Consumer Duty: Short implementation means firms must act now

5 September, 2022 Paul De'Ath

Summary

- Rules must be applied to new products by 31 July 2023

- Boards must sign off on implementation plan by October 2022

- GIPP and TCF give Motor and Home insurers a good starting position

- Gap analysis will still be a significant piece of work

- Building a fair value assessment framework may require new metrics

- Longer term, insurers could reassess use of product tiers, move away from direct sales of more complex business and bring greater automation into retention activities

The Oxbow Partners view

Personal lines insurance (particularly Motor and Home) is in decent shape when it comes to Consumer Duty. Price walking has been addressed through GIPP, so what is the big deal? The reality is that there is a big difference between selling products that meet the needs of customers and proving to the regulator that all products are being regularly assessed and managed to ensure compliance with the rules. There is work to be done even at the most “ready” firms.

On the face of it, this is less of a fundamental shift in the way the market operates than GIPP. However, there could still be some lasting changes: for example, the use of tiered products could come under scrutiny. If products are differentiated and aimed at different segments of the market, they should be fine – but if the main reason for tiering is to secure higher value sales, insurers could be challenged if they are “acting in good faith” towards customers.

Communication with customers will be more important, and we could see greater use of advisers for parts of the market where the duty of care should be higher (e.g., vulnerable customers). Finally, the Duty reinforces the requirement to allow customers to cancel their policy without undue friction. The days of cumbersome phone-in processes could be behind us, meaning business and operating models will need to adapt too.

Analysis

The FCA has issued its final rules and guidance on Consumer Duty. Firms are required to implement the rules within 12 months (i.e. by end of July 2023) – a short timeline for even those companies already close to compliance. Furthermore, the FCA is requiring board sign off on implementation plans by the end of October 2022 to avoid firms leaving action until the last minute. A gap analysis against the new requirements will be the first step; we set out later in this note the key aspects of the rules that will need to be assessed as part of this analysis.

Setting the standard of care for customers

Hot on the heels of the General Insurance Pricing Practices (GIPP) regulations, UK insurers have more regulatory change to deal with. The Consumer Duty (“the Duty”) comes into effect in 12 months (end of July 2023) and aims to ensure that firms offering products and services to retail customers help those customers to get good outcomes.

While this is a little vague, the general principle is that firms should treat customers how they would want to be treated and not take advantage of them in order to make money. The combination of Treating Customers Fairly (TCF) and GIPP should mean that most players in Home and Motor markets have a good starting position for these rules. However, as ever, the devil is the detail. Firms will need to be able to evidence to the FCA how they have assessed the value provided by each of their products, that they have been marketed to customers who are likely to benefit, and that their communications have allowed the customer to understand what it is they are buying.

This is not just a matter of additional admin to document current processes, though that is likely to be a significant task in itself. There will likely be areas of the portfolio that are not in line with the new rules. Is it fair and acting in good faith, for example, to upsell a customer onto the ‘gold’ product if the ‘bronze’ would be sufficient for their needs? Perhaps – if you can prove that the customer is likely use the additional benefits that the gold product offers.

The Consumer Duty

The Duty sets the standard of care that firms should give to customers in retail financial markets.

“We want to see a higher level of consumer protection in retail financial markets, where firms compete vigorously in consumers’ interests. Firms need to understand their customers’ needs and to have the flexibility to support them with certainty of our expectations, so they get good outcomes.”

It is a higher standard than existing FCA principle 6 (“A firm must pay due regard to the interests of its customers and treat them fairly”) or principle 7 (“A firm must pay due regard to the information needs of its clients, and communicate information to them in a way which is clear, fair and not misleading”).

Firms (across all retail financial services) need to consider the needs, characteristics, and objectives of their customers and how they behave, at every stage of the customer journey. As well as acting to deliver good customer outcomes, firms will need to understand and evidence whether those outcomes are being met. This is all about being fair to customers, in all interactions, including providing value for money and treating them how you would want to be treated.

