Future at Lloyd’s: Blueprint One COVID-19 Update

1 June, 2020

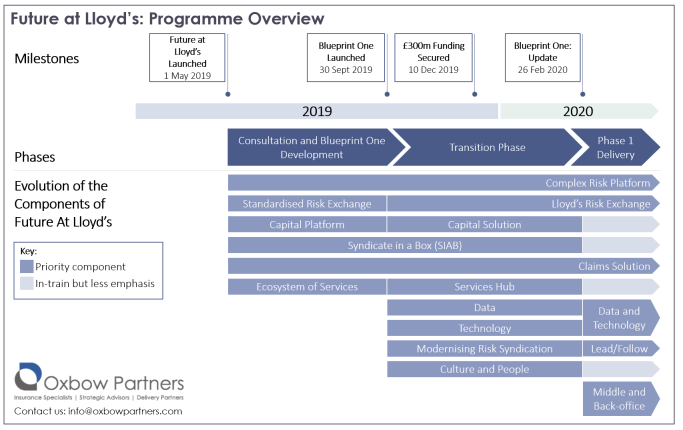

This is our third post on the Blueprint One since the launch in October 2019 and the previous update in February. The most recent update comes in response to the COVID-19 pandemic which has required Lloyd’s to sharpen its focus. Based on feedback from the market, Lloyd’s has prioritised the following three elements aimed at delivering the most impact to participants:

- Building a next-generation PPL

- Delivering a digital coverholder solution

- Fast-tracking claims process improvements

Lloyd’s are also actively building on the data and technology needed to support the above items.

Blueprint One Outcomes to date

While the pandemic has required a number of activities to be scaled back throughout Q2 and 2020, Lloyd’s have announced progress in the following areas:

- Syndicate in a Box (SIAB): The first SIAB with Munich Re started writing business on 1 January 2020 and the second SIAB was recently approved with Carbon underwriting in May

- Capital: Lloyd’s launched its first ILS pilot with Brit in January

- Complex Risk Platform: Lloyd’s announced that it acquired a 40% stake in the PPL platform in February

- Lead/Follow: In April, Lloyd’s approved the innovative Ki collaboration between Brit and Google. The algorithmic follow syndicate is scheduled to launch in January 2021.

- Claims: The small claims automated settlement (SCAS) pilot is now live, with the first claim successfully processed on May 12

Make sure to read more of our updates on the Future at Lloyd’s.