary exposure characteristics and key peril-specific attributes.

Impact: The client achieved a significant impact on understanding and pricing of risk.

Case Study Two

Client situation: A client wanted to understand the impact of high-resolution, accurate exposure information on its global earthquake portfolio.

What they did: The client commissioned a consulting project to assess a subset of its portfolio, including the US and UK, and multiple countries in Asia. Insurdata assessed the risk using augmented exposure information, Digital Elevation Model and soil data.

Impact: The client has a much deeper understanding of its portfolio, including the volatility of hazard data and potential loss estimates.

The Oxbow Partners View

Traction: Founded only in 2017, Insurdata has been quick to make an impact in the industry. Multiple insurance executives called out this business as one to watch based on the results of their 2017 proofs of concept.

Potential: Insurdata has a world-class management team with decades of insurance modelling experience behind them (RMS). Early pilots in the first year of operation demonstrated impact beyond management’s expectations, suggesting to us that this business will have impact in 2018 and beyond.

The 2018 challenge: Insurdata was in ‘set-up’ mode in 2017 with a team of experts in London and Denver. As client demand increases, the company will need to deliver at greater scale, globally.