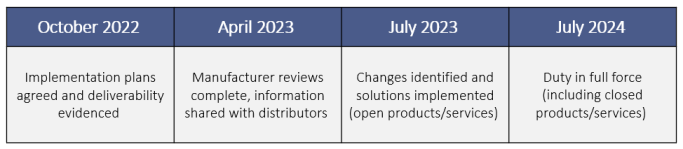

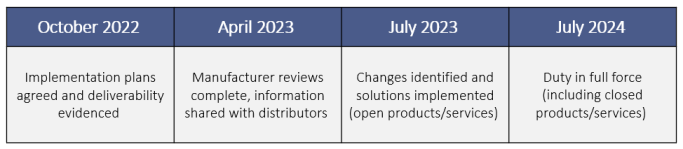

The FCA has been specific about what it expects from firms over the next 12 months ahead of implementation. The timeline is quite short, and the regulator is keen to ensure that firms do not leave everything to the last minute:

The Duty applies to financial services firms providing products and services to retail customers in the UK. It does not apply to activities connected to the distribution of group insurance policies or the extension of these policies to new members. The rules specifically exclude reinsurance, ‘contracts of large risk’ sold to commercial customers and other contracts of large risk where the risk is located outside the UK. Our reading of this would suggest that small commercial customers fall within the remit of the Duty but it is unclear where the line on ‘contracts of large risk’ will fall.

The Duty is made up of three components (see “Summary of the 3 components” below for detail):

Consumer Principle: the general principle for how consumers should be treated

Three Cross-cutting Rules: the three rules outlining expectations of behaviour in delivering good outcomes

- Act in good faith

- Avoid causing foreseeable harm

- Enable customers to pursue financial objectives

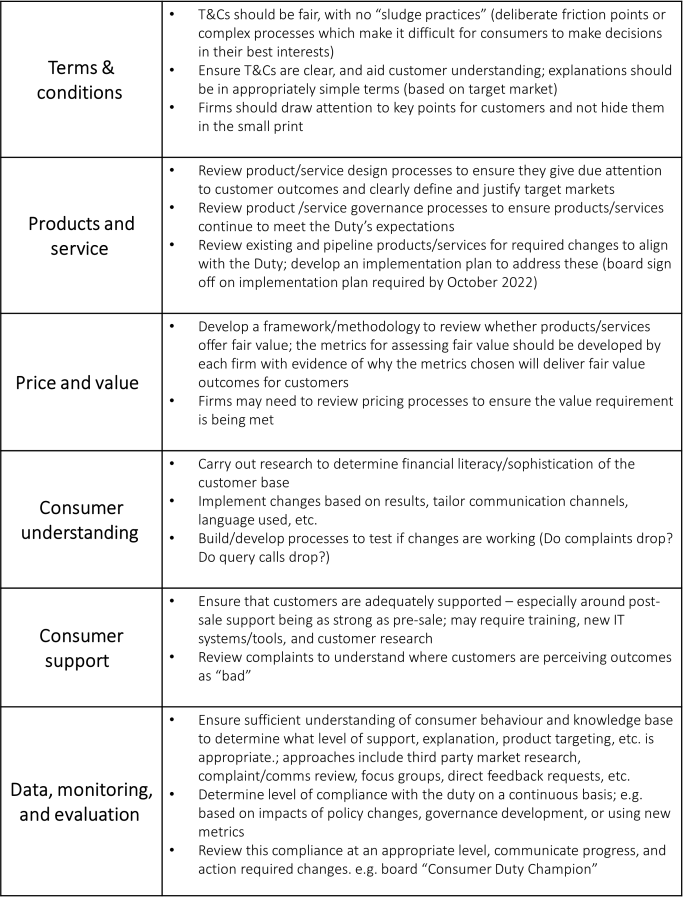

Four Outcomes: more detailed set of rules and guidance, specific to 4 elements of the consumer relationship

- Products and service

- Price and value

- Consumer understanding

- Consumer support

The FCA will be monitoring adherence to the rules and is ready to take action against firms that do not comply:

“Penalties on firms who do not comply include fines, removal of permissions, and paying redress to consumers. With senior managers and boards held to account for delivering these outcomes”

