Bitesize InsurTech: Qover

August 31, 2017 George Hanks

Qover is a digital product platform for insurance distributors. Those who prefer traditional insurance terminology might call them an MGA or Lloyd’s Coverholder.

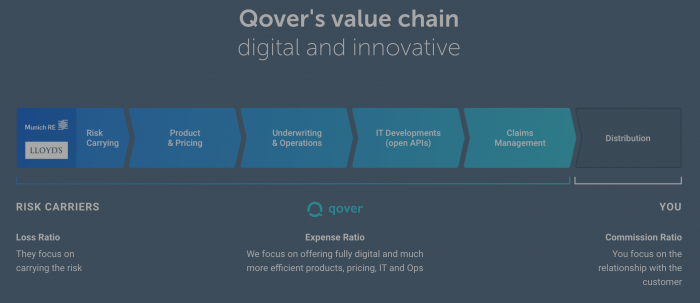

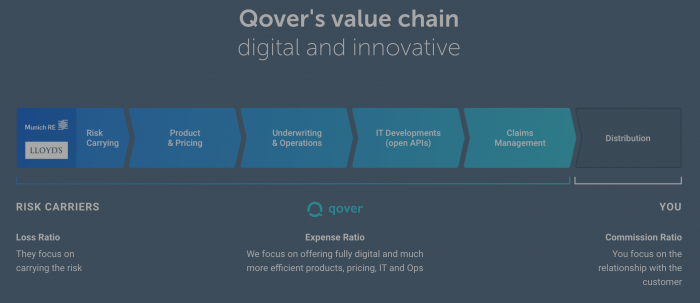

It’s the focus on technology which persuades us to use tech language to describe their model; the business itself describes its model as “insurance-as-a-service”, whereby distributors call Qover’s open API to access insurance products. This picture from their website illustrates the concept nicely.

The critical component of Qover’s proposition is the product. “We’re not a software vendor” says Jean-Charles Velge, Co-Founder. Qover is building a suite of products on the platform which distributors can access. The product definition includes a pricing structure, commission level and claims process (via a TPA). The first live product is a motor GAP policy underwritten by AmTrust Syndicate 5820 at Lloyd’s for the Belgian market.

Qover is targeting three distribution channels:

- Traditional brokers that want to digitise: Jean-Charles observes that many brokers are struggling to digitize “organically”. Some are therefore using the Qover platform (which can be whitelabelled) in parallel to their core systems.

- Large non-insurance distributors: Qover’s platform can be used by third parties as a customer- or agent-facing system. Qover believes that “comfortably over 50%” of the car sales market in Belgium is speaking to him about a possible integration.

- InsurTechs: Qover can be accessed by InsurTechs looking for capacity; in this regard the proposition is similar to Digital Partners at Munich Re (Bitesize).

The business was founded in 2016 and has recently raised €5.5m (led by Anthemis in London), bringing the total raised to €7.5m. The team scale-up is nearly complete, and Qover will soon have 30 employees in Brussels and London with a Paris office likely to open soon.

The Oxbow Partners view

In a recent infographic we revisited a theme that we discussed in a June blog post called “Brokers: Wake up and smell the Lemonade.” In actual fact, we should have called the post “Wake up and smell the Qover”, but that didn’t work so well.

Many large brokers have substantial affinity businesses and we think these are vulnerable to companies like Qover. These brokers have not, on the whole, invested in personal lines or SME trading technology over the years; where brokers have invested, it has generally been software to enable traditional offline fulfilment rather than to move to truly digital propositions.

The Qover’s platform makes the experience better for the customer, easier and more profitable for the affinity partner, and cheaper for the insurer. We are not surprised that the business is seeing traction in that space.

Brokers currently have a window to use companies like Qover as a partner for their high-volume / low-value business before they become a threat.