FINABRO: Impact 25 2019 profile

March 4, 2019

This is a summary of the profile which first appeared in the Oxbow Partners InsurTech Impact 25 2019.

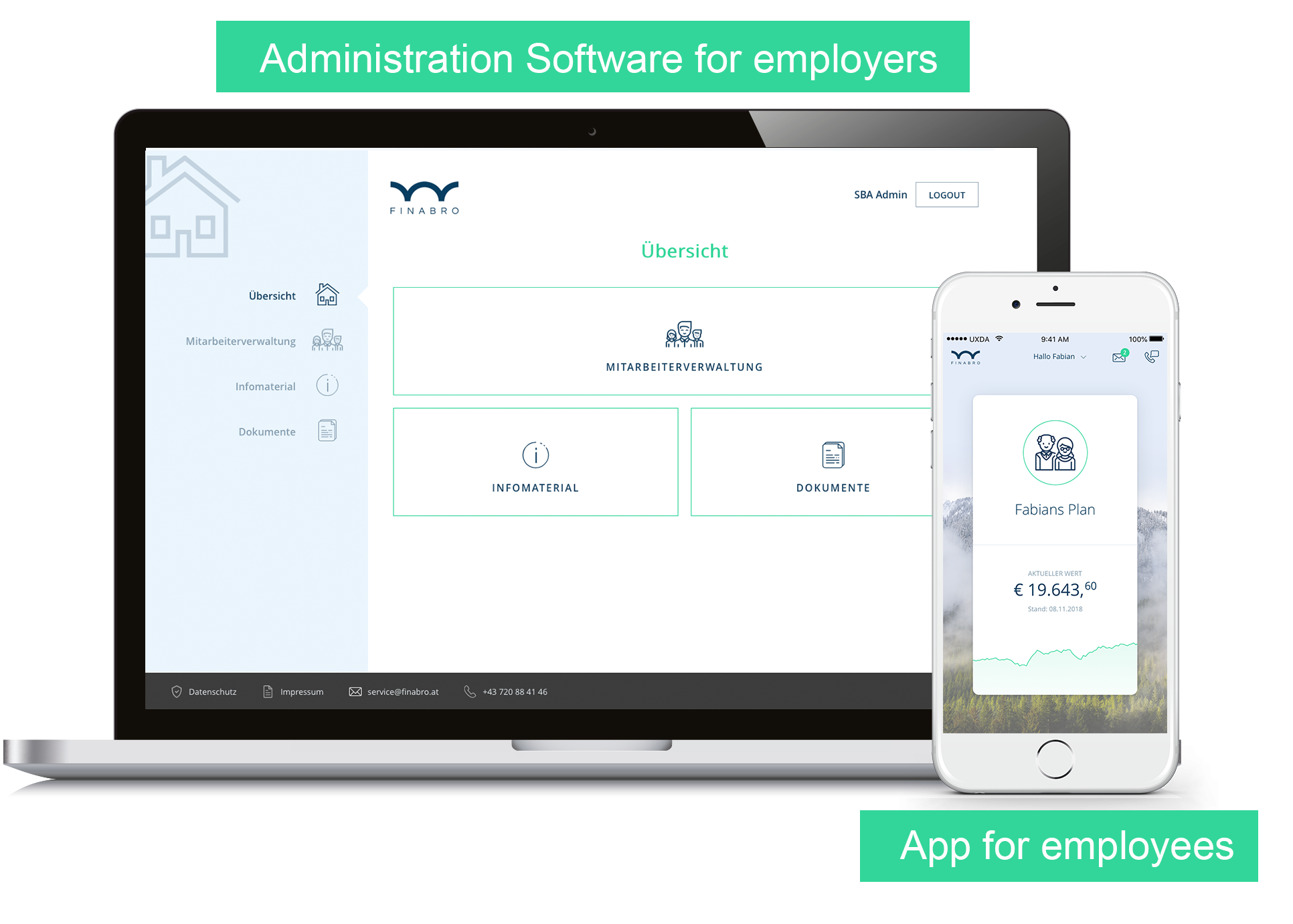

FINABRO provides full digital processing, removing a large part of the administrative burden. For employees, the company offers a pensions product either as a low-cost ETF-based robo-advisor or more classical capital life insurance products. The company also offers non-wrapped investment products.

The company’s core focus is the pensions market in central Europe which is underdeveloped compared to northern Europe. For example, costs are high (5 to 10 times the cost in UK and Scandinavia), and risk appetite defaults to inappropriately low levels especially for those with a 30 to 40 year investment horizon. With regulatory reform on the horizon (especially in Germany), FINABRO hopes to import some practices to the region.

Founder Søren Obling tells us that companies welcome his business’s digital-first proposition, and he expects to sign up some large companies in Austria in 2019. Whilst the D2C channel remains open, it expects B2B2C to deliver most of its volumes from now on.

The pensions wrapper is provided by Helvetia and Zurich, both Swiss insurers with a strong presence in Germany and Austria. The savings product is offered in conjunction with an Austrian and a German custodian bank. FINABRO is licensed by the Austrian financial market authority.

“Due to the current low interest rate environment, long-term saving and old-age provision is one of the biggest challenges to society. FINABRO’s vision of digital retirement saving is centred on solving this challenge and helping people prepare for better, longer living”

Andreas Nemeth, CEO, UNIQA Ventures

Company in action

Case study

Case study

Client situation: A customer had 200 employees, all of whom were offered a company pension scheme. The finance department spent close to one day per month calculating pension payments per employee as the insurer did not provide an overview. Any changes (employee leaves of absence, employees leaving the company) were manual and highly time consuming.

What they did: After meeting FINABRO, the client cancelled its current contracts and signed up all employees to FINABRO’s platform and insurance partner.

What impact it had: Via FINABRO’s employer platform, the administrative burden was almost eliminated. Employees were given the opportunity to choose tailored products through a digital MiFID II and IDD compliant process. Employees could get anything from a zero-risk guaranteed product to a high-risk (100% equity) portfolio. FINABRO’s app and newsletter informed and educated employees on retirement, and the pensions contributions of the company were more visible to its employees.

The Oxbow Partners View

Austria may not be the largest market in the world, but conditions for technology disruption are closeto perfect. Distribution remains dominated by agents, which means that insurers struggle to make significant progress in digital channels for fear of channel conflict. There are opportunities for startups to provide products that insurers cannot offer to customers whose digital expectations are no less developed than in other European markets.

Furthermore, the market structure has allowed fees to rise to levels that would not be tolerated in more competitive markets. For example, banks regularly charge upfront fees of 5% on investments. There is plenty of margins for startups to feed on. Germany is obviously where the volume is in this region, and competition is stiffer there.

The challenge for FINABRO’s business model in any market will be ramping up its B2B distribution force. It will be interesting to see if the company remains an independent brand with an insurer providing the product at arm’s length to do this, or if the provider promotes it to its own distribution more actively. Indeed, the business could also evolve into a platform that allows multiple insurers to deliver a robo-product.