Whitespace: Impact 25 2019 profile

March 5, 2019

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25 2019.

Whitespace transforms documentation in Word and PDF into universally readable digital contracts, reducing transactional and processing costs.

Whitespace is aiming to play a major part in the London Market’s move to digital trading. The company’s solution does not change the way the market places business. Instead, it augments the existing process with an electronic platform, requiring little technical training upon adoption of the software. Brokers, insurers and policyholders can monitor the progress of the placement and can review any changes made to the contract.

A comprehensive set of APIs allows Whitespace’s platform to be integrated with an insurer’s existing systems. Brokers can manage every contract from draft to final signature via desktop or app. If a change is needed, it’s made once rather than needing to be re-keyed and is instantly available to the people who should see it.

Brokers can also compare quotes using the ‘differences’ function, and the ‘chat’ function allows all users involved to discuss the contract terms.

The system also allows underwriters to view the work of their entire team and check how far along contracts are in placing. Subjectivities and endorsements on the platform look exactly as they do in paper form, and underwriters can use the digital stamp as soon as they write a line.

In the future, Whitespace intends to expand its offering by introducing digital premium settlement and claims services.

“End-to-end and fully digital client engagement is critical to our future success. Whitespace will enable us to work with the latest technology, providing a better experience for our clients, our markets and our people.”

