Kovrr: Impact 25 2020 profile

March 11, 2020

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2020.

Kovrr has developed a cyber risk analytics platform for (re)insurers based on the founders’ experience in cyber security and intelligence.

The company raised a £4.25m seed round in 2019 which will enable it to scale its client portfolio following successful implementations in Israel, Asia, Europe and the US.

The company’s platform calculates financial exposures to cyber events. Loss simulations are generated using a catalogue of more than 100,000 events which vary from cloud provider outages in specific territories to massive, distributed global ransomware attacks.

The platform can be integrated into several parts of the value chain including modelling, underwriting, portfolio management, aggregation exposure calculation and accumulation management. For example, one of Kovrr’s clients has increased its cyber business by 52% over the past two years following the integration of its analytics into the underwriting process. The analysis of the insured risks has reduced from days to minutes and pre-bind interactions have decreased by 90%.

Kovrr’s platform also continuously harvests global cyber data related to specific organisations and cyber events. This enables Kovrr to accurately map business assets, enterprise networks, service providers and in-use technologies regardless of the organisations’ industries, size and location.

“With Kovrr we’re able to better manage our silent cyber risk exposures and more precisely define our risk appetite for affirmative cyber risk.”

Hetul Patel, Group Chief Actuary, Asia Capital Re

Company in action

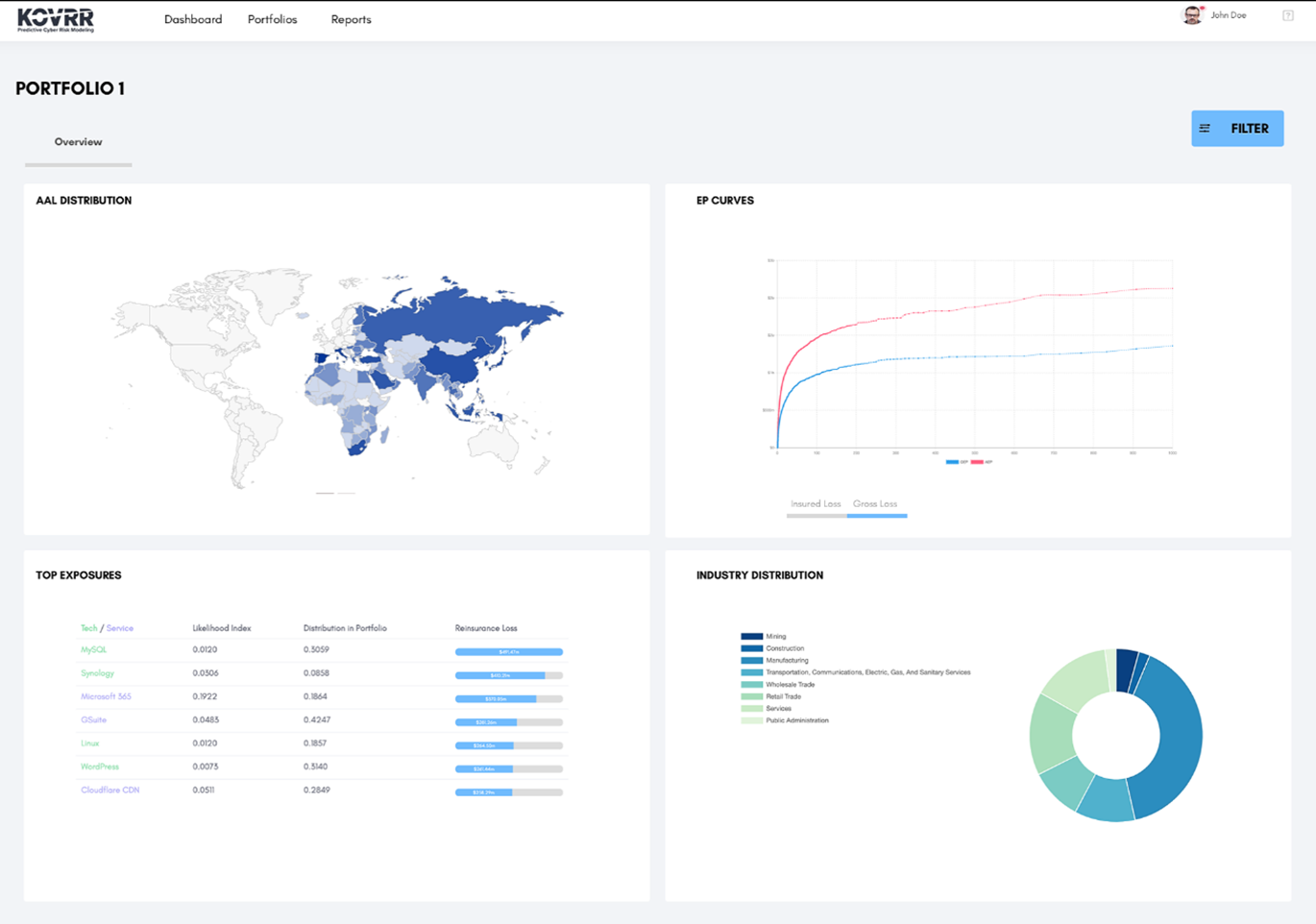

Kovrr’s insights are used to apply loss simulations to (re)insurers’ portfolios to pinpoint the exposure to specific cyber threats and calculate aggregate exposures. The results of these simulations are also summarised in a Yearly Loss Table (YLT) and Exceedance Probability Curves.

Case Study

Client situation: A reinsurer wanted to quantify the silent cyber exposure in its P&C portfolio. It had no tools or processes to perform a quantitative assessment. Product lines included aviation, credit, D&O, engineering, marine, offshore energy, professional indemnity and property.

Solution: Kovrr applied its proprietary probabilistic model and AI technology to run loss simulations for this client to predict the probability and severity of events including catastrophe scenarios.

Results: Kovrr’s solution estimated the reinsurer’s silent cyber exposure at 136% higher than previously forecast. The reinsurer has developed a structured process that provides visibility into its silent cyber exposure on a quarterly basis or more frequently if necessary.

This also allows the reinsurer to share its perspectives on these risks during the negotiation of retrocession agreements and meet board and regulatory compliance requirements.

The Oxbow Partners View

Kovrr is one of two cyber companies selected in this year’s report.

The company has made impressive progress since launch in 2017 reflecting both the rapidly evolving cyber market and the strength of its management team.

Regulators, ratings agencies and investors are requesting ever more information on companies’ approach to cyber exposures and how it impacts both cyber and other products (“silent cyber”). We believe that most companies will outsource cyber risk assessment for the foreseeable future given the specialist and complex capabilities required. This means that Kovrr is well positioned.