About the author

Gayle Watts

Get market insights straight to your inbox

Keep me informedMarch 5, 2019 Gayle Watts

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25 2019.

Snapsheet started as a direct-to-consumer mobile app which provided estimates from repair facilities directly to consumers. It pivoted into insurance in 2012 and has over 70 insurance clients in the US and Canada along with several ‘new economy’ players such as ridesharing companies.

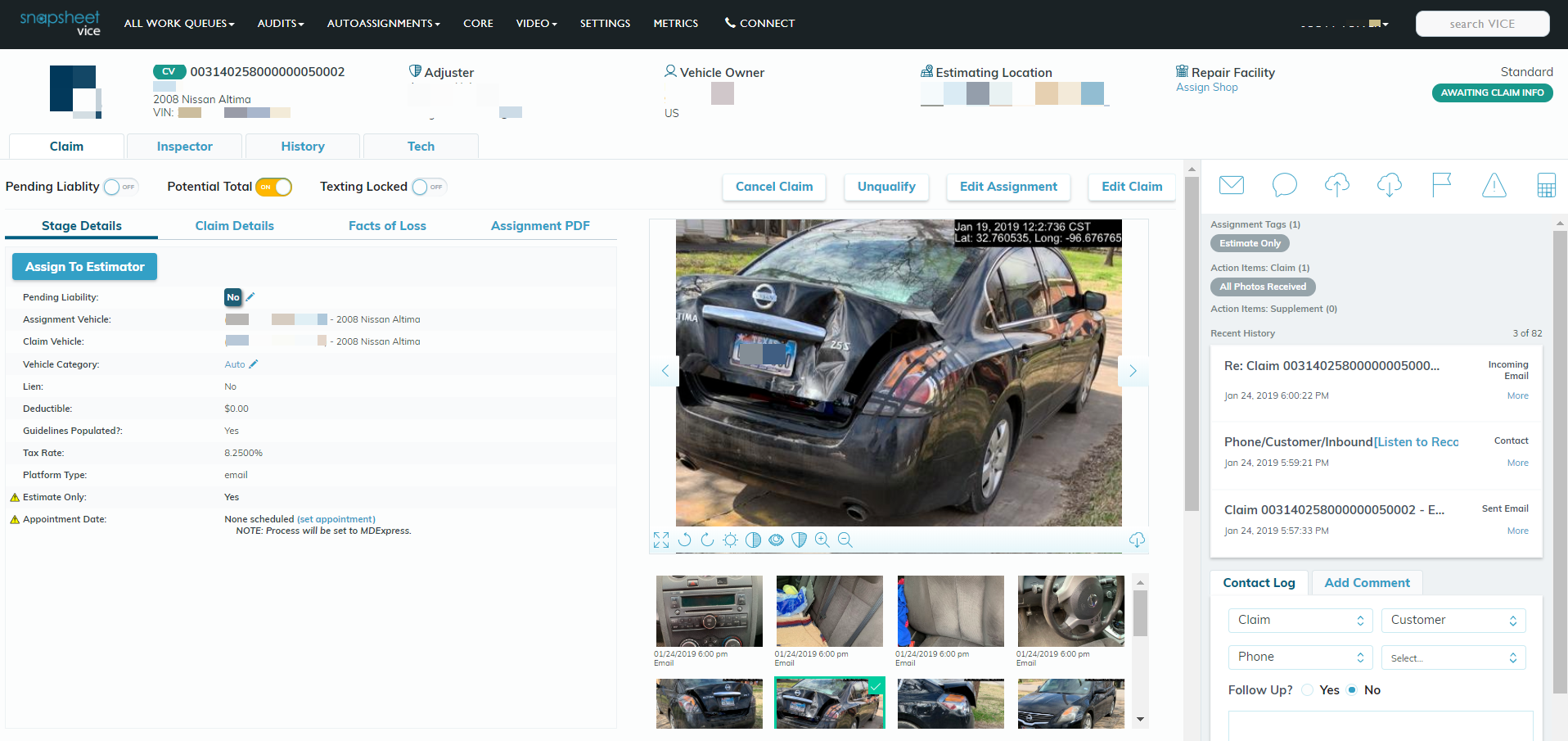

Snapsheet’s core proposition is a virtual appraisal service which allows insurers to collect information about claims and make estimates on motor physical damage automatically. For example, Aviva Canada allows its customers to file claims by taking photos of the damage, submitting them through an Aviva branded app, and getting a repair estimate – all within hours.

Alongside this sits Snapsheet’s second main product, a payment engine which allows insurers – many of whom still pay claims by cheque in the US – to offer electronic payments. This SaaS platform allows for digital population and transmission of payments and electronic signatures. Based on the functionality of its internal platform for virtual appraisals, Snapsheet extended its platform to be an end-to-end claims management solution and brought it to market as a SaaS model.

In 2018, the company signed a global deal with Zurich, which will allow Zurich to offer its customers and users a digital claims experience enabling faster cycle times. Ireland is the first market where Zurich is implementing the platform. This is Snapsheet’s first European client.

“The collaboration with Snapsheet will allow Zurich to further streamline the claims journey for our customers and provide additional innovative services.”

Ian Thompson, Group Chief Claims Officer, Zurich

The Snapsheet platform enables insurance carriers to seamlessly engage with customers and intelligently automates the entire claims process. It combines customer communication, proactive workflow, document management and a singular view of a claim to provide an easy-to-use interface for claim handlers.

Client situation: Zurich wanted to improve the customer claims experience and improve claims efficiency by simplifying the claims journey and shortening the overall claims lifecycle. The innovation team identified Snapsheet as a good alternative to the standard universe of vendors.

What they did: Snapsheet entered into a global partnership agreement with Zurich in Q4 2018. Under the agreement, Snapsheet will build an end-to-end claims system for Zurich which integrates with existing legacy systems. Ireland is the first country where the system will be implemented, with other countries likely to follow.

What impact it had: The implementation is ongoing but is expected to have indemnity, opex and customer service benefits.

Snapsheet is one of the companies that breaches our £10m revenue cap, but given its rapidly evolving product and only recent entry into Europe, we felt the company merited a place in the Impact 25.

The company’s core product has established a strong market position in the US, allowing it to benefit from a reliable revenue stream.

The Zurich deal could be transformational, allowing Snapsheet to build out its proposition from a solution for a specific claims ‘vertical’ to an end-to-end system that could compete with the established systems.

As it happens, we think that most ClaimsTechs will work on broadening their propositions in the next year for two reasons. First, there is a risk that niche solutions will not be high enough on the agenda of claims leaders looking for transformational solutions in the next wave of InsurTech. Second, end-to-end vendors are the gatekeepers of many niche solutions, and there is a risk that these vendors will buy or develop technology making the niche vendors, which did well in the first wave of InsurTech, redundant. Owning the whole claims journey is a more sustainable position.

The challenge for Snapsheet in 2019 will be to make the transition from InsurTech to ‘vendor’ – a nuanced progression but one requiring companies to develop a new set of capabilities (which we recently discussed on our blog).

Magellan™ is Oxbow Partners’ online searchable database of insurance technology

FIND OUT MOREAbout the author

Gayle Watts