It is fair to say that the last few years have been tumultuous for the UK motor insurance market. We have had COVID-induced frequency changes followed by one of the most significant regulatory changes in a generation and the highest level of inflation in 41 years. We have built a Motor Market ModelTM using publicly available data, interviews with market participants and our own market insight to forecast the market performance over 2023 and 2024.

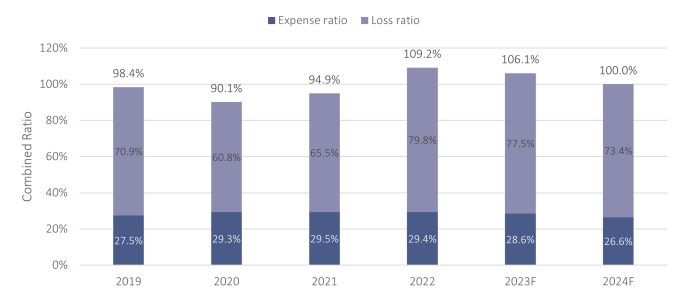

In 2022 the market had to adjust to the General Insurance Pricing Practices (GIPP) rule changes at the same time as dealing with a jump in claims inflation. This created a ‘perfect storm’ for the motor insurers in 2022. While new business prices were increased, renewal prices remained static or reduced as GIPP equalised pricing across new business and renewals. This was good news for renewal customers. Several players in the market were either unwilling or unable to increase premiums sufficiently to offset the higher claims. As a result, the market combined ratio increased by over 15% points to 109%.

Source: Oxbow Partners analysis

Moving into 2023 we expect to see some improvement for motor insurers. The pricing cycle remains hard with premiums increasing faster in the first quarter than many had expected. Motor insurance customers will have seen increased prices both from their existing insurer at renewal and when searching for the best deal from other providers. This will ultimately put the industry in a better position once the new rates earn through. Claims costs remain elevated, however, and though we foresee some easing in the rate of claims inflation, the absolute costs should continue to rise. We forecast a combined ratio of 106% in 2023.

In 2024 things will improve further. We expect the earn-through of 2023 premium increases to more than offset ongoing claims inflation and the market to get back to break even (100% COR) on an underwriting basis (premiums less claims and insurance expenses).

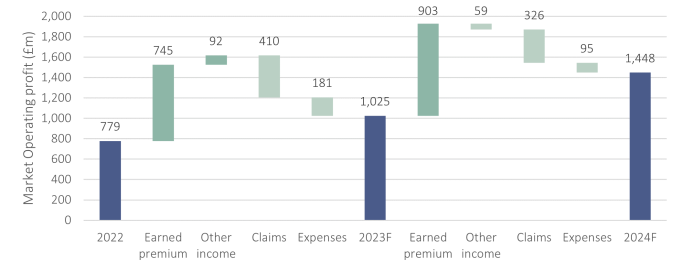

Operating profit will be boosted by other income as investment returns benefit from higher interest rates and more customers take the option of paying via instalments. We expect operating profit in 2023 of £1bn, 25% higher than 2022 but still 26% below the £1.4bn of 2019 and less than half the levels seen during COVID.

Figure 2: Higher premiums are the main driver for earnings uplift over the next few years

Source: Oxbow Partners analysis

The Oxbow Partners View

This is undeniably a tough time to be a motor insurer. Shareholders and boards will be asking questions around where all the profit has gone. However, there are opportunities. Those who have the capacity to invest can grow market share during one of the hardest markets we have seen. The market will return to pre-COVID levels of profitability by 2024 but the distribution of that profit could be quite different from 2019. Companies with lower expenses should be the natural winners here as they should be able to offer the best prices while still remaining profitable.

If management teams believe that the end is in sight for ‘excess’ claims inflation then this is a good time to grow in UK motor, especially as some players are simply not equipped to take advantage. The question for many is whether the longer-term gain is worth risking shorter-term pain.