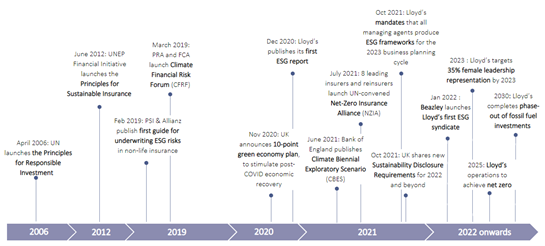

ESG has emerged as a hot topic in insurance over the past year. Numerous insurers, reinsurers and brokers have already made commitments to more ethical and sustainable practices. We predict that this trend will accelerate as laws, regulations and guidelines are introduced and shareholder and other stakeholder pressure increases.

One such announcement was from Lloyd’s on 21 October. The Corporation has mandated that managing agents must create an ESG framework and strategy in 2022, for consideration and sign off in the 2023 business planning cycle. This announcement was followed up by the Lloyd’s joining the United Nations Net Zero Insurance Alliance (NZIA), committing the marketplace and all its insurers to reach a net-zero underwriting position “by 2050 at the latest”. In this blog post, we provide our assessment on how managing agents can develop their response.

Other recent Oxbow Partners articles on ESG

ESG: A primer for insurance executives →

ESG and the insurance industry →

10 technologies improving ESG in insurance →

Risks and opportunities for insurers from the ESG wave →

What the IPCC report means for insurers →

What should managing agents do?

We see a three-step journey for managing agents to develop their ESG credentials.

1. Develop the ESG ambition

Create executive buy-in and support

ESG requires strong executive commitment and support. Executives must see ESG as an integral part of their organisation’s fabric rather than as a tick-box exercise, and be authentic in the way that they talk about it. In some ways, ESG has parallels with the early days of IT, something that was also considered a fad and a distraction by some at one point but is now inseparable from most business decisions.

This is why we talk about building ESG “credentials” rather than developing an ESG “strategy”. ESG is not a separable business initiative that can be built on top of or alongside the current operating platform, such as a new product strategy, but something that must be integral to the whole organisation.

Being authentic requires a high degree of understanding of the subject and of its centrality to the business’s success. The topic is multi-faceted as it provides insurers with both significant opportunities and risks, and has implications across the whole business model, from the client-facing proposition (e.g. Beazley’s recently launched ESG syndicate) to underwriting strategy and guidelines and operations (e.g. HR policies, sourcing strategy and partner vetting).

For many, the short-term financial implications of ESG are likely to be more risk than reward. For example, several insurers have withdrawn from underwriting mines. Across multiple products from environmental liability to catastrophe covers and D&O, the lost premium could create a significant top-line hole for many London Market insurers, particularly if – or rather when – more industries become red-lined. Management teams will need to be truly committed as they transition their business models.

Setting the ESG ambition

ESG has wide-ranging implications for an insurance business. Before jumping in, managing agents need to assess their ESG credentials and identify where they have the greatest need or opportunity to invest. There are two lenses: what they must do to satisfy various regulations and requirements (for example complying with the new Lloyd’s framework), and what they can do to achieve the internal credentials. Getting the right balance between compliance and harnessing business benefits is key.

Our frameworks allow companies to rapidly build a profile of their current performance.

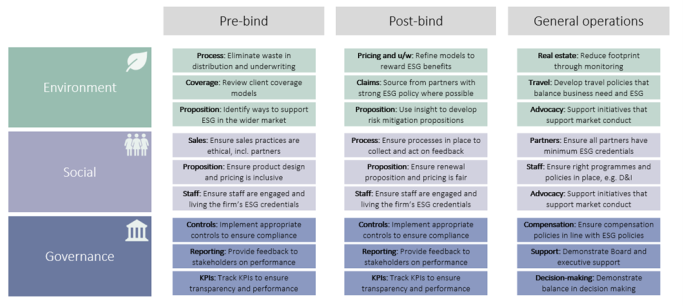

Figure 2 provides an overview of the possible impact of ESG on the insurance value chain.

Managing agents then need to set an ambition for their ESG credentials, covering the scale of their ambition, the speed of transition and how they want to position themselves publicly. For example, do you want to lead the market, and if so in which areas? Do you believe in a ‘big bang’ transformation to kick things off, or is a softer ‘bottom-up’ approach more appropriate for your organisation? Do you want to put ESG front and centre of your strategy (like Parhelion, which develops products for the green economy, or Beazley) or is it an enabler? This step will result in a ‘long list’ of possible ESG action areas or initiatives.

All of these will have financial implications, some of which will be more measurable than others. For example, updating the travel policy could bring massive cost savings to companies (and a carbon emission reduction), but will there be a negative impact on business origination? Companies will need to have a detailed understanding of their options to ensure that it is sustainable itself.

