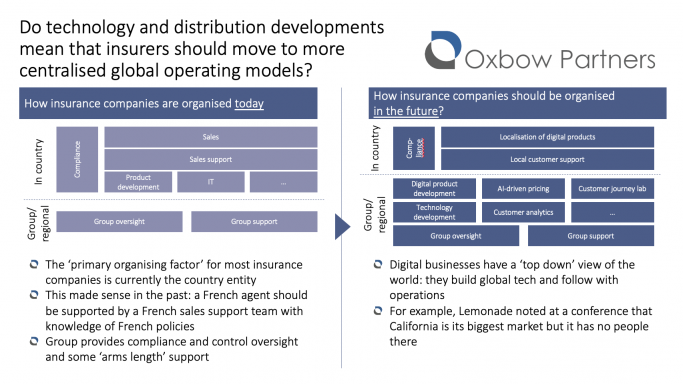

It is true that insurance incumbents – like most established industries – are organised geographically. Regions and countries are the ‘primary organising factor’. This has historically made sense: a Munich-based, Bavarian-speaking individual is best placed to cover the Bavarian salesforce, and that person needs to be plugged into a market-focused infrastructure. For example, companies need sales handbooks that are compliant with local regulations, and processes need to enable local requirements such as the vehicle registration process and links to local claims and fraud databases.

There is, in other words, a lot of local custom and complexity which has contributed strongly to geography being embedded as the ‘primary organising factor’. Lemonade’s expansion into Europe will, we believe, provide empirical evidence about whether this continues to be the right model.

The reason that Lemonade’s move into Europe is interesting is because it will provide an objective datapoint on the ability of insurance to be a global, technology-led proposition. The big difference between Lemonade and incumbents it that Lemonade is starting with no local infrastructure and will put in what is required, whilst incumbents would have to go the other way. As any change director will know, taking things away is much harder than putting new things in.

The acid test will, therefore, be whether Lemonade can ‘stretch’ its customer base without scaling its costs proportionately. How much local resource will be required? Is the level of local product customization feasible from a single technology stack. What can be maintained in a scaleable global/regional core, and what level of duplicated, local resource is required.

We think there are three datapoints which suggest that Lemonade will be successful, with a few caveats that follow.

First, Lemonade already has some track record in asset-light expansion. At a 2018 event, Daniel Schreiber, Lemonade’s CEO, noted that whilst California was their largest market, they had no employees there. Our readers will know that the fragmentation of US regulation means that each state is similarly onerous as entering new countries.

Second, we see some similar insurance propositions already working on a regional level. On the incumbent side, Swiss Re’s iptiQ business provides some evidence that digitally-driven regional business models can work. Our Impact 25 Member Element is an insurer with capability to operate across Europe.

Third, other heavily regulated industries have not been immune to global propositions. Uber is the obvious example – a technology giant that is consolidating the way that consumers access a heavily fragmented industry with hugely localised regulation (everything from who is allowed to be a taxi driver to the way pickups work at Heathrow airport).

But now the caveats.

First, Lemonade is (currently) offering only renters and homeowners policies. Their renters policy is arguably particularly simple. Lemonade will prove only that a tech-led business model will work in principle, not that it will work across the insurance product set (such as statutory general insurance products like motor, or life insurance).

Second, it is important to differentiate between technical and operational feasibility, and commercial or practical success. Lemonade will prove the former but not (necessarily) the latter. Insurance is about much more than scalable tech – for example, efficient distribution and the ability to pay claims quickly and affordably.

There is undoubtedly a lot of local complexity in insurance, especially statutory covers like motor. For this reason, one client recently said to us that he’d throw the next consultant who talked to him about the importance of creating global “product tribes” out of the room (luckily we were not talking to him about this). We did, however, agree during the meeting that Lemonade has the potential to provide evidence that challenges the fundamental assumptions on which insurance groups organise themselves. The impact could be painful but necessary.