Why claims digitisation is accelerating, and how you can take action

26 October, 2020

In UK GI, claims is often thought of as the last bastion of traditional people-based processes. Though there is some truth in this, we believe the reality is that digital uptake varies considerably across insurer segments. We also believe claims digitisation is accelerating across all insurer groups. Read on to see our insurer segmentation model, why claims digitisation is accelerating, and how you can take action.

Thanks to the UK GI claims directors who gave us their time to augment our own experience of the market.

Digital adoption variation:

Whilst many of your claims processes are likely to be similar to your peers, our research shows that adoption of digital claims varies considerably. There are several reasons for this:

- Your scale can impact both the maturity of your in-house claims capabilities and your willingness to invest in new technology and propositions.

- Your line of business, whether motor, home, or commercial, requires you to excel in different skillsets: some more technical, others more problem-solving. It may also require different claims journeys: “quick & cheap” rather than “thorough and hand-holding” service.

- Your corporate attitude may be CFO-driven (if you’re PE-backed or publicly listed), or it might be brand-aligned and customer-centric.

Get market insights straight to your inbox

Optimser, innovator, tactician, or fast follower?

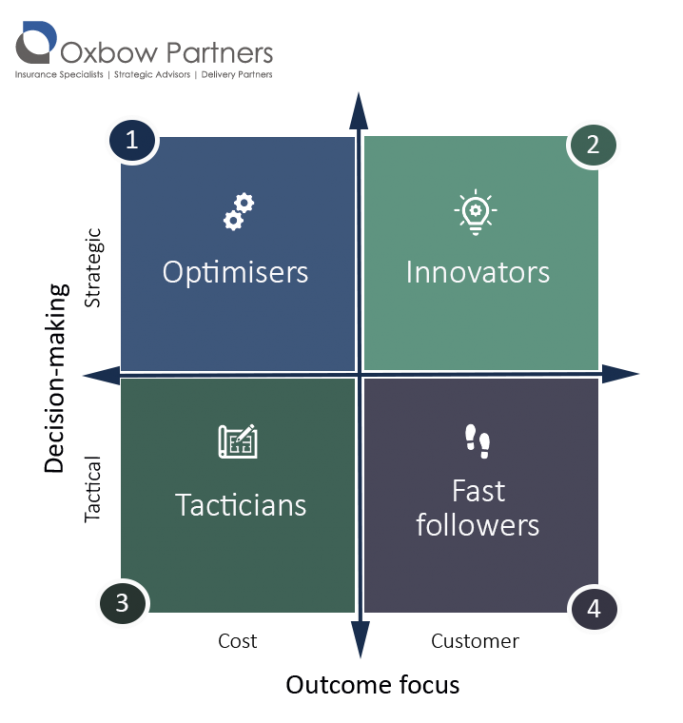

Our analysis shows that the adoption of digital claims varies based on (a) your decision-making approach and (b) your outcome focus.

- Decision-making approach. Are you making long-term strategic decisions about what you want your claims proposition to customers, colleagues, and shareholders to be or are you making short-term tactical decisions to service the “here and now”?

- Outcome focus. Are you trying to give customers a great customer journey or are you trying to keep costs as low as possible? Controlling costs is clearly a critical component to all successful operations but the results of the cost-customer trade-off can vary greatly.

Segmenting insurers along these two axes reveals four types of claims approaches.

- Optimisers. Large financially driven insurers focused on strategic cost control. Typically, Optimisers have scale and investment to forge strategic partnerships e.g. repair networks. Strategic use of outsourcing to keep costs low.

- Innovators. Insurers, typically start-ups, with highly customer-centric claims propositions & the latest systems to support them. Proposition is predictive to customer needs and undergoes continuous improvement.

- Tacticians. Small to medium sized insurers focused on cost control by managing indemnity spend, operational efficiency, and lean processes e.g. STP. Committed to “tried and tested” ways of working, with limited appetite to experiment and jeopardise loss ratio.

- Fast followers. Small or large sized insurers focused on delivering an excellent customer claims proposition but unwilling to invest or experiment in drastic changes. Reactive to customer demand, the market, and competitor actions.

With regards to digital, historically only the innovators and fast followers took any real action – perhaps most well-known is Lemonade’s 3 second claims payments.

Digital on the rise:

Optimisers and tacticians, though further behind the innovators and fast followers, are now starting to adopt digital too. There are four reasons for this.

- Customers want it. Digital is ubiquitous for even the most complex of transactions in adjacent industries, for example digital banking. As a result, customers expect digital and self-serve capabilities from insurers too.

- Insurers have the tech capability to do it. Digital evidence capture tools, total loss evaluation tools, quicker and cheaper integrations, and low barriers to entry made possible through APIs and low code, have made digitising claims possible.

- Insurers are comfortable with it. Proof that digital claims capabilities are used by customers and support cost control, has given insurers increasing confidence to experiment with digital. Where in the past making adjustments to their claims TOM may have been considered risky.

- COVID-19 demands it. COVID-19 has forced consumers to move online and abruptly adopt digital behaviours which seem likely to stay. Enforced WFH has also raised questions around handler enablement, premises costs, the ability of call centres to handle surges, as well as underlining the importance of an efficient workflow to ensure handler productivity. To many of these questions, digitisation offers an efficient, flexible, and low-cost solution.

COVID-19 in particular has done much to act as a catalyst in claims digitisation. As the “new normal” becomes genuinely normal, digital acceleration is surely here to stay and even increase.

What can you do?

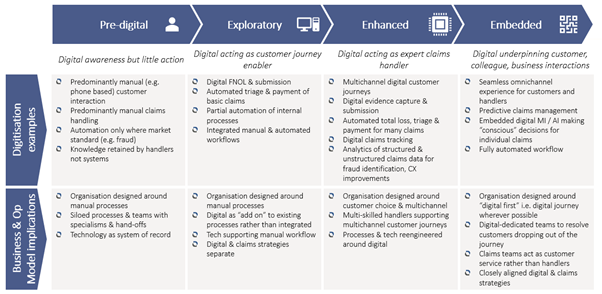

Taking action requires you to first understand how digitally mature you are already. We have identified four maturity levels of claims digitisation from pre-digital – largely manual claims operations – to embedded – “digital-first” claims operations.

- Pre-digital. Digital awareness but little action.

- Exploratory. Digital acting as a customer journey enabler.

- Enhanced. Digital acting as an expert claims handler.

- Embedded. Digital underpinning all customer, colleague, and business interactions and functions.

To avoid big-bang implementations & the execution risks that come with them you can work incrementally through each level of digital maturity by focusing on five areas. These are proposition, journey, tests, TOM, and agile delivery – read our previous blog for more detail.

The Oxbow Partners View

Whatever you choose to do, now is the time to act and set up your claims operation for the future. Whilst some are using the current situation to rethink and “grow out of a crisis”, others are not taking action and insist it will be business as usual post-pandemic. If “another six months” of restrictions is anything to go by, we are in this for the long haul. We expect to see a divide between those taking strategic action to prepare for the “New Normal”, and those who are stuck in the industry’s old ways. Lockdown has led to the realisation that change can happen rapidly when needs must and those that take advantage of this urgency will reap the benefits in the future.