Flavour of the Month is a new content series for our UK Market Intelligence subscription. We highlight notable monthly market trends, keeping you up to date on the industry’s “Flavour of the Month”. This month we focus on flexibility of insurance contracts. Subscribe to UK Market Intelligence to receive this insight straight to your inbox.

As we continue to work our way out of the depths of the pandemic, more people are heading back to the office but looking for a hybrid working pattern offering a mix of office and home time. Increasingly customers are also looking for flexibility in the rest of their lives. Insurance is not immune from this trend and there are reasons to believe that flexible insurance is going to deliver strong growth for those companies that can get it right over the coming years.

This is not just a pandemic-related change.

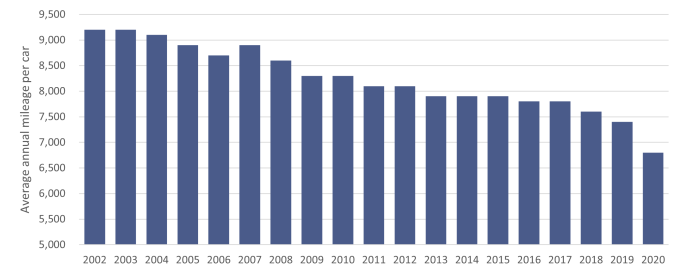

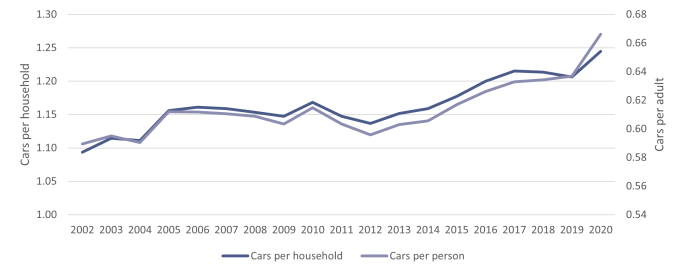

In the UK, we are using our cars less. This is not just a pandemic-lockdown related issue. Since 2002 the average number of miles driven each year has reduced by 26% from 9,200 to 6,400 in 2020. As the number of miles driven reduces, the value proposition for ‘standard’ insurance contracts becomes weaker as it is likely that vehicles will sit idle for long periods of the day/week and therefore pose a lower insurance risk.

Source: National Transport Survey. Click to enlarge

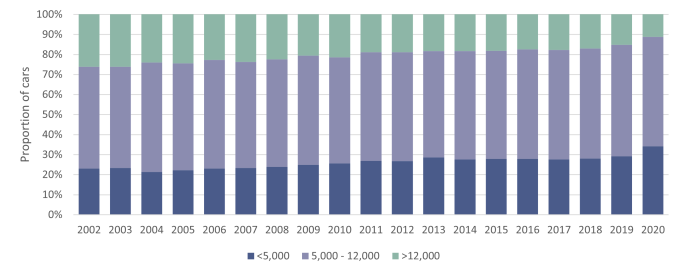

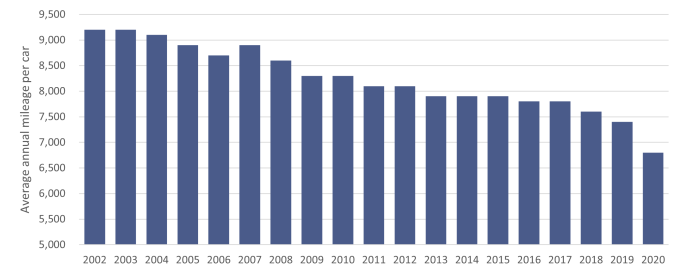

The reduced annual mileage in the UK has come from a higher proportion of low-mileage cars. In 2020 over one third of all cars in the UK drove less than 5,000 miles. Even in 2019 this was 29% of the UK fleet or 9.2m cars (Source: Department for Transport). This creates a market for non-standard motor insurance products such as pay-by-mile policies, temporary insurance or a combination of both where car owners are happy to lend their vehicles to their family and friends rather than leaving them idle.

