Ottonova: Impact 25 2019 profile

March 4, 2019

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25 2019.

ottonova was the first health insurer to be founded in Germany for 17 years when it opened for business in 2017 (134 years to the day that Otto von Bismarck introduced health insurance in Germany). The company has attracted significant attention since being founded – investment of over £30m including from Debeka, Germany’s largest private health insurer.

ottonova’s app provides policyholders with a digital concierge service (allowing policyholders to book appointments, get support when abroad, etc.), a personal medical timeline (e.g. past appointments, prescriptions) and an automated claims handling process, including the ability to make claims by photographing receipts and uploading them. The service is supported by a 24/7 helpline.

The company has two variants of its main product called ‘Business Class’ and ‘First Class’. First Class offers perks like single rooms in hospitals, direct access to specialists and other perks. Expats can access short-term plans, and those who are insured via Germany’s public system can buy ‘top up’ coverages like dental insurance or add-on hospital cover. Unsurprisingly, given the branding and products on offer, the proposition is aimed at young professionals in Germany.

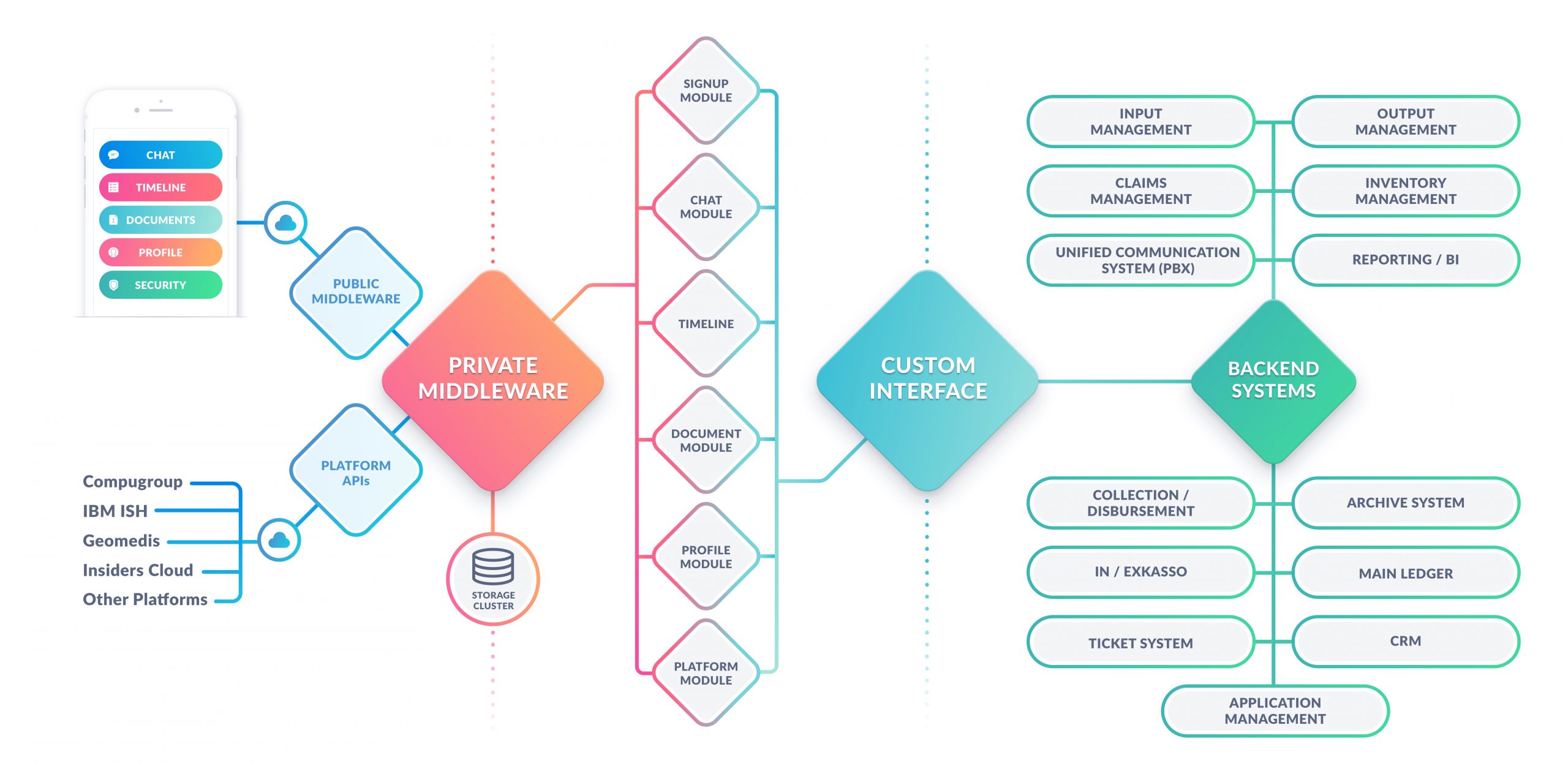

The company has so far focused on the D2C market in Germany but is now expanding its white label platform to other insurers. The first B2B customer is German health insurer Süddeutsche Krankenversicherung (SDK) based near Stuttgart. ottonova says its modular IT-platform can integrate with a large variety of systems across the insurance and healthcare market and that it is in talks with a number of insurers across Europe.

“What’s really important for me, is to know I’m taken care of when I need it. I don’t really want to be bothered with too many details and too much paperwork”

KT Flood, US expat customer

Company in action

The ottonova technology platform supports all parts of the health insurance value chain:

Case study

Client situation: The customer needs to see a doctor, be that a general practitioner or a specialist, for a check-up.

What they did: The customer contacts ottonova’s concierge who asks for further details and recommends reliable and customer-oriented physicians. Once the customer has chosen a doctor, the concierge books an appointment, taking into account the travel time to the surgery. The appointment confirmation and details are displayed in the Timeline section of the ottonova app and a push notification reminds the policyholder shortly before the appointment.

What impact it had: ottonova delivered an end-to-end solution to ensure the customer received the medical attention or help they needed.

The Oxbow Partners View

We selected ottonova for the InsurTech Impact 25 because it is one of Europe’s leading ‘full stack’ InsurTechs (startup insurance carriers). We think that it has potential to become a significant player in the €34bn health market with its digitalfirst product delivered through a legacy-free technology stack.

The challenge for the company will be acquiring customers quickly and cheaply enough. Traditional German medical insurers may be archaic, but they do the job and the care provided by the system is good by any European benchmark. All of the usual comments about customer inertia apply.

For this reason, we like two pillars of ottonova’s strategy:

First, a dedicated expat product is a smart, tactical way to build D2C volumes in a pure new business market (in the same way that Lemonade’s customers are primarily new to insurance rather than switchers).

Second, white labelling the platform to a few other insurers is a good way to boost short term revenues to give the D2C business a chance to mature.