3 takeaways from the 2020 results

26 March, 2021 Paul De'Ath

Flavour of the Month is a new content series for our UK Market Intelligence subscription. We highlight notable monthly market trends, keeping you up to date on the industry’s “Flavour of the Month”. This month we focus on the 2020 results. Subscribe to UK Market Intelligence to receive the Flavour of the Month every month.

The majority of the UK insurance sector have now issued their 2020 results. We highlight three trends that have run through the results and caused debate in our conversations with clients over the last few weeks.

FCA pricing fairness – different strategies being employed

2021 is set to be an interesting year for the UK insurance industry and one of the biggest changes on the horizon is likely to be the FCA pricing fairness changes. Companies will need to implement equalised new business and renewal pricing by the end of the year. The results over the last few months have given some insight into how different companies are preparing for the changes. It is notable, however, that there are many very different viewpoints on what the outcome might be. Direct Line believes that there will be a reduction in switching in the market once the rules come in whereas Hastings is expecting switching levels to be maintained. The difference of opinion could be explained in some part by a difference in target customers but goes to show the different scenarios insurers are working with at the moment.

When the rule changes were first announced we questioned what the best strategy would be for the period before implementation – push for growth or increase prices early – and it seems that both approaches are being taken. Sabre has been clear that it will continue to increase new business prices in order to offset claims inflation. The company also highlighted that some in the market have been using heavy discounts on new business in order to boost market share before there is a requirement for renewal prices to be equalised.

Pricing fairness could be a dramatic change to the way the market operates, and insurers, brokers and distributors will need to be flexible in order to succeed in the new world. Understanding the scenarios that could play out will also be very useful. We have teamed up with Swiss Re to run a survey of market views on the new rules. The results will be released soon, if you would like to know more please get in touch.

Searching for the new normal in motor frequency

Unsurprisingly, one of the major talking points in the 2020 results has been the impact of the coronavirus. The two areas that have been most impacted have been business interruption and motor insurance. The FCA test case has brought some clarity to the business interruption claims and most insurers are now working through paying claims where coverage has been established – whilst also making sure the policy wordings are tightened up for new customers.

In motor insurance, the lockdowns in 2020 have dramatically reduced road use and therefore frequency of motor claims. This has translated into significant reductions in calendar year loss ratios.

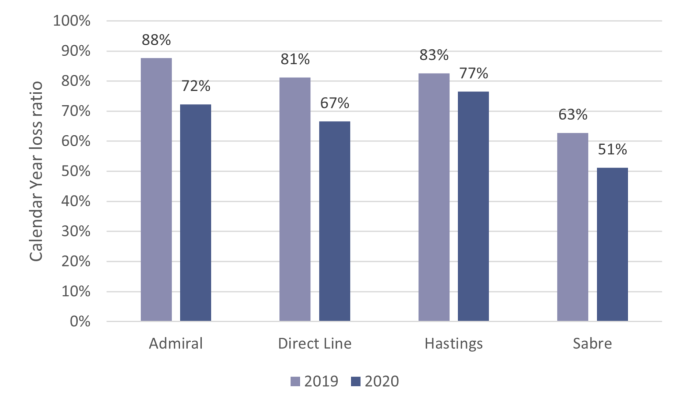

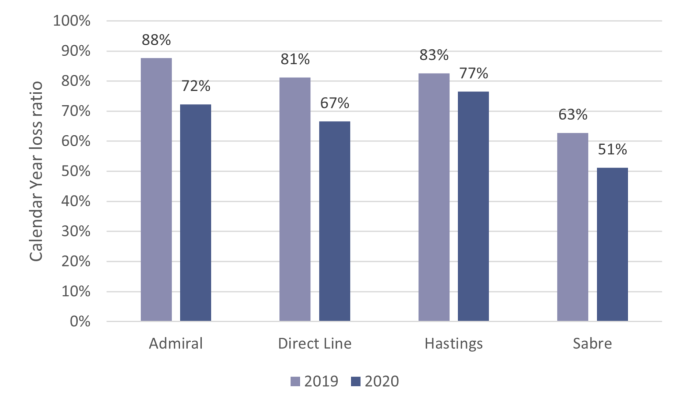

Figure 1 – Motor Loss ratios have reduced significantly in 2020

Admiral, Direct Line and Sabre have all seen a proportional reduction in their motor loss ratios of 17-18%. Hastings has not recorded as large a reduction in loss ratio in 2020 most likely due to a change in reserving approach. Another factor could be lower new business prices in 2020. Many players have reduced prices to reflect the lower claims environment, which has also led to growth in market share for insurers such as Admiral and Hastings. Frequency is likely to increase over 2021 as we are released from lockdown and it will be important for motor insurers to push prices back up to offset higher loss ratios that could come out of the lockdown renewal period.

ESG in the spotlight

For a simple three letter acronym coined in 2005, ESG’s meteoric rise over the last decade has seen it go from a fledgling set of ethical principles to a subject most companies feel they need to address and embed, especially in global insurance. In its simplest form, ESG is a method of driving and judging the sustainability of a company and its investments. Environmental and Social aspects generally concern more outward facing practices while Governance encompasses the practices found within the running of a firm from codes of ethics to employee treatment.

Aviva has set the bar for others in the market by committing to be a carbon Net Zero company by 2040. The company plans to ensure that its business leaves no impact on the environment. In addition to its own operations, Aviva also includes the carbon emissions from its suppliers and investments in its Net Zero pledge with the plan to reach Net Zero for its own operations, and for those of its suppliers, by 2030. Worth noting for anyone looking to supply Aviva that your ESG policy could be a point of differentiation.

While Aviva has set very clear targets, others are also working on boosting their environmental credentials and reducing their carbon footprint. The question is whether this comes at the expense of profitability and if shareholders are happy with that. Given the rise in ESG funds in recent years it would appear that positive ESG policies can be attractive to all stakeholders in the business. We will be looking in more detail at ESG and the impact on the insurance industry in a detailed note for our clients so please get in touch if you would like to know more.