Figure 2: One third of cars are driving less than 5,000 miles per year

Source: National Transport Survey. Click to enlarge

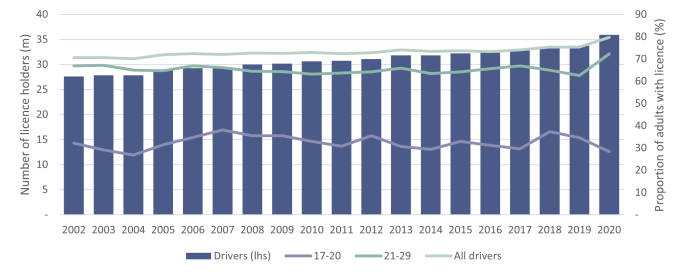

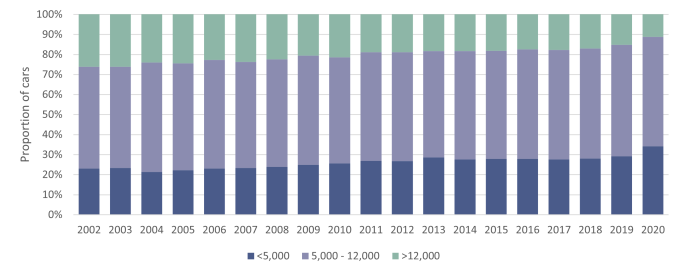

While the fact that cars are being driven less is good for insurers with flexible policies, there could be a concern that younger people may move away from driving altogether as they opt instead for public transport and Ubers to get around. The data indicates that this is not the case. Despite the pandemic slowing down the number of driving lessons and tests throughout 2020, the proportion of the population with full driving licences has increased by 2m during the last year. This is due to a higher proportion of 21-29 year olds holding full licences than in previous years. It appears that although we are a nation that is driving less, we still want to have the option to drive if the need arises with 80% of adults holding a driving licence in 2020 – a record high.

Figure 3: More people in the UK than ever have full driving licences

Source: National Transport Survey. Click to enlarge

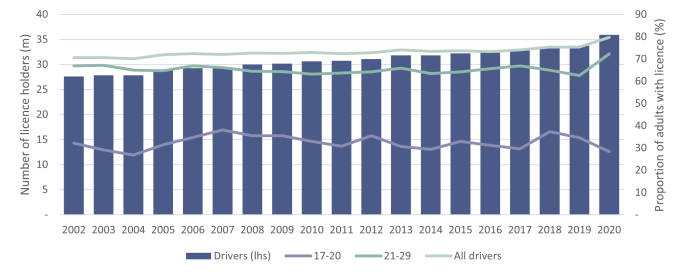

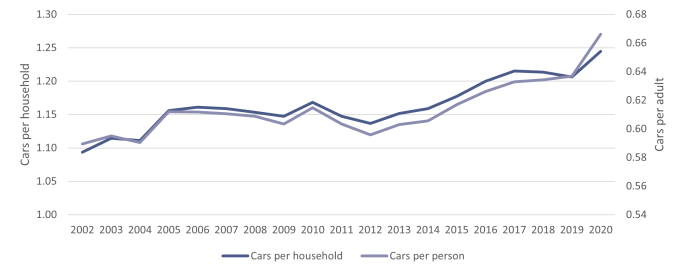

One final piece of good news for the motor insurance industry is that although we are driving each car less often, the number of cars per person continues to increase with 2020 recording 0.67 cars per adult in the UK and 1.24 cars per household, both at the highest levels recorded. With more cars on the road each driving less miles, there is an opportunity for flexible insurance providers to cut into the mainstream motor insurance market if they can get their pricing and value proposition right.

Figure 4: One third of cars are driving less than 5,000 miles per year

Source: National Transport Survey. Click to enlarge

Usage-based vs Temporary cover

In terms of flexible motor insurance options, most providers fall into one of two camps: Usage-based insurance or Temporary insurance.

Usage-based insurance

Of the two, usage-based insurance is more like a traditional policy with insurance cover often provided on an annual basis but with a relatively low base cost plus a charge for each mile driven. This is often monitored using telematics (either a ‘black box’ fitted to the car or increasingly a mobile phone) that keeps track of how many miles you drive so that you can be correctly charged each month. While many providers already have telematics options for young drivers that also monitor driving style and a host of other factors to improve the underwriting, there has been limited take up in mainstream policies for drivers over the age of 21.

Changing working patterns and the reduced mileage stats shown earlier have fueled increased demand for usage-based policies with providers such as By Miles seeing a significant uplift in sales in the last few years. A new entrant to the market this year is Vitality which we believe many in the industry will be watching closely as it attempts to cross-sell to its large base of life and health customers and bring telematics to the mainstream.

Usage-based insurance is suitable for those that own their own car but don’t drive it very much is an increasing segment of the market. The challenge for usage-based players is making the proposition cheap enough for older drivers who already get very competitive prices from traditional players without the need for ongoing monitoring costs.

