Zeguro: Impact 25 2019 profile

March 4, 2019

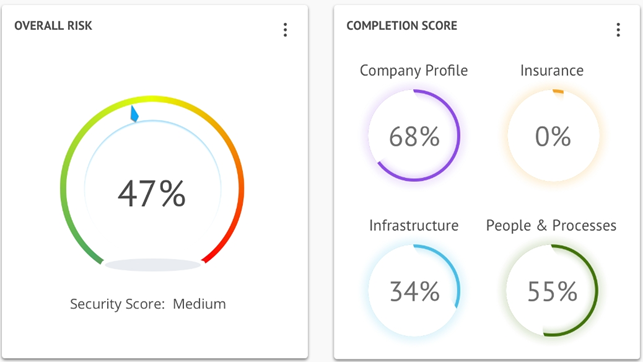

Zeguro reduces the threat from cyber attacks for small and medium enterprises. Its cyber safety platform identifies risks, delivers best practices to reduce exposure, and provides insurance against damage caused by cyber attacks.

Zeguro’s virtual cybersecurity officer has three main roles:

- Identify and mitigate cyber risk: Zeguro continuously scans businesses’ digital assets, identifying areas of potential cyber weaknesses.

An example could be that a team member has not selected two-factor authentication on a cloud-based service: to do that, Zeguro monitors AWS, Azure, Dropbox, GSuite and Office 365 and if weaknesses are identified, either automatically fixes the issue (e.g. changes settings) or recommends fixes. The solution depends on the issue.

- Provide cyber risk training: Zeguro provides services such as cyber security awareness training to help employees prepare for threats, including ransomware scams, password management and phishing schemes. It also helps companies comply with data and cyber standards.

Zeguro creates a to-do list and audit trail to keep clients in line with current regulations, tailoring recommendations based on the client’s industry, sector and business.

- Offer insurance: Zeguro uses the data it collects on each business to provide cyber insurance coverage that is tailored (i.e. cover and price) to meet the business’s needs.

The company’s cyber insurance policies cover loss of customer or employee data and third-party lawsuits among other cyber-related threats. The distribution channel is fully digital without intermediary fees, and policy holders can file a claim and receive assistance from the Zeguro team 24/7.

“Loss prevention has always been a core element of HSB’s business model. That’s why we were attracted to Zeguro’s approach of using technology and risk assessments to help businesses defend against cyberattacks and breaches.”

Stephanie Watkins, Senior Vice President, Hartford Steam Boiler

Company in action

Case Study

Client situation: A small business did not have the knowledge or resources to protect itself against cyber attacks, a common scenario given that 61% of SMEs faced a cyber attack in 2017 but only 4% had cyber insurance.

What they did: Zeguro’s cyber safety platform allowed the company to continuously monitor and mitigate its cyber risks. The SME could also easily buy cyber insurance because of the real-time insights that Zeguro had. The business saved on its insurance premiums by using the Zeguro platform and decreasing its cyber risks.

What impact it had: Zeguro’s client is likely to have saved up to 30% on cyber insurance by using the Zeguro platform and decreasing its cyber risks.

The Oxbow Partners View

Cyber insurance is the much-talked about growth opportunity for insurance, and given the low penetration rates it is not hard to see why. New volume will build in personal lines, SME and commercial.

Zeguro is a good example of a ‘predict and prevent’ proposition. Rather than focusing on insurance sales per se, it is providing a cyber proposition that has insurance embedded into it. This seems to be the emerging standard for many personal lines and SME cyber propositions; this is a cover that is bought primarily as a risk management product with the indemnity providing the ‘backstop’.

It will be interesting to see whether this model becomes the standard in more lines of insurance as companies try to be more than a mere financial partner.