KASKO: Impact 25 2018 profile

March 10, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

KASKO offers an end-to-end insurance platform to enable insurers to create, launch, run and optimise digital insurance products in any distribution channel quickly, cost-effectively and flexibly.

Specific features include:

- White-labelled front-end as a plugin solution

- Quote, offer, bind functionality

- Payments and redistribution

- Policy administration

- FNOL claims submission and bespoke claims workflow

This allows insurers to launch and manage products entirely on the KASKO platform, integrate any third party data / tech services in a compliant manner, and integrate or replace any aspect of the KASKO platform with their own infrastructure.

“I am impressed by the inspiring collaboration with KASKO. Agile, quick and uncomplicated. Keep it up.”

Michael Muller, CEO, Baloise Switzerland

Impact

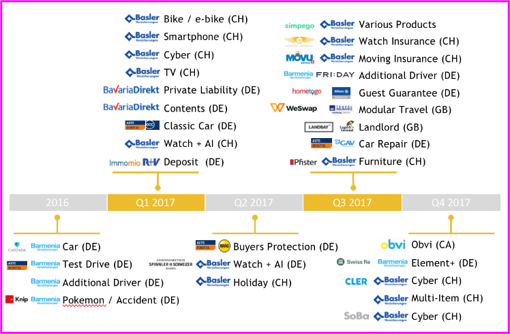

KASKO has brought over 20 products to market in the last 12 months with an average time-to-market of 2-3 weeks.

Case Study One

Client situation: AXA Travel Insurance wanted to minimise the time to market and cost of selling travel insurance through the long-tail of distribution channels.

What they did: KASKO digitised a modular travel insurance product on its platform, creating a bespoke REST API and a front-end that embedded the insurance proposition within the checkout and follow-up notifications of any digital channel (incl. dynamic pricing). Given its position as an MGA, KASKO also created an AR onboarding process to minimise the operational and regulatory burden.

Impact: KASKO onboarded fintech and banking partners such as WeSwap and Starling Bank as a result of creating this plug and play solution.

Case Study Two

Client situation: Following initial success with D2C item insurances, Baloise Group wanted to create a comprehensive B2B2C proposition to attract new customers via affinity channels, including the ability for agents to onboard offline retailers as sub-agents.

What they did: KASKO scoped and implemented the pricing and underwriting framework to enable Baloise to price any product and any module individually and amend them at any time. KASKO also enabled Baloise to create different pricing and commission variants per product and distribution partner.

Impact: Within 4 weeks of launch, Baloise agents had already acquired over 100 retailers.

The Oxbow Partners View

Traction: KASKO launched products with 14 insurers across Europe over the last 12 months. We think this demonstrates impressive marketing reach for a young business and a good understanding of the challenges faced by their target clients.

Potential: We are seeing more and more insurers and MGAs consider their core platform strategies. For the large players this involves thinking about niche platforms for specific products, innovations or markets. For smaller players it is the realisation that the ‘household names’ are not the only viable options. We think that KASKO is well positioned to capitalise on this trend.

The 2018 challenge: KASKO is subject to the corporate procurement and change cycle, which will remain the most significant constraint on its growth.