RightIndem: Impact 25 2018 profile

March 10, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

RightIndem’s claims SaaS platform has three main components, all facilitating customer self-service:

- Notification: An FNOL solution allowing customers to share incident data with a claims handler in real time; and a fully online FNOL notification solution (‘electronic notification of loss’, or ENOL)

- Core claim: Web app-based claims management, total loss and repair functionality modules

- Settlement: Payments, repair and replacement functionality with features such as payment scheduling to improve reserving.

“By looking to give back control to the policyholder, providing a transparent costing process, offering effective repair solutions

and managing claims efficiently as they come through their system, it is not surprising that RightIndem have been able to tangibly reduce expense ratios and improve customer satisfaction and retention rates for insurance companies.”Andrew Johnston Willis Re

Impact

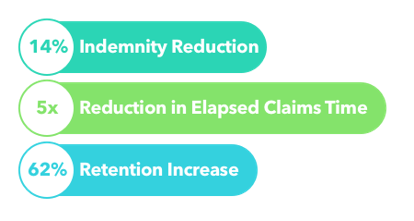

RightIndem’s platform has delivered a 10x improvement in claims handler productivity, a 14% reduction in indemnity and a five-fold reduction in elapsed claims time. Importantly, customer renewals have also increased by 62%, when compared to existing, non-digital claims processes.

Case Study One

Client situation: A motor insurer wanted a tool that digitised total loss claims and reduced manual claims processing costs.

What they did: RightIndem implemented their digital total loss module, enabling a digital total loss claim process.

Impact: Retention of customers using the total loss process improved by 62% (compared to those using the traditional process) and the client realised a benefit of >£116 per case due to an increase in processing speed.

Case Study Two

Client situation: A marine insurer wanted to digitise their marine claims process.

What they did: RightIndem implemented a bespoke ENOL module that allowed brokers and customers to report and self manage claims.

Impact: Operating expenses have fallen with brokers and customers servicing their own claims; claims cycle times have fallen across the portfolio.

The Oxbow Partners View

Traction: RightIndem was a product of StartupBootcamp’s frst (2016) cohort. The business struggled with the inertia of the industry initially, but has gained momentum in 2017. They are one of only a handful of emerging, specialist ClaimsTech businesses.

Potential: We think the most significant RightIndem data point is the 14% reduction in indemnity spend that they achieved in one pilot. With loss ratios of 80%+ in UK motor, for example, this is where insurers have the potential to feel significant economic benefit. We believe the RightIndem technology could be game-changing for insurers of high volume lines.

The 2018 challenge: RightIndem has built a compelling proposition and has delivered proofs of concept in multiple lines including motor and marine. However, it is yet to implement at scale. We see 2018 as a critical year for finding its core ‘product market ft’ and establishing a revenue foothold in the market.