Figure 5: Example companies in the Usage-based insurance space

By Miles

- Started in 2018

- Offers connected policies for Tesla drivers

- Other drivers use a dashboard plug-in

- Base cost plus charge per mile each month

Learn more on Magellan™

Vitality

- Launched in 2021

- Provides rewards for car-free days

- Also rewards for good driving

- Marketing to 1m+ life and health customers

Learn more

RAC

- Launched in 2021

- Base cost plus charge per mile each month

- GPS tag used to track miles driven

- Rolling monthly contract

- Focused on <6,000 miles pa

Learn more

Sterling

- Specialist broker offering wide range of insurance

- Pay-by-mile, pay as you drive and short term cover

- Phone-based purchase only

Learn more on Magellan™

Temporary insurance

A Temporary insurance product is one bought for a limited duration, normally between 1 hour and 1 month to provide customers with coverage for only the period of time that they need. Motor insurance is the biggest segment for temporary cover with use cases ranging from borrowing a van to do your own removals to covering yourself to test drive a second hand car. The main barrier to traditional insurers offering temporary insurance is likely to be legacy systems built around the annual policy cycle. Despite this, a number of large insurers have temporary insurance options such as Veygo by Admiral and Aviva who provide capacity to Dayinsure. Sabre are also in the process of launching a temporary motor product. In addition to the big name insurers there are a number of InsurTechs and brokers that specifically target the temporary motor insurance market.

One of the key differences between temporary insurance and usage-based is that temporary cover does not have an underlying base of cover to insure the vehicle when it is not in use. The use cases are therefore more limited as a customer cannot leave their car uninsured in between periods of cover. This inherently makes temporary insurance more of a niche product but in a growing niche.

One aspect of the temporary cover market showing strong growth is drive away cover for new and used cars bought online via new car sales models such as Cinch and Cazoo. Temporary cover can be used to insure the delivery drivers or the new owners during the initial period of ownership before they decide whether to return the car or buy more traditional insurance. GForces, an ecommerce provider for 20 car manufacturers saw a 1228% increase in new and used cars biought throught its platform in 2020 with the expectation that this will double again in 2021 and continue to grow at 24% in 2022 (Source: Autocar). The shift to a new way of buying cars looks like it is here to stay for many customers and this will provide structural growth to the temporary insurance market.

Figure 6: Example companies in the Temporary Motor insurance space

- Started in 2006

- Cover from 1 hour to 28 days

- Wide range of vehicles

- Over 2m policies sold

Learn more on Magellan™

Veygo by Admiral

- Started in 2017

- Cover from 1 hour to 30 days

- 150k policies sold

- 47% growth in 2020

Learn more on Magellan™

- Started in 2005 – Aviva as sole insurance provider

- Cover from 1 hour to 30 days

- 1 million polices written in last 12 months

- Wide range of vehicles

Learn more on Magellan™

Cuvva

- Started in 2016

- Cover from 1 hour to 28 days

- 5m policies sold to 500k customers

- Also offer a pay monthly option

Learn more on Magellan™

Personal motor is not the only market for temporary cover

It is not only motor insurance that can be temporary. In home insurance there are options to buy short term cover. Examples could be to protect against loss during renovation works or while you are out of the country for an extended period where standard annual coverage will not normally suffice.

This phenomenon is not just limited to personal lines cover. Thimble offers short-term business liability cover for freelancers and seasonal workers who only need the cover for part of the time. Likewise Zego has swiftly become an InsurTech unicorn on the back of its offering to part-time taxi and delivery drivers looking for additional coverage only when they are working.

Taking things a step further Justincase in Japan offers customers 24 hour injury insurance for when you are attending an event, playing sports or even just travelling.

Figure 7: Example companies in other Temporary insurance markets

Avantia

- Non-standard home insurer

- Online quotes for multiple NS risks including: renovation

- unoccupied

Learn more on Magellan™

Thimble

- Flexible business insurance cover

- Get cover by the job, month or year

- Adjustable to the size of business

Learn more on Magellan™

Zego

- Commercial motor insurance for delivery drivers and fleets

- Policies available from 1 hour to 1 year

- Over 200,000 vehciles insured since 2016

Learn more on Magellan™

Justincase

- 1-28 day injury insurance in Japan

- Cover for attending events, playing sports or going on business trips

- Insured can claim for medical service and rescue costs

Learn more on Magellan™

The Oxbow Partners View

The driving habits of UK consumers have been changing for some time but the pandemic has accelerated the demand for flexibility in many aspects of people’s lives. In motor insurance this has manifested itself in greater demand for usage-based policies and temporary insurance, a trend that has not gone unnoticed by a number of the more traditional insurance players.

We believe that until there is a paradigm shift in mobility (for example widespread acceptance of autonomous vehicles) the majority of customers will continue to buy motor insurance that fits the ‘traditional’ model however the growth of more flexible options will reduce the size of the traditional market over time. Reduced mileage and increased online purchasing are two factors that should boost demand for more flexible options over the coming years. Smaller niche players might be better placed than incumbents to offer the products and services that many customers now require. The main caveat to this, however, is that for most customers it still comes down to price and the scale of the traditional players can often outweigh the sophistication of smaller challengers.