RiskGenius: Impact 25 2018 profile

March 10, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

RiskGenius’s platform uses AI to ‘read’ insurance policies and categorises each clause by type (e.g. fre, liability). It then stores each clause in a computer-searchable format. Users can interrogate the data, for example: ‘show me all the war exclusion clauses in this portfolio’.

RiskGenius has several tools including:

- Comparison: Side-by-side comparison of polices and clauses

- Manuscripting: A policy creation tool allowing users to drag and drop clauses from a library of pre-approved clauses

- Analytics: A tool to analyse all policy documents (e.g. language trends over time)

- Compliance: A tool for reviewing and approving proposed policy language across other teams (e.g. legal and compliance)

“The RiskGenius product will provide a platform for building better products and better meeting our customers’ needs.”

Bob James Group Head of Transformation, QBE

Impact

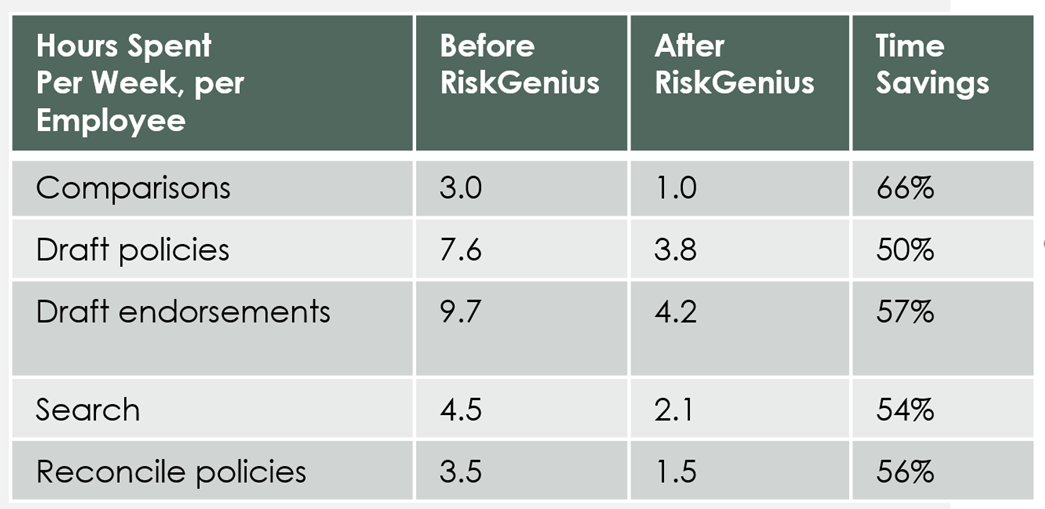

Analysis by QBE showed that RiskGenius saves certain groups of underwriters c.750 hours per week across a range of tasks.

Case Study One

Client situation: An insurer wanted to understand the content and find inconsistencies in 100,000 commercial general liability policies and endorsements.

What they did: RiskGenius applied machine learning to the policy library, identified the content of each clause and tagged clauses that were similar.

Impact: The insurer can now conduct analysis across the library of policies in seconds, identifying common clauses and variations.

Case Study Two

Client situation: An insurer wanted to define a methodology to identify specific clauses in a library of thousands of policies without having to review each policy individually.

What they did: RiskGenius loaded up policies for each line of business onto their platform. Underwriters then used Genius Search (a search tool for insurance policies) to identify matching clauses.

Impact: The insurer reduced manuscripting time, resulting in faster turnaround times and less underwriting leakage.

The Oxbow Partners View

Traction: At this stage of development, we view pilots that lead to implementation at scale as strong indicators of impact. Rolling out with QBE in North America is a strong signal.

Potential: A comment by Chris Cheatham on LinkedIn summarises our view very well: “[My trip to] London was amazing. It took two days for one very big learning to sink in: underwriters in Europe are empowered to manuscript with little or no formal approval process.” We see RiskGenius as an important tool to monitor and control manuscripting in the London market in particular.

The 2018 challenge: With the London Market TOM project ongoing, RiskGenius will need to make sure it can get the attention of underwriters and IT departments to implement its technology.