There are moments in history when companies can shape their reputation for a century. Following the 1906 earthquake and fire in San Francisco, Cuthbert Heath, Chairman of Lloyd’s, famously sent a message to his San Francisco agent saying “pay all of our policyholders in full, irrespective of the terms of their policies.” Munich Re’s founder and Chief Executive, Carl Thieme (later von Thieme), travelled to San Francisco personally to pay claims. Swiss Re similarly paid out beyond the terms of its reinsurance treaties. All three brands have resonated as solid, long-term partners ever since.

For some thoughts on what companies are doing to keep employees motivated, see our recent blog post.

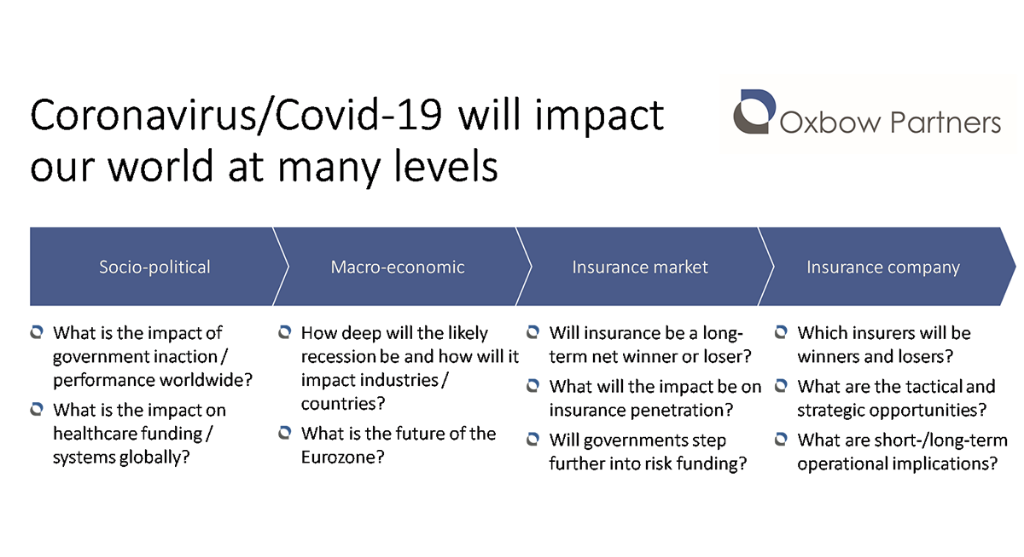

Covid-19 will have an impact that is much bigger than insurance, of course, and until we have it unequivocally behind us we will not know what it is. At the socio-political level, scenarios range from civil unrest if hospital capacity is overwhelmed through to a boost for social democracy in the UK and perhaps the US. Healthcare systems will inevitably be examined and could be fundamentally redesigned, most obviously in the US.

There will also be a major macro-economic impact. Markets have been in turmoil over the last month and many countries have announced enormous stimulus packages to maintain their economies. Apart from government debt and the resulting impact on fiscal policy, challenges will likely include mass unemployment and the further concentration of wealth. Questions will be asked about the solvency of Italy in particular and the sustainability of the Eurozone. The next phase of the Brexit negotiations will take place in a different world to when Britain left the EU on 31 January.

Insurance impact

Insurance must operate in this new macro environment. There will be wide-ranging consequences for companies. Most immediately they will need to deal with solvency (e.g. losses from claims and reduced asset values) and changes in demand (e.g. increase in income protection insurance). Medium term they will need to consider the impact of a recession on demand, claims and fraud, and long term the structure of products given, for example, an expansion of government involvement in catastrophe risk funding (like Pool Re for terrorism in the UK).

Insurer operating models have already been disrupted. Companies have, almost overnight, become fully virtual organisations. Even Lloyd’s has closed the underwriting Room (for the first time in its 334 year history). We expect this to be a semi-permanent change, and that it will have a profound impact on the strategies of those companies.

The virtualisation of companies and the need for clear purpose

The virtualisation of companies has implications which go much further than technology and staff policies.

Companies were until recently entities that could be visualised and ‘touched’. If you are asked to think of an insurance company, you might visualise a building, a room you were once in, or person you met.

People came to work in these physical spaces for many reasons including (to varying degrees) money, intellectual development, social interaction and purpose. For many, especially those not in a management role, going to work is a social routine: making a statement through fashion or spending breaks with friends for example. Companies have increasingly encouraged the community environment, in some cases by reconfiguring offices to recreate the WeWork vibe.

The virtualisation of the organisation will lead to a re-prioritisation of motivations by employees. With social interaction stripped out and more time to reflect, purpose will become much more important as a source of motivation. Do I feel fulfilled talking to customers about their insurance? Can I be proud of what I’ve achieved for customers every day or do our policies make me feel uncomfortable? Did my company do the right thing at the time of Covid-19? Am I feeling connected to and proud of the objectives of the company?

Corporate purpose is, of course, not a new topic. Climate change and citizenship are rapidly becoming material concerns of both the workforce and customers. It is not surprising that companies are falling over themselves to support the global Covid-19 response, for example by turning over factory space to produce ventilators or facemasks. What is new is the centrality of purpose for many employees now working and reflecting on life in their kitchens.

When it comes to purpose, insurance has a long way to go. It is notable that insurance is the only industry that does not feature on a website of “meaningful” Covid-19-related innovations by TrendWatching, the consumer trend analytics firm. We believe that this is partly sample bias because, as we have described in our research notes on Covid-19, some insurance companies have recently announced initiatives such as premium refunds and other support for customers. If anything, it shows how hard the insurance industry needs to work with its messaging given the intangible nature of its product; it’s easier for Uber to be spotted delivering food for free to doctors.

This leads to a number of questions and actions for management:

- Does management have a clear ‘purpose’ for the organisation beyond maximising shareholder return? Is this purpose clear in the business vision and strategy?

- Is the purpose translated into the operating model and policies of the organisation?

- Is the purpose ‘lived’ by the organisation day-to-day? What KPIs are used to ensure the balance between financial and non-financial returns?

- Is there an internal and external communication strategy that focuses on the organisation’s purpose?

- Do our employees believe in what they’re doing?

Survive or thrive?

The last few weeks have been operationally tumultuous but disruption has been remarkably limited with even the most legacy-constrained insurers making remote working work. It is clear that insurers can survive Covid-19 operationally (and almost certainly financially).

The question insurers should be asking themselves is whether it is enough to survive, or if they, like Lloyd’s, Munich Re and Swiss Re in 1906, see an opportunity to thrive. We believe that insurers who emerge strongest from this crisis will be those who started to answer this question by thinking about their purpose.