Have you heard of that new InsurTech model where a company arranges insurance for a customer and takes a 20% cut of the premium for doing so?

This is Lemonade’s model – no wonder they have raised over $60m from investors and are making all the waves in the global InsurTech scene.

Most commentary about Lemonade puts the company on a pedestal. It is seen as an untouchable, “full stack” insurer, operating in a parallel, Millennial universe.

But look closely and you see that the fundamentals of its model are unremarkable: Lemonade is a glorified insurance intermediary. After taking its cut, Lemonade administers a mutual risk pool, and reinsures excess losses with Munich Re and Berkshire Hathaway.

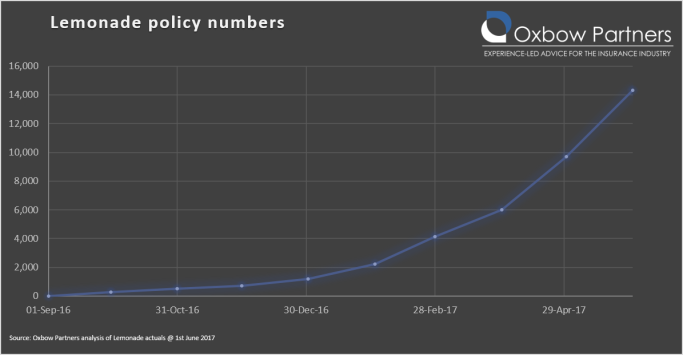

But whilst Lemonade’s model might not be revolutionary, the company appears to be offering a much better customer experience including, for example, the transparent and simple way it communicates with customers, its buying journey and the claims process. As Greg Brown describes in a recent post, Lemonade’s recent disclosures point to real traction (albeit from a zero base).

Lemonade is merely a metaphor for InsurTech, or startup-led innovation in the insurance intermediary space. For example, Qover and SimpleSurance are platforms that facilitate insurance sales through affinity partners; the former has raised over $7.5m and the latter is selling through 2,000 online retailers in Europe. Bought By Many is a digital broker for niches in personal lines, Simply Business is an online SME broker that was recently acquired by Travelers for $490m.

CB Insights has produced a good graphic which shows how FinTech startups are attacking specific (normally high margin) banking verticals (link here, picture below). For example, TransferWise is attacking international payments and is transferring £1bn per month, P2P lender Funding Circle lent over £300m in the UK in Q4 2016.

We have argued in the past that insurers are somewhat protected from this selective unbundling of their product suite because most insurance products require a large institutional balance sheet to support large or unexpected losses; most startups do not have this because investors have relatively limited appetite for insurance risk.

Brokers, on the other hand, are not protected. It is easily plausible that traditional brokers will see their personal lines and SME revenue streams eroded as InsurTech intermediaries enter the market. Given the scalability of tech businesses, this could happen in a relatively short period of time.

Three steps to survival

Traditional brokers can and should survive. But to do so, they need to reconsider their organic and inorganic strategies in three ways:

1. Step back from the P&L and consider the proposition

Most brokers, especially the large globals, are heavily focused on their 12-24 month P&L – securing 5% revenue growth and optimising the margin. They need to refocus on strategic questions: Who will be my most relevant competitors in five years’ time? How are customer expectations changing? How could InsurTechs create a step-change in my proposition?

A good example is affinity distribution. The global brokers are strong in this channel because they have relationships with the biggest brands and the credibility to serve them. But are brands still looking for the same insurance arrangement today as ten years ago? Are they still satisfied with an offline hand-off into a contact centre or do they want digital integration into their customer and staff interfaces? Why are Qover and SimpleSurance getting traction?

Brokers need to think about their proposition from a customer perspective and without reference to the established model. How do they ensure that their strategy and capabilities are fit for the future?

2. Invest in IT capability

A consequence of rethinking the strategy and proposition is likely to identify a gap in IT capability. This is likely to have the following facets:

- A lack of experience building anything but the most basic digital propositions;

- A “build and it’s done” rather than a “build, test, learn” approach to developing propositions;

- A “waterfall” as opposed to “agile” approach to building technology infrastructure;

- Reliance on outdated IT systems that are expensive to change and in any case do not support proposition innovation;

- An IT team that is physically and structurally disconnected from the customer-facing parts of the business.

And the list goes on.

Brokers need to think about what InsurTech means for their IT requirements. They need to review how their capabilities map against them, and redesign their IT structure and processes. They need to start seeing IT investment as an enabler or opportunity or at least survival rather than as a pure cost.

3. Refocus the acquisition strategy

Finally, brokers need to reconsider their acquisition strategy.

Traditionally brokers have used M&A to buy scale, consolidating smaller players or merging with competitors. There are very few examples of brokers buying genuine digital capability such as Marsh’s acquisition of SME Insurance.

Digital propositions can shift volumes very quickly even in insurance – look no further than aggregators in the UK motor market. Scale does not protect against a superior proposition – think Addison Lee in the UK taxi space.

Brokers therefore need to refocus their acquisition strategy to ensure that they are not creating white elephants. A business that creates an in-year P&L uplift could be a write-down in five years if it is not supported by strategic investments in the proposition.

This will stretch management – few would have been comfortable with the 50x EBITDA multiple that Travelers paid for Simply Business. However, the Simply Business metrics were only unusual given the scale of the business: early stage technology could come at much higher multiples.

Brokers should be scouting for customer propositions or enabling technology to strengthen their models, not just courting businesses that could give them short-term scale.

Overall, we see digital as an opportunity for brokers. Brokers have things that startups don’t have like relationships, expertise and a strong and stable (sorry) brand. But they are also held back by a strategic short-termism that startups could exploit. With a refocus of their strategy, brokers could continue to dominate their market for the next decade and see off the insurance “disruptors”.