Bitesize Impact 25: Insurdata

June 22, 2018 Chris Sandilands

Insurdata enhances exposure data relating to individual properties for (re)insurers and brokers to improve insights used in underwriting, pricing, risk assessment and portfolio management.

The company recently concluded a pilot with reinsurer SCOR in Florida which revealed that 44% of properties (equating to 50% of total insured losses) were incorrectly geocoded in the existing dataset. Expected losses per location changed by up to 80% as a result of Insurdata repositioning. The pilot also revealed significant changes in both annualised and return period losses. Another pilot with a different company revealed that over 90% of locations were inaccurately geocoded at an average displacement in excess of 50m.

The technology scales to any portfolio size, but founder Jason Futers says Insurdata is most effective for addressing high impact issues (such as poor geocoding and the absence of first-floor elevation data) through a ‘data on demand’ service. He says the platform has the greatest perceived value at the point of underwriting.

Insurdata can be integrated via API, which Jason says will significantly reduce the time it takes for data to find its way through the value chain: some processes currently can take months of manual re-keying.

The platform is currently being used by clients based in the US and Europe. Jason says dozens of conversations with potential partners – including brokers, MGAs, insurers and reinsurers – are ongoing.

Insurdata says that for every dollar spent on its technology, users generate $13 of corrected technical premium for residential property, or $50 for commercial property.

The company received $1.3m in funding from partners including Anthemis and Plug and Play in October last year and is currently in advanced discussions for its next round. Headcount could as much as double to around 20 in the next 12 months to drive growth in multiple markets.

While the focus of the business is initially flood, the platform applications can be widened to other catastrophe events (e.g. terror) and to other impacts including infrastructure. Jason adds that Insurdata could be used for other coverages including parametric triggers in the future, and could support community responses to catastrophic events by advising on how and where new properties are built.

The Oxbow Partners view

Insurdata was founded in 2017 and is the youngest company on the Impact 25. We included the company because the team is strong (Jason is ex RMS) and emerging results were impressive. This is a business that has come out of the gates quickly.

Exposure modelling is big business. Revenues of RMS, the leading loss modelling platform, were £233m in 2017, and Jason estimates that the total exposure-based (re)insurance analytics market is close to $1bn. (Re)insurers’ investment in modelling infrastructure and capabilities, for example the Oasis framework, suggests that investment in improved risk insight will continue for years to come.

But “GIGO”, as thew3y say: “garbage in, garbage out”.

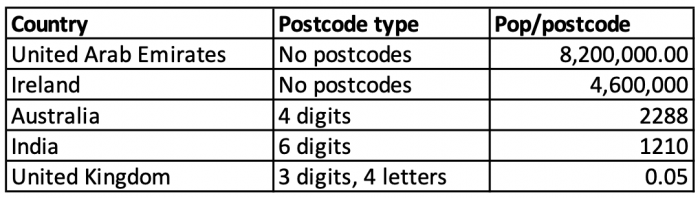

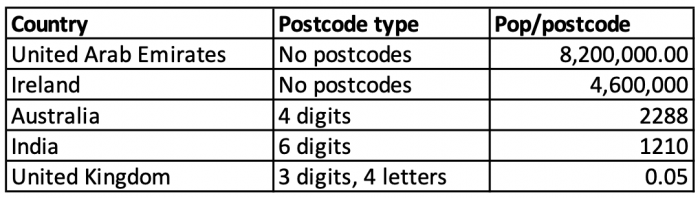

The inaccuracy of underlying location data cited in Insurdata’s case studies is staggering but perhaps not surprising. Portfolios have been placed for decades using analogue geolocation metrics, for example postcodes. Data from What3Words, a tech business that is “addressing the world” with a globally consistent 3-word system, shows the difference in postcode resolution in different countries:

When this ‘analogue’ information is pulled into exposure modelling platforms it goes through a variety of processes, including disaggregation and geocoding, during which insured exposures are allocated to specific coordinates. These coordinates are often incorrect, and thus inaccuracies start to creep into geolocations; for example, a property is believed to be at the top of a hill rather than 54m down the road at the bottom of it.

In some ways, Insurdata is solving a problem that shouldn’t really exist. But it does, and the industry clearly sees value in Insurdata’s solution.

Indeed, Jason notes that Insurdata has already been asked to play a “steering role” in the industry to help identify and define data requirements to reshape approaches to risk management. Perhaps Insurdata will transition over time from being a ‘problem solver’ to a ‘standard setter’ for industry geolocation data.

SaveSave

SaveSave