wefox: Impact 25 2018 profile

March 9, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

wefox Group comprises two integrated but separate digital insurance businesses: wefox, a digital insurance marketplace connecting brokers and customers to insurers, and ONE, a digital insurance company.

wefox offers 3 key components:

- For brokers, a portal to manage their portfolios

digitally - For insurers, a portal to drive campaigns

- For customers, a digital wallet where they can also connect to their agents ONE has recently been launched in Germany with a personal liability and a household product.

They hold a European insurance licence (incl. Switzerland) and aim to gradually redefine the insurance proposition (e.g. AI to settle claims rapidly, on/of coverage, etc.).

“We are convinced by ONE’s future-focused business model and the strategic and operational strengths of the parties involved.”

Tobias Sonndorfer,

Client Manager, Munich Re

Impact

wefox acquires customers at a fraction of typical industry costs (less than 10%) by focusing on independent brokers, which account for approximately 50% of insurance distribution globally. wefox also ‘helps independent brokers into the digital age’, allowing them to interact 5 times more with customers with a range of digital support and technology at their disposal.

Case Study One

Client situation: Richard, married, two daughters, was looking to manage his insurances more effectively. He appreciated the human interaction, especially when it comes to health and life insurances, and especially in light of his young family.

What they did: wefox onboarded Richard via its customer app, digitized all of his insurance policies, conducted a personal risk analysis and connected him to an insurance agent.

Impact: Richard was able to fully digitize his ‘insurance relationships’ (digital wallet), effectively manage his entire insurance portfolio, whilst continuing to have a dedicated agent providing him personal advice.

Case Study Two

Client situation: A mid-sized broker with 15 insurance agents looked to professionalize his operations and enhance its overall performance. Management wanted digital tools to (a) better manage the company and (b) improve agent performance.

What they did: wefox onboarded the broker to the platform and provided agents with relevant customer leads, task management, calendar and video conferencing capabilities, and delivered 1st and 2nd level operational support to its customers.

Impact: Agent performance increased substantially, driven by (a) significant reduction of administrative work, (b) increased new business performance through leads, and (c) significant uptake in client interactions per day. The broker in turn was able to manage his agents more effectively in terms of activities and performance.

The Oxbow Partners View

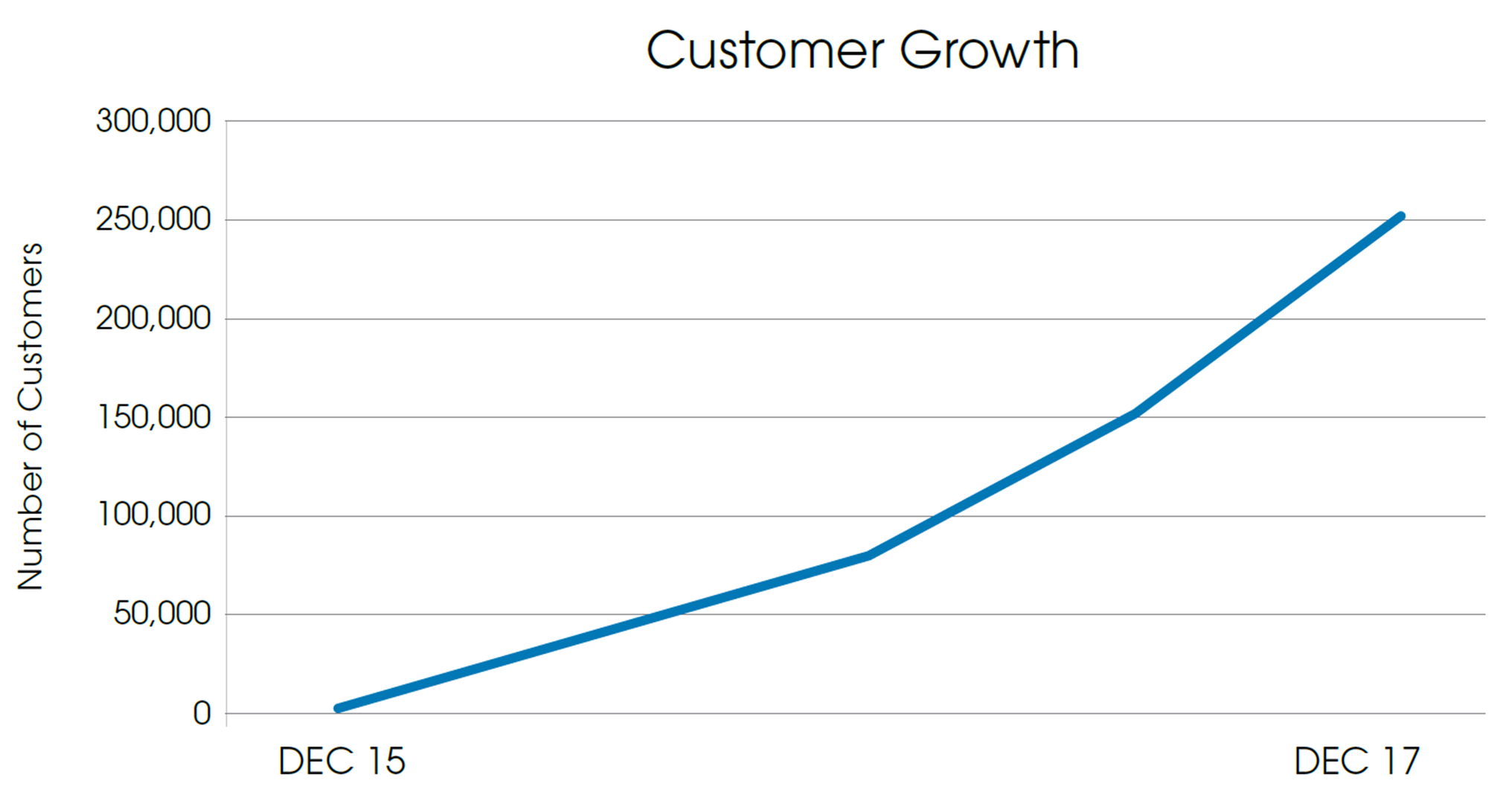

Traction: wefox’s group revenues exceeded £10m in 2017 – the only company for whom we had to waive the maximum revenue threshold in our eligibility criteria. This is an InsurTech with real traction.

Potential: wefox’s vertical integration strategy is interesting and, we believe, unique in the InsurTech space. With strong management teams in both businesses and a wefox panel member that is now fully aligned to the distribution strategy, one must assume that sales will accelerate.

The 2018 challenge: wefox has taken a bold risk with the launch of its own insurer, ONE. Building volumes to justify this investment will be important to guarantee the funding pipeline.