– FCA, Jul ‘22

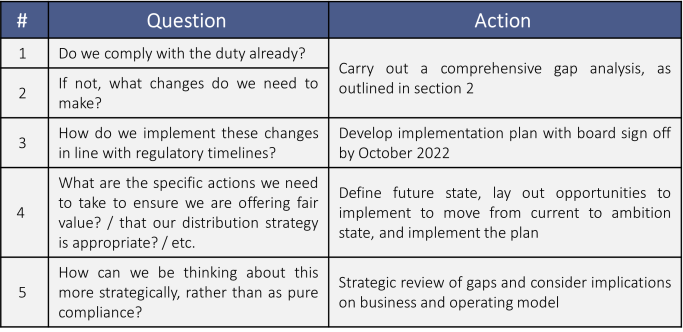

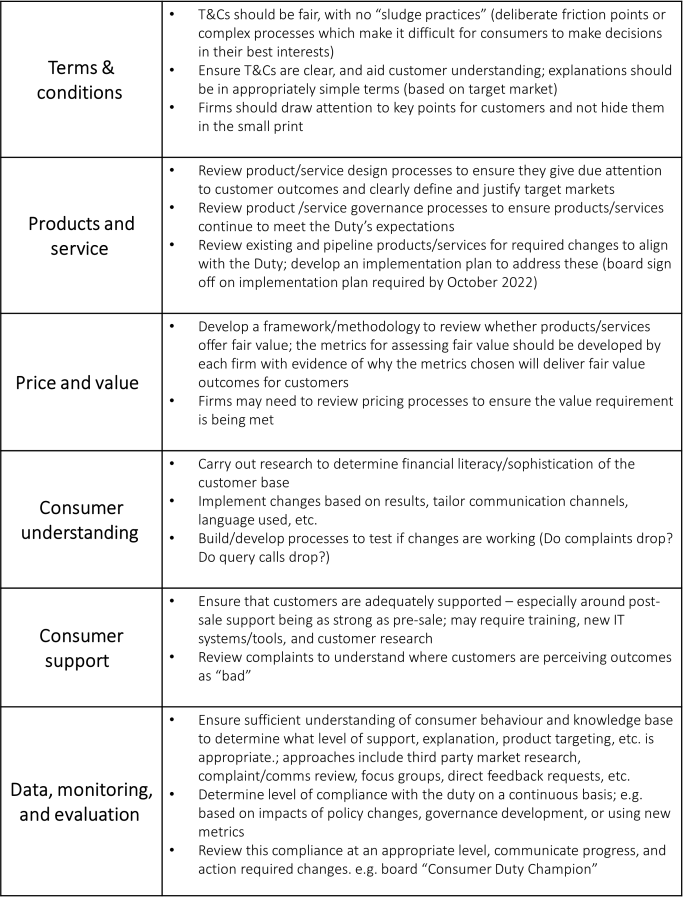

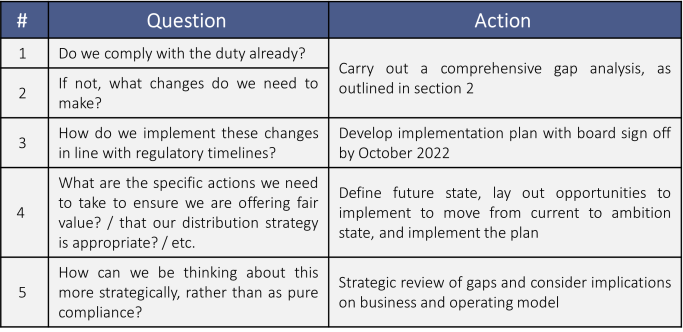

What firms should be doing now

The Duty comes into force for all new and open products in July 2023. All firms will have to carry out a gap analysis against the new requirements to understand if changes are required and to formulate a plan to implement them. We expect the range of required activity to vary greatly across the market.

Where gaps are identified, an implementation plan to address them must be signed off by board (or equivalent) by October 2022. Changes must be implemented across the existing and pipeline product sets by July 2023 – so timelines are tight for those firms with significant gaps to fill in order to be compliant.

Depending on the firm’s position and ambition, this could be roll into a broader strategic and operating model redesign piece. After all, the Duty’s requirements are not dissimilar to a robust customer-led strategy definition framework.

What does this mean for the market long term?

