Prenetics: Impact 25 2020 profile

March 11, 2020

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2020.

Prenetics is a genetic testing and digital health services company headquartered in Hong Kong with backing from Ping An and Alibaba. It expanded into Europe and widened its range of solutions with its 2018 acquisition of DNAfit, a UK- based direct-to-consumer genetic testing company.

To date, Prenetics has processed 300,000 DNA samples globally.

Prenetics helps its insurer partners strengthen their value propositions by providing genetic tests and digital health services as riders to existing life and health products. Some insurers offer these services for an additional premium whereas others, for example Generali Indonesia, offer the solution to its premium clients as an incentive to upgrade from other products.

Other carriers using Prenetics are Swiss Life Global Solutions who following a detailed pilot with its employees got Prenetics as a wellness partner for their global customers. Irish Life Health, Ireland’s largest life and health insurer, which launched Wellness DNA in Q1 2020.

Prenetics has a strong pipeline of similar projects in mature insurance markets.

The company also provides a platform to allow carriers to ingest and analyse other health-related data, such as that collected by fitness trackers and wearables. By combining this data with genetic information, the company can present policyholders with an explanation of their unique genetic profiles and provides actionable wellness information.

Prenetics test results are not used for underwriting or claims purposes. Prenetics is integrated into its partners’ proposition through a white-labelled solution.

“Equipped with genetic information, we show members how to make positive lifestyle changes that lead to better health, fitness and quality of life. The Prenetics partnership has been great throughout.”

Brian O’Gilvie, Senior Manager, International Population Health Marketing, Aetna International

Company in action

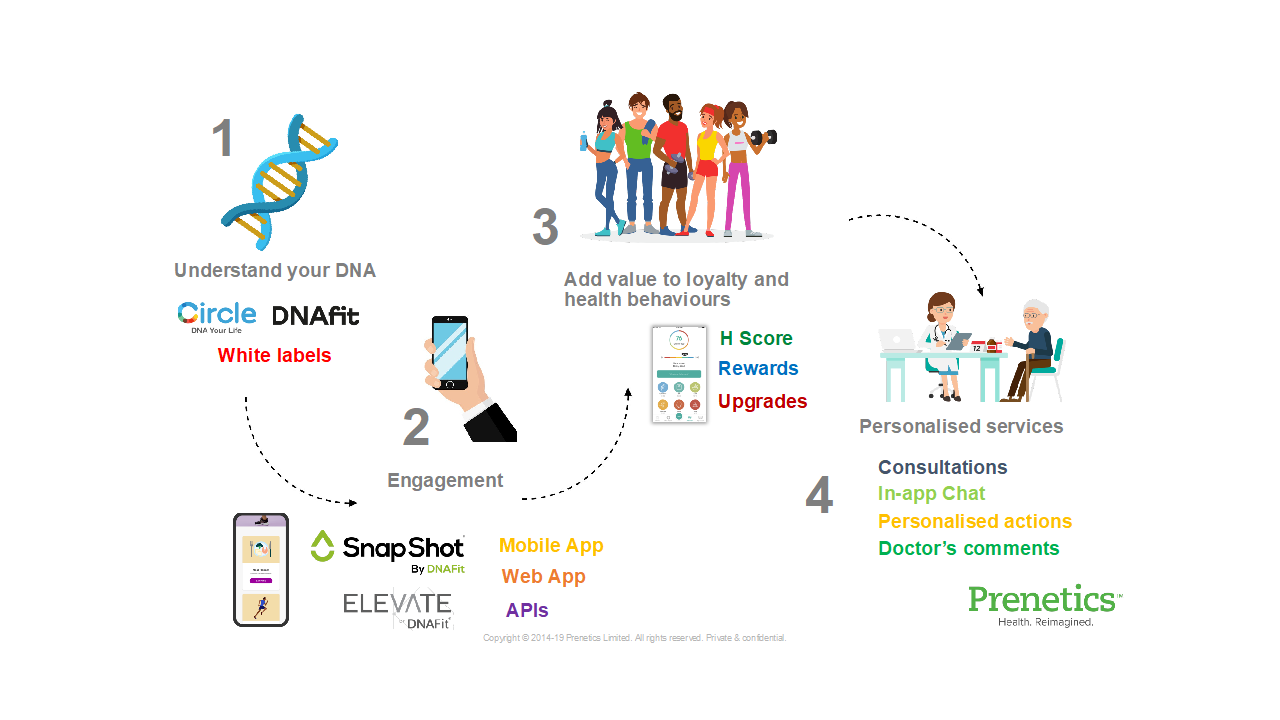

Prenetics offers a wide range of digital products and services across four pillars:

Case Study

Case Study

Client situation: Aetna International is one of the largest private medical insurance providers. It wanted to explore the opportunities to strengthen and differentiate its health and wellness value proposition. It only wanted to offer genetic tests examining genetic variants associated with diet, fitness, sleep and stress. Aetna International explicitly does not use genetic information as part of its underwriting or pricing processes.

Solution: Prenetics was chosen following a clinical evaluation of its products and services, and adherence to the strictest data privacy and protection standards. Aetna International DNA requires a saliva sample to produce personalised information that explains the relationship between a policyholder’s genes and their diet, fitness, sleep and nutrition. Follow-on support such as consultations with qualified dietitians and sports scientists is available from both Prenetics and follow-up is provided by Aetna Care.

Results: This service has been positively received by Aetna International’s clients since launching in Q2 2019. Recognising the complexity of genetics, initial feedback has centred on the quantity and quality of post-test support.

The Oxbow Partners View

Prenetics has been selected as it is widely viewed as one of the most innovative biotech company delivering genetic- and digital- related products and services to insurers. During our research for this report it was consistently the first genetics companyname mentioned.

Many insurers have been circling genetics over the past few years but have been reluctant to move due to regulatory constraints associated with building a business model here, and the reputational risk of even being perceived to be using genetic data in the underwriting or claims process.

However, the growth in health and wellness technology and related engagement platforms is opening up the opportunity for insurers to begin offering limited genetic-related services to policyholders. Indeed, we see opportunities for insurers to deliver on their ambition to move from ‘payer to partner’ here. For example, genetic tests could be offered to existing policyholders when they present with illnesses that have a strong genetic element, leading to rapid and tailored treatments.

Get market insights straight to your inbox