Bitesize InsurTech: Vitesse PSP

August 14, 2020 Chris Sandilands

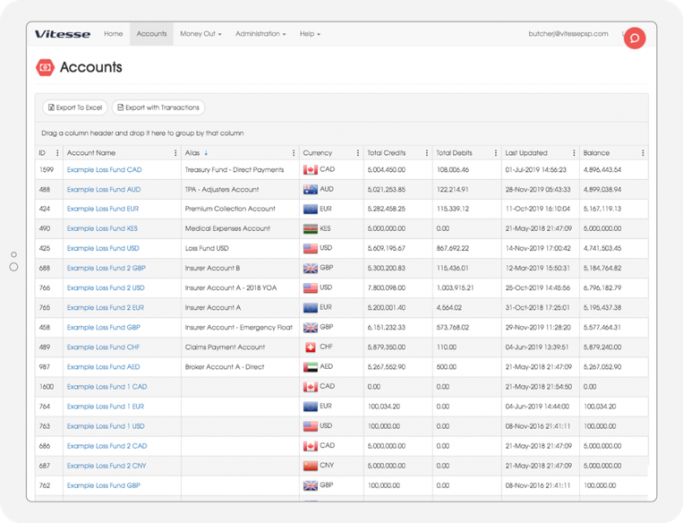

Vitesse has built a platform that can hold loss funds and execute cross-border payments.

The company was founded in 2014 by Phil McGriskin and Paul Townsend, two veterans of the payments industry who had sold their previous business to Worldpay.

Their initial proposition was a global domestic settlement network. As Phil explained to us, traditional cross-border payments normally go into the global SWIFT network. Delays and fees can build up as money goes from bank to bank, and the balance can change adversely, due to FX movements. Vitesse has developed relationships directly with the local networks such as Faster Payments in the UK, SEPA across Europe and the ACH network in the US and others throughout Asia, that allow it to make cheap and near-real-time payments even across borders.

This alone could save institutions like insurers huge amounts in fees – but a conversation with London Market insurer Brit identified a greater prize. Brit (and most other insurers) works with “Loss Funds”, which are pools of money that insurers allocate to third parties like claims outsourcers and brokers to pay for claims and services like lawyers and adjustors. An insurer typically has hundreds of these loss funds in operation, and Phil estimates the total loss funds in the London Market at any one time at over £1bn and a much bigger sum globally. This presents various risks and challenges to insurers. Funds are typically held in an unregulated environment by the third party: there is a lack of control, non-standard reporting and a lack of transparency for all parties in the chain which collectively result in poor cash management and slow claims payments.

The company’s platform allows multinational insurers to virtualise their loss funds. As a regulated e-money provider, Vitesse is able to hold these funds centrally in its own accounts, increasing transparency and control for insurers. Payments can be sent quickly and cheaply through its payments infrastructure when required and nearly 70% of the payments done by Vitesse for the insurance market in Q1 this year were real time – days quicker than the previous norm.

Vitesse is working with over 60% of the London Insurance Market and this week the business announced that it had raised £6.6m Series A led by Octopus Ventures.

The Oxbow Partners view

The Vitesse proposition shows how many niche but material inefficiencies remain to be solved in the insurance industry. To find them requires digging deep into the value chain, and possibly a collaborative approach as executives do not know what solutions might exist and vendors do not understand the specific pains insurers are facing.

We like the Vitesse proposition because it is a solution to a real problem that can drive material value for insurers. Insurers writing international business or multinational programmes should take note.