Avoiding the next beartrap: What Open Banking means for insurers

7 July, 2021 Chris Sandilands

We were recently happy to participate on a panel entitled “Open Banking: Opportunity or Threat for the insurance sector”, hosted by EOS Venture Partners, the specialist InsurTech investment firm.

It was fascinating to learn about developments in Open Banking, Open Finance and Open Data from experts in the field – Marcus Börner from OptioPay (an Oxbow Partners InsurTech Impact 25 2021 Member), Darek Nehrebecki from Mastercard, Sümer Uysal from Allianz X and Erik Muetstege, the founder and former CEO of NN Bank in the Netherlands.

We wrote a briefing note about Open Banking with a focus on the UK back in March 2021. In this article, we discuss the implications of Open Banking on European insurers, and specifically why they should take Open Banking seriously.

Open Banking is part of the new data paradigm

The EU’s General Data Protection Regulation (GDPR) came into force in 2018 and completely changed the status of data. The principle of the legislation is that organisations must obtain permission from “data subjects” (i.e. private individuals) to process data. Overnight this made troves of data unusable by organisations, for example, insurers who were using old contact data for purposes like periodic marketing outreach.

Philosophically, organisations have gone from being owners of their customers’ and prospects’ personal data to borrowers of it.

Open Banking is conceived within this paradigm. Bank customers can permission their bank to make their data available to a range of service providers, like insurers. The permission must be specific and, significantly, must be renewed every ninety days.

This is a big shift for insurers who have traditionally dictated the data that they wanted and hoarded it.

In the new paradigm, insurers become “data takers”. Gone are the days of asking customers what proportion of their roof is flat; in the future, they will need to process a standard “data package” and make their own assumptions and decisions, for example by augmenting data with third party sources in real time. They will need to understand the data package better than their competitors to make more precise decisions.

This leads to a fundamental shift in the capabilities required to “win”. No longer is success – real or perceived – driven by the volume of data held, but by the organisation’s ability to drive insight from the standard data package. In a recent blog post we argued that proprietary insight now trumps proprietary data.

Open Banking is part of the shift to distribution “super gatekeepers”

We have talked about “super gatekeepers” in a number of previous articles, most notably in the 2020 InsurTech Impact 25. We use the term to refer to companies that have been enabled by the internet and can directly reach millions, and in some cases billions, of customers – Google, Microsoft, Facebook, and so on. We believe that these companies have the ability to disrupt the industry through propositions such as embedded insurance and insurers need to consider how to engage with them.

Banks are arguably the original “super gatekeepers”. A 2015 infographic from CB Insights demonstrated that banks are simply a wrapper for a number of financial services products that could, in principle, be delivered independently of the bank such as international transfers.

In other words, banks have traditionally owned the interface to customers for a suite of financial services products. On the panel, we discussed what this interface might look like in the future, and personal financial management apps were mentioned as a potential disruptor – and it is no surprise therefore that several banks have built their own.

Irrespective of who the customer interface – or “super gatekeeper” is – insurers are completely separated from their prospects. Any ambition around brand differentiation is removed and digital connectivity and price reign supreme – an uncomfortable place for many insurance companies today.

British exceptionalism

The panel concluded that Open Banking is likely to have a significant impact throughout Europe and further afield. But the impact on insurance companies is likely to vary.

In the UK insurers are arguably well prepared for some aspects of Open Banking. They are used to receiving a standard data package from super gatekeepers – the price comparison websites mode accounts for c.70% of motor new business and c.50% of home these days. Many insurers are not precious about a brand or owning the customer interface at the point of sale.

The picture in countries like Germany, Austria and France is different. Insurers still invest heavily in direct distribution including brand and branches. It will feel uncomfortable delivering a commodity product through a third party site for many.

Even UK insurers will need to invest in new capabilities. Whilst they have similarities to super gatekeepers, price comparison websites are optimised for insurance meaning that they have extensive insurance-driven question sets. In the future, UK insurers will need to quote a home insurance policy from, perhaps, only an address and spending data.

Ignore at your peril

Insurers who do not thoroughly study and respond to the dynamics created by Open Banking do so at their peril.

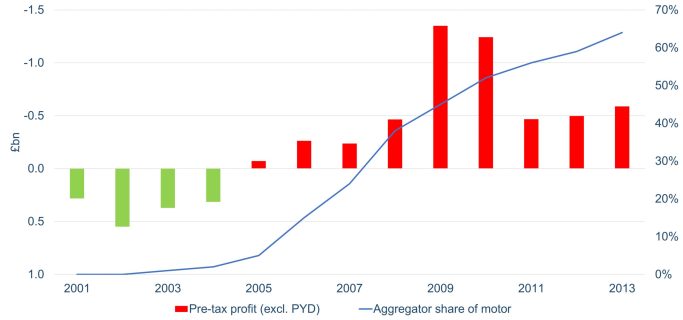

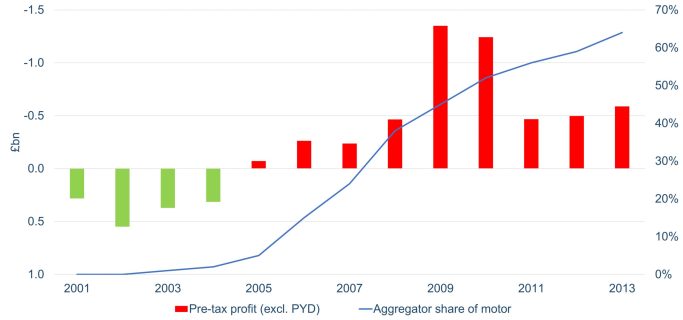

The UK motor market provides a cautionary tale. The chart below shows the market underwriting profit of the UK motor market (inverted left axis) and the penetration of PCWs in motor new business.

Figure 1 - Impact of price comparison website growth on UK market profitability

Insurers did not realise that PCWs were fundamentally changing their portfolios: all the new business they were winning was where they were the cheapest in the market. Gone were the days of portfolio pricing. This meant that loss ratios headed quickly in the wrong direction. Insurers took years to build the sophisticated pricing and nuanced business models required to win in this new market.

Open Banking – as a part of Open Data and shifts to super gatekeepers in distribution – risks being the same beartrap for insurers. Insurers should invest to ensure they understand the implications of Open Banking and have an appropriate response.

But Open Banking is not just a problem that needs to be managed. Instead, Open Banking presents numerous proposition-related opportunities for insurers. The OptioPay case study in InsurTech Impact 25 2021 is just one example of the transformational potential of Open Banking for forward looking executives.