James Masterton, CEO, Price Forbes

Company in action

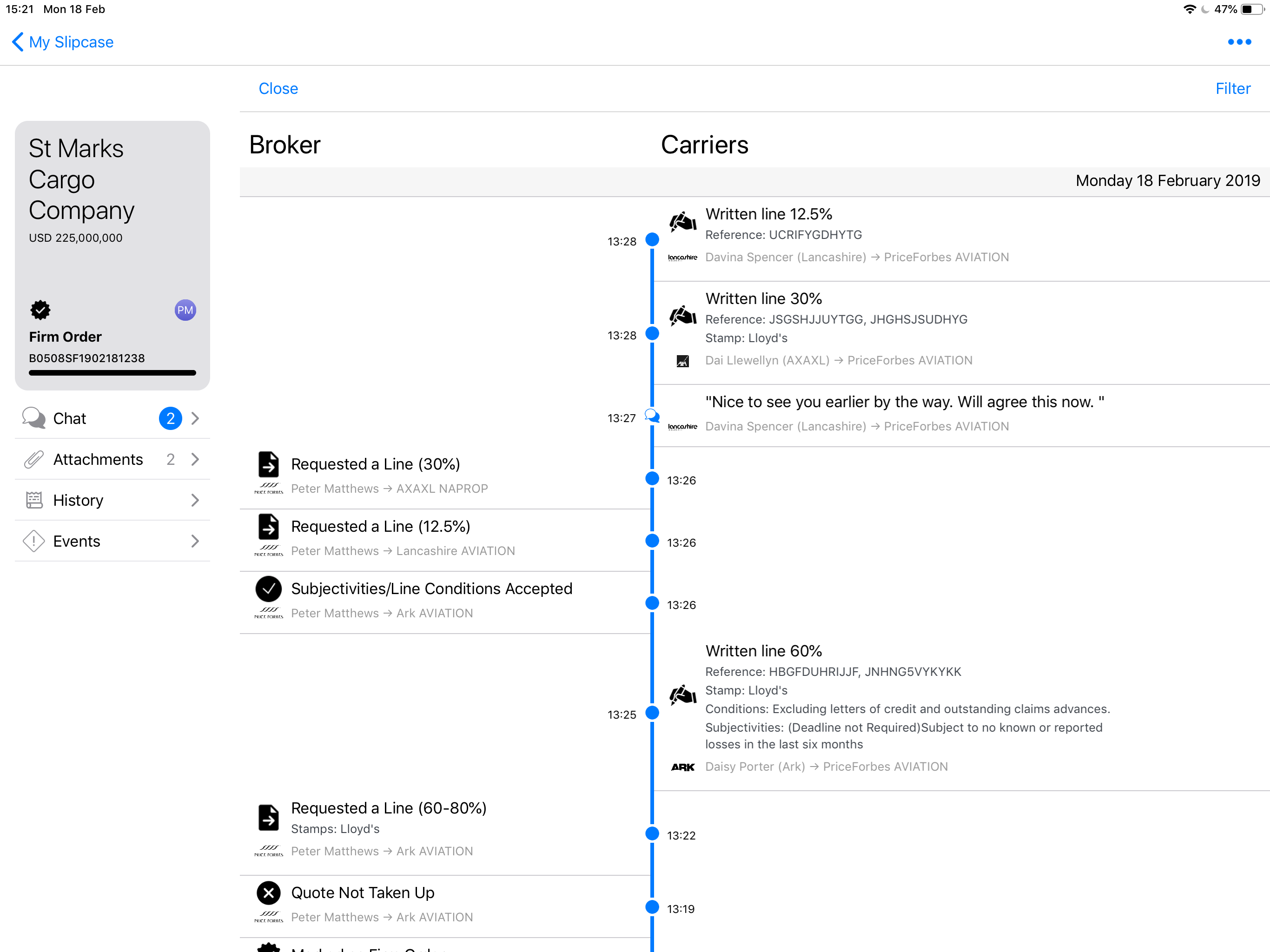

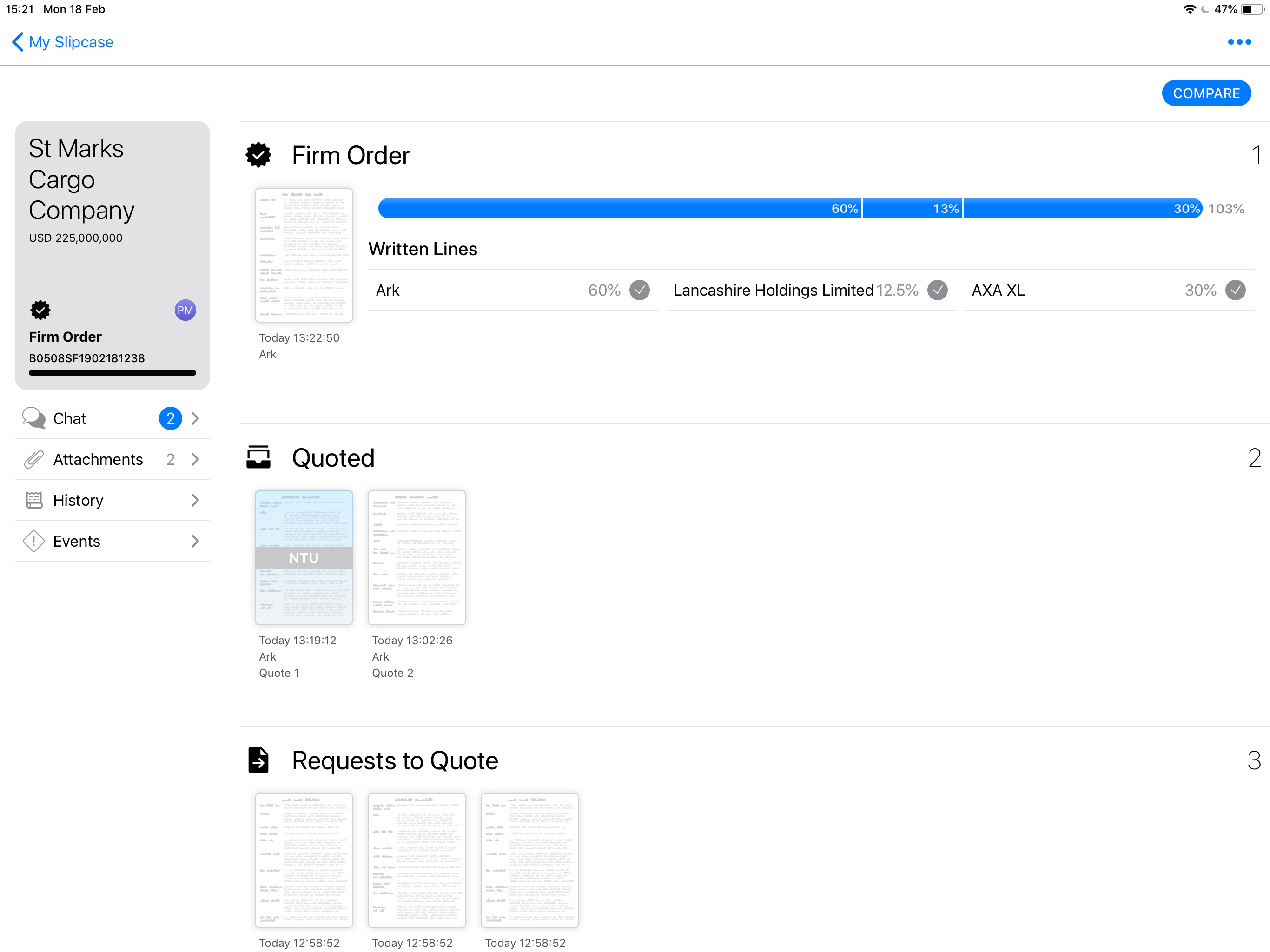

Whitespace allows the real-time negotiation, collaboration and placing of digital contracts. The two pictures show a summary of the placing process and the detailed audit trail which accompanies it. User experience is optimised by the platform and the same data is available via the APIs.

Case study

Client situation: Following the LM TOM proof of concept in 2017, a consortium of London Market carriers and brokers continued to work with Whitespace through 2018 to understand how it could help risks to be placed digitally in the market.

What they did: The consortium worked with Whitespace through a number of scenarios of increasing complexity. Risks were placed through the platform and Whitespace was able to improve the technology based on user feedback.

What impact it had: In September 2018 Whitespace was recognised by Lloyd’s for the purposes of the electronic placing mandate. In February 2019 Price Forbes & Partners, a broker, announced its partnership with Whitespace and intention to adopt the platform for all London business.

The Oxbow Partners View

Whitespace is something of an outlier amongst InsurTechs because the company has been going for over thirty years.

However, it ‘pivoted’ to its new digital marketplace proposition within our eligibility timeframe. We included the company because it is at a critical point in its evolution: the technology and ‘product-market fit’ have been proven and the ‘rocket fuel’ is now required. That will involve the usual challenges of creating a digital marketplace – growing demand and supply in sync.

The company’s timing is, however, good. Lloyd’s has outlined its commitment to digital trading since the launch of the London Market TOM project; the new CEO, John Neal, has only emphasised the centrality of technology since starting in his role in October 2018.