Pharm3r: Impact 25 2019 profile

March 5, 2019

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25 2019.

Pharm3r uses machine learning and artificial intelligence to collect, clean and aggregate data on all aspects of the life sciences market. Areas of focus include drugs, devices, clinical trials and physician outcomes.

Pharm3r’s technology allows insurers quickly to detect, predict and price litigation risk. For example, an underwriter can see the number of adverse events reported for a particular active ingredient or compare the nature of reported product defects for a type of medical device.

The company has a number of tools to help underwriters in risk assessment, pricing and portfolio management. Its PandoraPlus software application provides comprehensive profiles, comparing and aggregating risk at the product, class and manufacturer levels. Its built-in portfolio manager allows underwriters to track metrics such as risk, premium and exposure on insured manufacturers and to view portfolio trends. Customised reports on specific manufacturers and product classes can also be provided.

The team comprises biology and computer sciences expertise and information is gathered, curated and handled in a Pharm3r propriety process.

“Pharm3r has revolutionized the life science underwriting process with data and analytics that empower the underwriter to make critical risk decisions rapidly and confidently.”

Todd Lauer, LifeScience InsurTech MGU

Company in action

Case Study

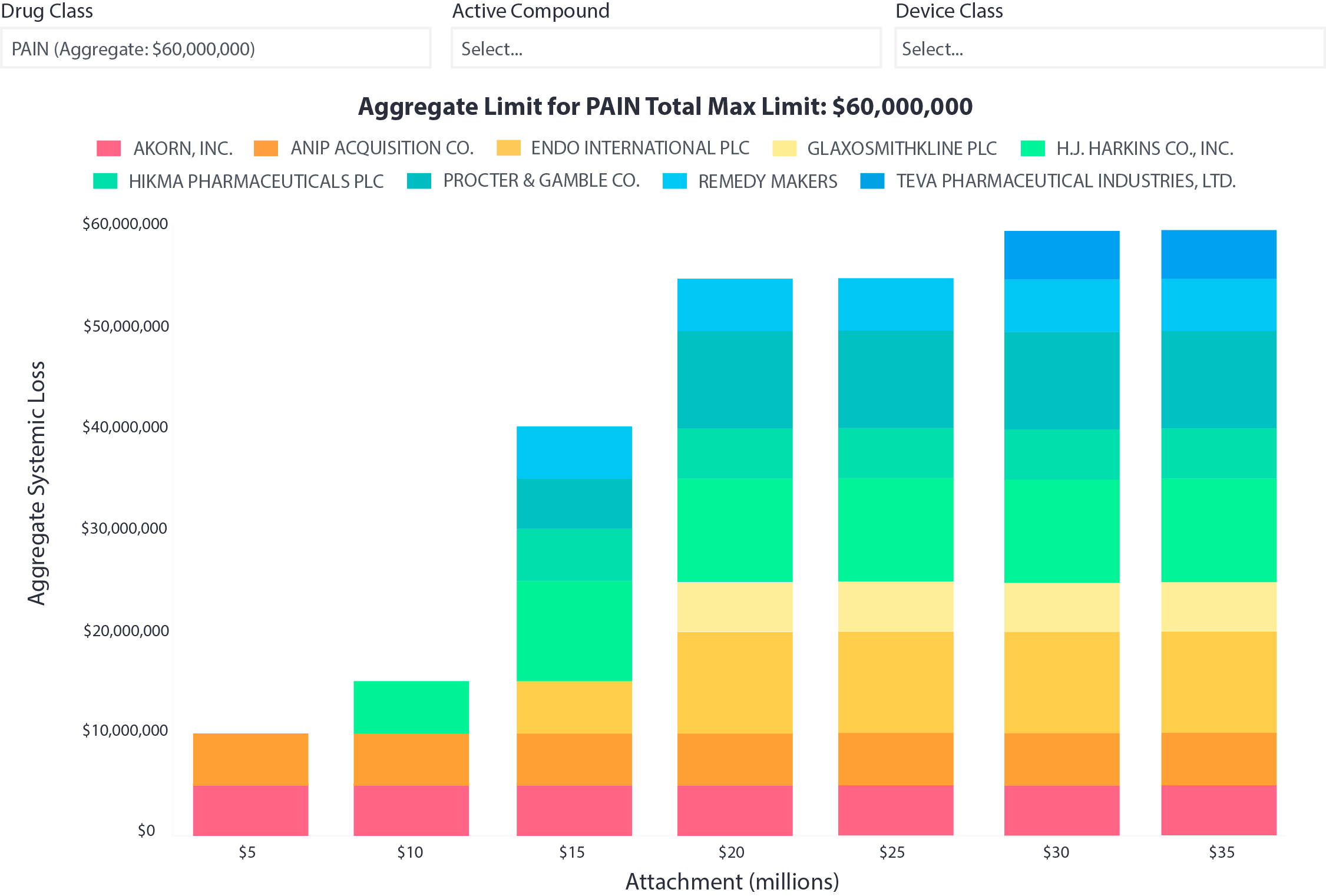

Client situation: A product liability insurer wanted an accurate assessment of the probable maximum loss that its portfolio would sustain.

What they did: Pharm3r used its database and risk scoring tool to analyse correlations within the client’s portfolio. The resulting exposure analysis was then applied to the client’s portfolio taking into account policy terms and conditions.

What impact it had: The insurer could pinpoint products and companies of outsize influence and measure the effect on the portfolio of different regulatory assumptions. Pharm3r was able to create an exposure management tool for liability insurance, which can be used in the same way as RMS and AIR are used by property insurers.

The Oxbow Partners View

Industrial insurers sometimes argue that their segment of the market is relatively immune to change. For example, D&O underwriters might say that there are too few claims for it to be possible to model risk and continue to price largely on gut instinct supported by some analysis of historic claims.

But industry databases and analytics companies are a game-changer for underwriters. In short, they allow underwriters to move away from using experience metrics (i.e. claims and near misses) as the primary source of rating to an informed and quantified view of exposure. Consider a high layer medical device manufacturer’s liability policy. The broker may be pushing for below-average ROL pricing due to manufacturer’s good claims history, but data could tell an underwriter that there has been a sharp increase in the number of lawsuits related to a specific device. This insight could be the difference between a profitable and highly unprofitable book of business.