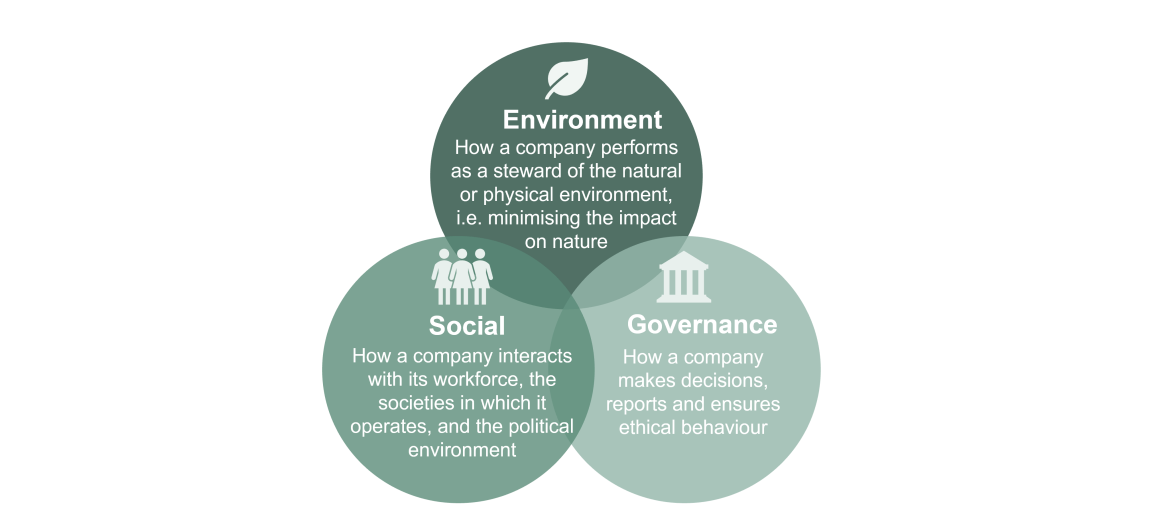

ESG is short for Environmental, Social and [Corporate] Governance. It is a framework for a company to demonstrate how it is contributing positively to the world in which it operates.

Environment relates to the way a company positively impacts its impact on the natural or physical environment. For an insurance company, this could mean a commitment to net-zero carbon emissions, or supporting the renewable energy transition through its underwriting policy.

Social relates to a company’s commitment to fairness in society. This could include the way it interacts with its workforce or addresses the known D&I challenges in the industry, how it vets its distribution partners and supply chain to avoid mis-selling or poor claims practices, or how it behaves in the community, for example by avoiding financial exclusion through discriminatory pricing practices.

Governance relates to the way a company runs its operations. This includes the way a company makes decisions, reports, and generally ensures ethical behaviour.

The term ESG first began to appear in the early 2000s and is often a synonym of “sustainability”.

What is driving ESG in insurance?

There are five main drivers of ESG activity in the insurance marketplace.

1. Climate crisis

International focus on the climate crisis and particularly carbon has hugely accelerated in the last few years, and certainly since the Paris Agreement signed in December 2015. Many governments around the world have committed to reaching net-zero by 2050 by the latest, and this will be in sharp focus next week during the COP26 in Glasgow.

Many large corporations have committed to net-zero goals, including over 200 who have signed up to Amazon’s Climate Pledge which seeks to achieve the Paris net-zero carbon goals 10 years early. Aviva is the only insurance company to be a signatory today.

2. Stakeholder pressure

As the climate crisis escalates, social pressure has intensified on companies to establish their ESG credentials. Pressure groups such as Extinction Rebellion are taking action against governments and companies.

This in turn is affecting investor sentiment. Investors such as Vanguard and Parnassus have updated their investment approaches to establish their ESG credentials. Insurers need to ensure that they remain an in-appetite company for their shareholders.

3. Employee expectations

As the war for talent intensifies, companies are increasingly focused on employee sentiment. Established initiatives such as Diversity and Inclusion have established vehicles for employees to self-organise and position their views at senior levels in the organisation. These vehicles will soon be expanded to capture broader ESG issues. Insurers should take heed of some of the leaks and accusations flying around the tech industry at the moment, and ensure that their policies and procedures do not expose them to negative stories.

4. Government regulation and codes of conduct

Governments and regulators are tightening their frameworks for driving and overseeing ESG issues, for example reporting requirements. In the UK, the Bank of England has launched Climate Biennial Exploratory Scenarios (CBES) to assess the resilience of the UK’s largest banks and insurers to climate risk and will set the agenda for further regulatory scrutiny over the next decade.

