Enhancing client strategy and operations to drive growth

27 March, 2025

In October we launched our 2024 paper about ‘Strategic Imperatives for P&C Reinsurers in 2025’. The paper is based on our work with numerous reinsurers and analysis of our Reinsurance Market Model, which contains detailed performance data on 19 of the largest P&C reinsurers accounting for nearly $400bn of premium.

Despite an outstanding 2023 market result for reinsurers and likely strong 2024, the market equilibrium feels fragile: traditional reinsurance capital is estimated to be up 10% in 2024; well-capitalised challengers are manoeuvring; some startups are lurking; and third party capital is steadily increasing. The outlook for 2025 is uncertain.

In section 1 of this report we briefly reflect on 2023 market performance.

In section 2, we consider two challenges that P&C reinsurers need to navigate in 2025.

In section 3, we consider four areas where reinsurers need to act in 2025:

2. Enhancing client strategy and operations to drive growth: Putting more structure into the coverage model to access risk in an increasingly competitive marketplace

We like to joke that reinsurance relationships are like a Patek Philippe watch: your team never actually owns them, but merely looks after them for the next generation.

For many reinsurers, the client portfolio is an accident of a broker-driven history rather than the consequence of a deliberate client portfolio strategy. Many place their focus on their largest accounts, often described as the ‘globals’, which can contribute a large proportion of total GWP. Knowing how dependent their reinsurers are on them for cost absorption and prestige, ‘globals’ can often drive a hard bargain, depressing margins.

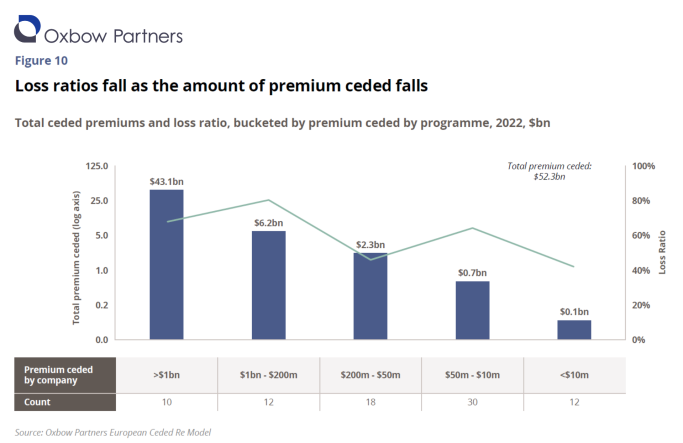

This is reflected in our analysis of cession data of 86 large European cedents. We observe two things: the significant concentration of premiums, and that the larger programmes have higher loss ratios.

Over the next five years, reinsurers will need to calibrate their strategies to generate adequate returns in potentially challenging circumstances. Whatever the market scenario, we believe there is both an imperative and an opportunity to manage the client strategy and proposition better. In a heavily relationship-driven market, underwriters will need to do the analysis and ask the tough questions that could rock the boat.

Incumbent and challenger reinsurers have an opportunity in H1 2025 to take stock of their client portfolio and do the analysis that allows them to make strategic choices about their target portfolio composition and proposition. For example, a persistent key question is the role of ‘value adding services’ to cedents – to whom are these offered, how are they monetised, and how are they maintained?

Questions for management:

- Do we have a robust client strategy that is clear about which clients to target and why? Do we have a logical segmentation and are we tracking ‘white space’?

- Do we have a clearly articulated value proposition? Is it clear what we stand for as a company and what our ‘edge’ is?

- Do we have an operating model that allows us to deliver our client strategy and proposition?

- What structures and processes do we need to deliver them?

- How do we ensure these have ‘teeth’ in the underwriting team?

- How do we measure progress towards our strategy?

- Do we need a different business or operating model or value proposition to reach the long tail of smaller but profitable clients?

- Should we be trying to access these clients ourselves? What do the value proposition and operating model look like?

- Should we be considering partnerships with regional specialists? Are there other lower cost or lower risk models?