The retail insurance markets have already seen a seismic shift in the way they operate with the implementation of GIPP. In this section we turn our attention to the longer-term impacts of the new regulations and how they could shape the market for retail insurance in the UK.

Need to be clear on tiers

Tiered products – for example offering Gold, Silver and Bronze versions of a motor insurance policy – have been around for some time but have received a boost in the last 18 months as they were seen as part of the solution to protecting profitability post-GIPP. The use of lower tier options as new, cheaper, products with limited back books has arguably suppressed new business pricing in the motor market in 2022. While the validity of this approach can be debated under the GIPP rules, the products themselves are likely to come under more pressure from the Consumer Duty rules.

In our view there are three main reasons for companies to deploy tiered products:

- To target different customer groups that have different needs and price points

- To occupy the top spot(s) of PCW results (including “brand stacking”)

- To upsell customers to more profitable options as part of the sales process

Under Consumer Duty 2) and 3) are not valid reasons for having tiered products, in our view. Filling the PCW results with similar products at marginally different price points is unlikely to meet the test of sufficiently granular target markets. If the same customers are buying Gold, Silver and Bronze products, as they are so closely priced then it suggests the target market of the product is too broad. Upselling customers to higher tiered products that make insurers more profit through exploiting customer behaviour will also be hard to justify under the new rules, unless a clear case can be made as to how those customers will benefit from the additional cost.

Rise of the advisers

Communication of risks is fundamental to the duty but for many customers it will be very hard to evidence that they really understand the risks they are taking or the complex aspects of certain products. As noted above, even something as apparently straightforward as motor insurance could cause issues for insurers under the Duty. They will need to be sure that customers understand the difference between tiers of products else they may find that customers have bought the wrong product for their circumstances. Equally vulnerable customers will require more admin and service costs to ensure that they are being treated correctly under the Duty as firms will have a higher duty of care.

This could lead to a number of outcomes for the industry. Some insurers may focus on only offering vanilla products that are easy to understand for a wide range of customers. This would limit the amount of additional work required around communication and value assessment. However, this could lead to some customers with specialist needs or indicators of vulnerability facing less choice.

An alternative (but not mutually exclusive) outcome for the market could be a resurgence in brokers providing advice. For complex risks or vulnerable customers advice may be required to ensure that the customer is getting the right product to reach their goals, understands what they are buying and realises the value that it provides them. The difficulty for personal lines advice is the focus on price that has driven the market for many years. If GIPP can remove some of the worst new business discounting behaviour, the use of the advised channel for certain products or customers might become more financially viable.

Customer service over customer retention

Guidance around the Duty makes it clear that the FCA believes customers should be supported by firms and that this includes making it as easy as possible to interact with their insurer. Many insurers are already some way down the path towards digital self-service for MTAs and claims.

Where there could be more activity is in retention. Cancelling a policy (either at renewal or mid-term) often still requires a phone call. This allows the insurer an opportunity to convince the customer to stay, and possibly upsell or cross sell at the same time. GIPP has taken steps to make this process easier for customers by requiring firms to inform customers of auto-renewals, provide an explanation of what this means, and confirm that customers have the right to cancel. Further, customers must be provided with practical instructions on how to cancel. At a minimum, customers should be able to end policies via the same channel they used to take them out.

The Duty continues this trend. In the Consumer Support Outcome one of the questions firms should be asking themselves is: “How has the firm satisfied itself that it is at least as easy to switch or leave its products and services as it is to buy them in the first place?”

Insurers now have to at least match renewal prices to new business (under GIPP) and they have to offer the option to cancel online. Surely retention activity should be focused on providing customers with the best possible price first time and cutting back on their renewal departments. For many businesses this will involve a significant shift in operating model.

Firms need to think strategically rather than just focusing on compliance

The market has already been through a significant change in the way it operates thanks to GIPP. For Consumer Duty we expect that most firms will focus first on pure compliance. Once that has been achieved firms will need to take a more strategic view to ensure they are able to take advantage of market shifts in distribution, retention and product design.

Key questions/actions

If you would like to discuss how Oxbow Partners can help understand and navigate the move to consumer centricity, then please get in touch with a member of the team.