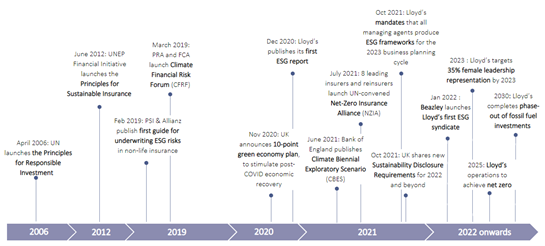

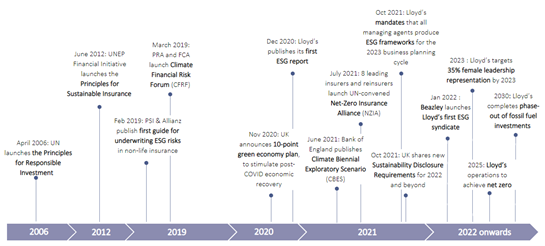

Lloyd’s recently announced that managing agents must create an ESG framework and strategy in 2022, for consideration in the 2023 business planning cycle. This follows on from publishing its first ESG report in December 2020.

5. Competitive forces

As these forces play out, insurers and brokers are pushing ahead with their own ESG agendas putting pressure on their competitors to follow suit.

Pressure comes in two main ways. Some insurers like Allianz have published comprehensive documentation designed to appeal to a wide range of stakeholders like shareholders and regulators about their ESG activities. Others have focused on messaging through specific business strategies. Examples include Parhelion, an insurer focused on renewable energy and climate finance, Beazley recently launched an ESG syndicate, and Marsh a D&O initiative for companies with a good ESG rating.

How does ESG impact insurance companies?

ESG affects all aspects of an insurance company’s operations. At the highest level, insurers are able to promote ESG in the wider market by recognising its benefits in their underwriting and investment practices, and they must lead by adhering to high ESG standards themselves.

To find out more, read our article about ESG and the insurance industry and the risks and opportunities for insurers from the ESG wave.

Insurance industry codes and principles

Numerous national and supra-national ESG codes and principles have been developed. Some examples are provided.

Principles for Responsible Investment

The Principles for Responsible Investment (PRI) are an early initiative in this area, launched in 2006 by the UN. These are a commitment to promote and account for ESG factors when making investment decisions and ensuring transparency in decision-making. Munich Re, SCOR and Aviva amongst the founding signatories.

The principles are:

- We will incorporate ESG issues into investment analysis and decision-making processes.

- We will be active owners and incorporate ESG issues into our ownership policies and practices.

- We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- We will promote acceptance and implementation of the Principles within the investment industry.

- We will work together to enhance our effectiveness in implementing the Principles.

- We will each report on our activities and progress towards implementing the Principles.

Principles for Sustainable Insurance

The Principles for Sustainable Insurance (PSI) were launched in 2012 as a separate UN initiative by the Environment Programme. These seek to “build on the foundation the insurance industry has laid in supporting a sustainable society” and “incentivise people to adopt sustainable practices”.

The PSI provides a basis for insurers to address ESG risks and opportunities, as well as offering a global roadmap to explore and develop innovative risk management solutions for ESG issues. Most of the world’s leading insurers are signatories.

The principles are:

- We will embed in our decision-making environmental, social and governance issues relevant to our insurance business.

- We will work together with our clients and business partners to raise awareness of environmental, social and governance issues, manage risk and develop solutions.

- We will work together with governments, regulators and other key stakeholders to promote widespread action across society on environmental, social and governance issues.

- We will demonstrate accountability and transparency in regularly disclosing publicly our progress in implementing the Principles.

Task Force on Climate-Related Financial Disclosure

The Financial Stability Board, the international body, established the Task Force on Climate-Related Financial Disclosure (TCFD) to “develop recommendations for more effective climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions and, in turn, enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks”.

ESG in the London Market

Lloyd’s is increasingly pushing its ESG credentials. It published its first ESG report in December 2020 before mandating in October 2021 that all managing agents produce ESG frameworks for 2023 business planning cycle.

Figure 2: Timeline of ESG developments. Click to enlarge.

Tech movers and shakers in ESG

Many tech companies are coming into the ESG space. Our Magellan™ Collection provides an overview of some of the movers and shakers.

If you would like to discuss any of the issues raised in this blog, such as how to push forward your ESG agenda to be both compliant with the Lloyd’s reporting requirement but also generate business value, please get in touch.