Increase portfolio resilience

30 January, 2025

In October we published our annual Lloyd’s and London Market CEO Agenda for 2025 – “Leading through uncertainty”. We look at the current market conditions and set out six transformation topics that we believe CEOs should address in 2025:

3. Increase portfolio resilience

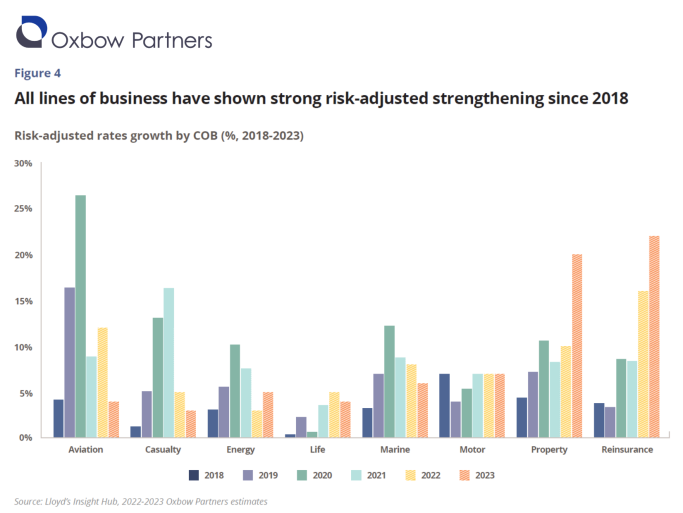

The rate environment has been positive across most lines of business since 2018 and benefited from both macroeconomic and geopolitical factors. Nonetheless, the growth in rates has varied across classes of business, with Property and Reinsurance demonstrating the strongest growth (c.10% CAGR) and Casualty, Energy and Motor showing more moderate gains of 6-7% CAGR.

The messaging from Monte Carlo was, as expected, positive with reinsurers keen to stress discipline and that the current rates remain broadly risk-adequate.

However, there are signs that the tide could be turning. We have already seen slowing rates in US Property lines and in some pockets of Casualty (e.g., Cyber rates have been negative since 2023). This trend is likely to continue, despite recent hurricanes, unless the remainder of 2024 and early 2025 creates additional surprises. In Casualty we have not seen as much of a cyclical spike upwards in rates. Loss cost inflation is still rising, particularly in the US, which could maintain positive rate movements for longer.

With that backdrop, we are reassured to see an increased focus on preparing for a shifting rate environment. However, we observe that insurers often talk the talk but end up following the market down. In fairness, there are conflicting forces at play, for example shareholders with their desire to see growth, and the need to absorb costs. However, this is all the more reason to have a structured and transparent approach to portfolio optimisation.

Imperatives for 2025

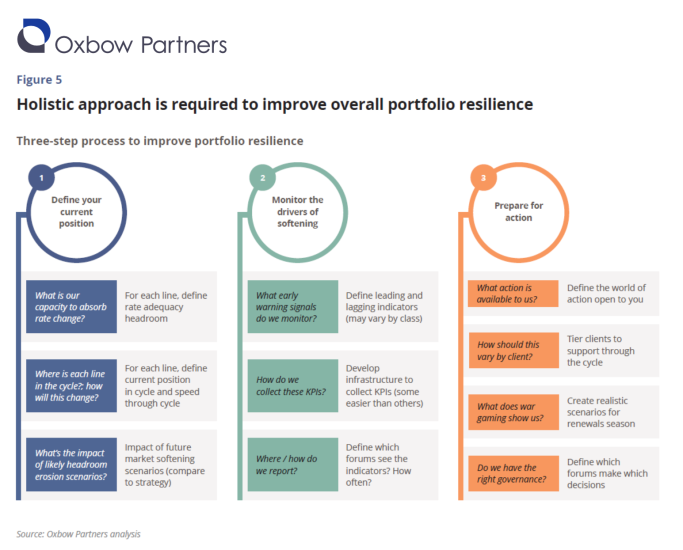

We believe that now is a good time to fundamentally review the resilience of the overall portfolio and ensure there are structures in place to respond to the changing cycle. We see a three-step approach.

First, carriers should develop a framework for understanding rating at the individual line of business level. This should include: current rate strength, current and future claims development and market sentiment. Modelling can be used to understand the impact of potential market scenarios.

Second, carriers need to identify and monitor the potential drivers of softening. What KPIs do we collect and how do we report?

Third, carriers need to identify potential responses and build the operating structures to monitor and act on their insights. In our experience, underwriting teams are structurally set up to capitalise on a hard market (e.g., incentives) but struggle to be disciplined on the descent. What is the transmission mechanism between insight and front-line behaviour?