A key part of the process is to ensure that the organisation is focused and accountable. This will be achieved by putting in the right metrics to measure progress. These metrics, which should identify quantum and timeframe, could be, for example: “to be carbon net-zero by 2040”, or “underwrite more than 20% of our businesses in green sectors”. To make these targets real, it is critical that the Board and management are held responsible; this is best done by communicating transparently about them to the market as companies like Aviva have done.

Building on these inputs, managing agents finally need to translate their ambition into a fully costed “embedding” plan. This needs to balance regulatory deadlines, shareholder and employee expectations and promises, and market forces to deliver a balanced programme of work.

2. Embed ESG credentials

Once the ambition is set, managing agents need to embark on embedding it into the organisation. Why do we call this step “embedding” rather than “implementation”? Precisely for the point we make about ESG needing to be part of the fabric of an organisation and not built around it. Managing agents need to make a big cultural transformation to gain benefits from their ESG credentials.

For managing agents, many of whom are too small to have dedicated (and certainly large) ESG functions, we recommend three steering groups to drive governance.

First, we recommend a Board-level oversight task force that has responsibility for agreeing the ambition and making the big trade-off decisions that will arise, for example whether or not to red-line particular industries and if so, which. This group will also sign off the overall programme of work. Companies that have invested in diversity at the Board and executive level here will benefit as they garner a range of perspectives; those who have significant imbalances will likely want to seek input from stakeholders around the organisation to ensure their evaluation criteria are robust and in tune – to the extent that it can be – with company sentiment.

Second, managing agents should set up a programme steering group. This will report to the Board task force and be responsible for the delivery of the ESG programme, akin to a “strategic PMO” or “value realisation office” in a traditional strategy process. This group will have reporting, planning and issue resolution responsibilities. On reporting, its role is to keep the Board task force fully abreast of progress, for example using the new KPI dashboards. On planning, it is responsible for turning the ambition into a detailed project plan and keeping this up-to-date using ‘agile strategy’ principles. On issue resolution, its members will need to think through strategic dilemmas such as how an established IT sourcing strategy is amended to take account of ESG credentials without significant cost or quality impact, and making recommendations about when it is reasonable to expect minimum standards of one’s producers or suppliers.

Third, we recommend a broader advisory group, comprising a diverse set of representatives in terms of seniority, function and demographic, and perhaps including representatives from outside the organisation. This group’s role is to represent the views of a broad range of stakeholders to the Board task force.

To be successful, it is imperative that ESG becomes part and parcel of all activities in the organisation and across all stakeholders. It is therefore important that workstreams are established under this governance structure which will deliver on the strategic initiatives and drive ESG interconnectivity throughout the business. Example initiatives include a re-evaluation of the proposition, underwriting strategy or HR policies.

Finally, targets and KPIs will also play a crucial role as the hard metrics against which progress will be assessed both internally and externally.

3. Communicate and collaborate

Finally, managing agents need to communicate and collaborate on their ESG capabilities in line with the Principles for Sustainable Insurance (PSI). This is a quirk of ESG over other strategies: the onus on corporates (visibly) to continuously improve their credentials and communicate these to the outside world. There are three main requirements:

- Demonstrate accountability and transparency through public disclosure of progress towards targets

- Interact with stakeholders and wider network to raise awareness of ESG issues

- Collaborate with regulators and government policy on ESG issues and enhance compliance

More information about the PSI can be found in this Oxbow Partners article.

The Oxbow Partners View

ESG will define the next strategic planning cycle for many corporates and is likely to be as enduring as the rise of technology given that climate change and other sustainability topics will be with us for the rest of our lives.

ESG should not be done just because it is a hot topic or because a regulator demands it, but rather for the value it creates for shareholders, customers and wider society. Management teams should take a broad view of ESG and see it as both a cultural and business transformation. In our experience, forward thinking management teams will find opportunity in this period of upheaval. Those who take a broad, integrated approach will develop break-out business strategies welcomed by investors, make better investments and engage with the best partners, and have the most engaged workforce.

To use a cliché, if they are not walking the walk, managing agents will be quickly found out if they try to talk the talk.

Oxbow Partners is proud of our efforts to recognise ESG in our own ways of working. We are currently preparing our submission to be awarded B-Corp status, a designation that is awarded to companies who meet the highest standards of social and environmental performance, transparency and accountability. B-Corp status was made famous by Lemonade, who publicly adopted the certification, but has been held by Simply Business, the UK broker owned by Travelers, for much longer. We believe it is only credible to advise on ESG if we ourselves can demonstrate that we have the right credentials in place.

If you would like to discuss any of the issues raised in this blog, such as how to push forward your ESG agenda to be both compliant with the Lloyd’s reporting requirement but also generate business value, please get in touch.