Zego: Impact 25 2018 profile

March 9, 2018

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25: 2018.

Zego integrates with gig economy apps (e.g. Uber, Deliveroo) to provide usage-based insurance. Zego’s cover automatically starts and stops when the driver logs in and out of the gig economy app, leading to a better customer experience and lower potential for fraud.

The company has launched four products to date:

- UBI for scooter drivers

- Social, Domestic and Pleasure insurance for scooters

- UBI for car drivers

- UBI for cyclists

“It’s an exciting and very innovative opportunity which addresses a clear consumer gap traditionally underserved by our industry.”

Brian Spinks, Head of New Business, Aviva

Impact

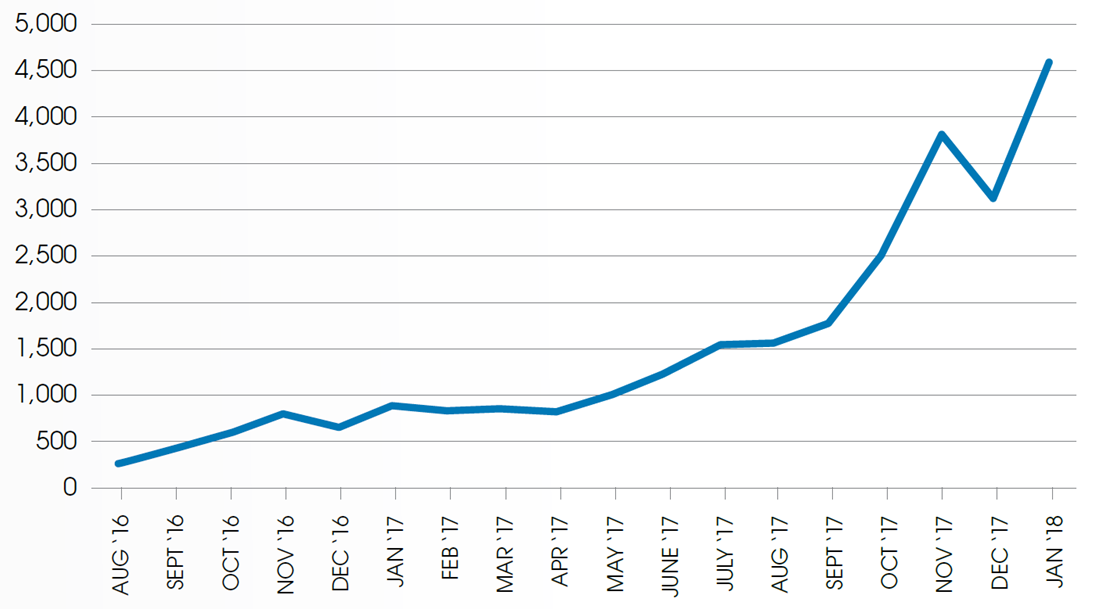

Since launching in Summer 2016, the number of drivers signed up has increased steadily and has spiked in the last 6 months.

Case study One

Case study One

Client situation: A delivery driver wanted to work flexibly around their university studies for just 15 hours per week as additional income. However, the proportional cost of commercial insurance across those working hours made the job commercially unviable.

What they did: Zego worked with the customer’s gig economy platform to allow them to pay for insurance just when required.

Impact: With no fixed insurance costs, the insurance enabled the customer to truly be flexible in their working hours.

Case study Two

Client situation: A large carrier wanted to explore new customer cohorts and new revenue streams in the on-demand economy but couldn’t manage micro policies through their systems.

What they did: Zego integrated the carrier into their bespoke system, allowing the carrier to access customers using micro policies whilst being able to generate their own MI and reports.

Impact: The carrier was able to access a new cohort of users, a new revenue stream and utilise a new customer experience to develop their digital transformation through their partnership with Zego.

The Oxbow Partners View

Traction: Zego has logged nearly 1.5m hours on its platform in under two years and attracted significant investment from high profile investors.

Potential: With Munich Re and Aviva amongst their capacity providers and accelerating worker sign-ups, this business looks set to make a real mark in the UBI / gig economy insurance space in 2018. We see opportunities in both D2C and B2B2C.

The 2018 challenge: Several companies are pursuing similar business models to Zego (including Impact 25 Member GUARDHOG). We foresee a ‘landgrab’, which means Zego will need to ensure sales continue to accelerate in 2018. It will also be interesting to see whether Zego can find a point of differentiation that is not just price/commission.