Tractable: Impact 25 2018 profile

March 10, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

Tractable provides artificial intelligence for motor claims. Tractable’s AI is able to assess damage to a vehicle based on images and instantly estimate the cost of repair without any human bias and at lower cost than traditional people-led operations.

Tractable’s technology changes the customer claims experience: Customers take a picture of the damage and send it to Tractable. Tractable’s algorithms generate the estimate of the damage and run anti-fraud checks, allowing insurers to expedite the claims settlement process.

“Tractable have developed ground-breaking technology using AI, which will improve the entire customer experience as insurance companies harness the benefits.”

Andy Homer, former CEO, Towergate

Impact

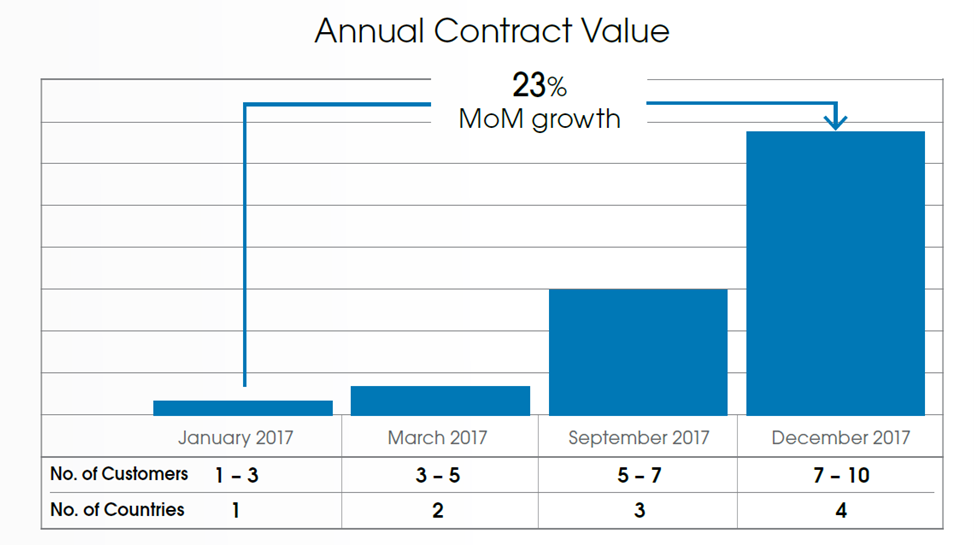

Tractable’s annual recurring contract revenue grew over 10x from 2016-2017.

Case Study One

Client situation: A top 5 UK insurer needed a solution to control rising motor repair costs.

What they did: Tractable integrated its AI into the client’s motor claims handling workflow, allowing bodyshops to receive real-time feedback on their repair estimates.

Impact: Tractable helped to change bodyshop behaviour and reduced overall repair costs.

Case Study Two

Client situation: A top 3 French insurer had visibility over only 2% of their bodyshops with their manual audit processes.

What they did: By partnering with Tractable the client was able to score all of their motor claims costs and have full visibility over their repairer network’s performance.

Impact: The client now has a dynamic view of all their repairers and is able to manage them more effectively.

The Oxbow Partners View

Traction: Tractable created considerable buzz in the InsurTech community in May 2017 when they announced that they were moving to a production-scale implementation with Ageas in the UK. We believe that Tractable was one of the first InsurTechs to reach this milestone in Europe.

Potential: Insurers are investing considerable time and effort into their claims processes. Tractable is well positioned to capitalise on this area of investment.

The 2018 challenge: For simple motor claims, Tractable will need to grow fast and stay ahead of the mounting competition. Tractable will also almost certainly reach a point where it diversifies away from motor claims. At that point we will discover to what extent AI can be applied to other lines of business where there is often less data to train algorithms, and more complex claims.