Bitesize InsurTech: Tremor

June 30, 2022 Chris Sandilands

Tremor is a reinsurance placement platform, effectively a programmatic clearing house for reinsurance transactions.

As an independent marketplace, Tremor allows buyers (i.e. insurance companies) to see the entire market, before determining the final limit and price, while simultaneously allowing reinsurers to execute precise transaction strategies.

The overall sequencing of the reinsurance placement does not change: insurance companies prepare their annual submission to the market in the usual way and reinsurers calculate their pricing.

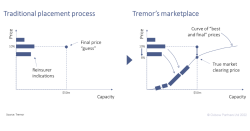

But here things change a little. Reinsurers provide their pricing in the form of a preference curve, indicating capacity and pricing. For example, a reinsurer might say they will write $10m at 10% rate on line (ROL) but only $5m at 8% ROL. Some reinsurers provide just a few data points whilst others provide dozens; either way, Tremor interpolates data points to create each reinsurer’s curve along with any further contingencies they may have (such as a request for equal share participation across layers).

Once all bids have been collected, Tremor presents a “market curve” representing every reinsurer’s price and quantity preferences, respecting contingencies, to the insurer. The buyer then decides how much limit they would like to buy at given prices (noting that reinsurance placements have one common price), and can additionally further constrain the market for dimensions like preferred reinsurers or credit quality aggregates to see the impact on capacity and pricing.

Sean Bourgeois, CEO, explains that this is in contrast to the traditional placement process, where brokers “guess” the clearing price up front from indications and then try to fill the programme. “These are not modelled prices or estimates, it is not a black box algorithm, it is a true and accurate representation of the market’s best and final offers all collected in a matter of days and settled in a matter of hours.”

Finding the true market clearing price

Brokers are as important as ever in supporting the cedent with their submission and setting some of the parameters of the deal. For example, their role in expected loss modelling, advice on deal structuring (including advising on preferred reinsurers, which can be set as an auction parameter) and advocating for the quality of the portfolio remains the same. Tremor impacts purely the final, transaction step.

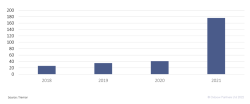

Sean believes that Tremor has now found its product market fit – and the numbers would certainly suggest that this is the case. 125 reinsurers signed up the Tremor platform. Reinsurance premium transacted rose from $41m in 2020 to $176m in 2021, with clients such as Allianz and Generali coming on board.

Reinsurance premium transacted 2018 -2021

The business mix is also diversifying, with property treaty now accounting for only two thirds or the limit priced and casualty treaty and parametric making up 16% each.

The Oxbow Partners View

We believe Tremor has a big opportunity to evolve the reinsurance placement process. Vast sums are transacted on each deal and yet the placement and price discovery process has barely changed in decades.

Naturally the transition to a new placement model will be a voyage of discovery for insurers, reinsurers and brokers alike. Some will miss the familiarity of the offline process. But sophisticated buyers will undoubtedly appreciate the transparency of the Tremor buying process – the fact that they can now be sure that they are transacting at the optimal price whilst respecting their constraints.

For reinsurers – many of whom were early adopters of sophisticated modelling, portfolio construction and pricing technology through software like RMS and AIR – we see Tremor as an opportunity. Leaders will be able to construct more optimised portfolios by picking up risks at the right price points.