InvestSure: Impact 25 2020 profile

March 11, 2020

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2020.

InvestSure has built a technology and analytics platform that enables a parametric insurance product that protects investors in listed equities against sudden and severe losses caused by allegations of management fraud and dishonesty.

Claims are triggered by two events: alleged or actual fraud and a 10% share price fall. The premium is low enough for the product to be economic for investors (0.6% of the value protected in South Africa).

InvestSure is currently live in South Africa, where it has partnered with Compass Insurance as the carrier.

InvestSure’s first distribution partner, EasyEquities, has embedded the product into its online customer journey. Over 10,000 policies have been sold since launch in May 2018. This traction has enabled InvestSure to fine-tune its proposition. The average claim settlement time is less than a minute from when policyholders sell their shares.

The seed for InvestSure was sown during a global innovation competition developed by Hannover Re. Hannover Re’s Executive Board provided InvestSure with seed capital after incubating the idea in its African operations. InvestSure’s co-founders have subsequently raised external capital to fund its growth.

“InvestSure is one of the most digitalised insurance businesses, with claims being paid in record time. The product and processes have been thoroughly tested in South Africa, and InvestSure is now looking to expand internationally.”

Achim Klennert, CEO, Hannover Reinsurance Group Africa

Company in action

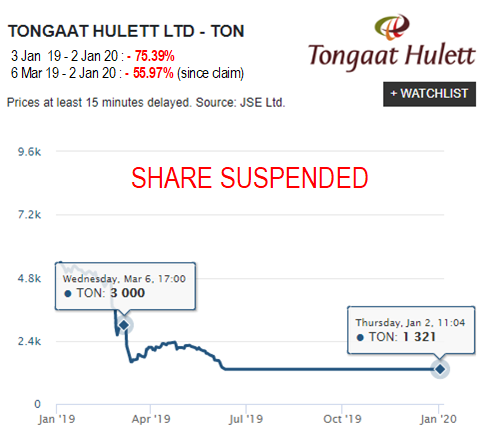

Tongaat Hulett is a South African listed agriculture and agri-processing business that identified accounting issues in early 2019. Media reports alleged accounting fraud of several billion Rand causing a sharp fall in the share price. The Johannesburg Stock Exchange subsequently suspended trading when shares were trading at R13.21. All InvestSure clients were able to exit at an effective R27.00 per share.

Case Study

Client situation: Management fraud is an extremely difficult risk for investors to assess and manage. Allegations of fraud often cause sudden, severe and often sustained losses to innocent investors.

Solution: InvestSure has developed a first-of-its-kind parametric insurance product that indemnifies investors for losses caused by allegations of management fraud and dishonesty. InvestSure integrates its technology with online investment trading platform partners via APIs. These integrations allow investors to purchase and manage these insurance products directly on the trading platforms.

Results: InvestSure currently covers 121 companies on the Johannesburg Stock Exchange, 95% of the local market. It has paid claims on 12 separate events since launch after assessing over 30 events.

The Oxbow Partners View

InvestSure’s does not meet our minimum revenue requirement, but we chose to include the business because we like the market-creating innovation. The company is bringing a new form of protection to the retail market, and it will take time to educate regulators, insurers, investment platforms and retail investors.

InvestSure has also managed to execute its proof of concept with a lean operating model; counterintuitively, many InsurTechs employ dozens if not hundreds of staff even as they preach technology-driven efficiency.

The parametric nature of the product helps given that claims are determined algorithmically. There are related product opportunities. Targeting professional investors and other asset classes are obvious examples.

We wonder whether there is also a play in the D&O liability market, where underwriting is still largely judgement-based for larger companies.